Investor sentiment has remained excessive for Amazon AMZN inventory for the reason that firm’s announcement of a document vacation season when it comes to each gross sales and gadgets offered.

Amazon continues to be probably the most affluent e-commerce enterprise with an edge over eBay EBAY and even oblique world rivals Alibaba BABA and JD.com JD. Moreover, Amazon Internet Providers (AWS) stays the main cloud supplier forward of Microsoft MSFT Azure.

Gaining momentum in current months, let’s see if it is time to purchase Amazon inventory for extra upside as its This autumn outcomes method after-market hours on Thursday, February 6.

Picture Supply: Zacks Funding Analysis

Amazon’s This autumn Expectations

Primarily based on Zacks estimates, Amazon’s This autumn gross sales are thought to have elevated 10% to $187.28 billion in comparison with $169.96 billion a yr in the past. Notably, AWS gross sales are anticipated to extend 19% to $28.83 billion versus $24.2 billion within the comparative quarter.

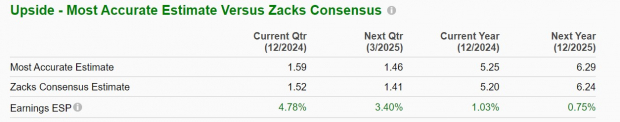

On the underside line, This autumn EPS is projected to soar 50% to $1.52 from $1.01 a share within the prior interval. Extra intriguing, the Zacks ESP (Anticipated Shock Prediction) signifies Amazon might surpass earnings expectations with the Most Correct Estimate having This autumn EPS at $1.59 and almost 5% above the Zacks Consensus.

Picture Supply: Zacks Funding Analysis

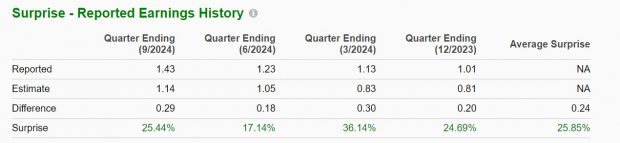

The tech big has exceeded earnings expectations for eight consecutive quarters with a really spectacular common EPS shock of 25.85% in its final 4 quarterly experiences.

Picture Supply: Zacks Funding Analysis

Full-12 months Expectations

Amazon is slated to spherical out fiscal 2024 with complete gross sales increasing 11% to $637.43 billion. Even higher, annual earnings are slotted to climb 79% to $5.20 per share from EPS of $2.90 in 2023.

Monitoring Amazon’s Valuation

Buying and selling round $240, AMZN is at a 38X ahead earnings a number of which is not a very stretched premium to the benchmark S&P 500 and is close to Microsoft’s 31.5X.

Additionally encouraging to long-term traders is that AMZN trades properly beneath its five-year excessive of 161.3X ahead earnings and gives a steep low cost to the median of 66X throughout this era.

Picture Supply: Zacks Funding Analysis

Backside Line

Forward of its This autumn report, Amazon inventory sports activities a Zacks Rank #2 (Purchase). To that time, the Zacks ESP does recommend Amazon might report sturdy This autumn outcomes on the heels of its document vacation purchasing season.

Plus, the rally in AMZN might actually proceed if that is accompanied by favorable steering with Zacks projections calling for an additional yr of double-digit high and backside line progress in FY25.

Analysis Chief Names “Single Finest Choose to Double”

From 1000’s of shares, 5 Zacks consultants every have chosen their favourite to skyrocket +100% or extra in months to return. From these 5, Director of Analysis Sheraz Mian hand-picks one to have probably the most explosive upside of all.

This firm targets millennial and Gen Z audiences, producing almost $1 billion in income final quarter alone. A current pullback makes now an excellent time to leap aboard. In fact, all our elite picks aren’t winners however this one might far surpass earlier Zacks’ Shares Set to Double like Nano-X Imaging which shot up +129.6% in little greater than 9 months.

Free: See Our Top Stock And 4 Runners Up

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

eBay Inc. (EBAY) : Free Stock Analysis Report

JD.com, Inc. (JD) : Free Stock Analysis Report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.