Valentine’s Day is simply across the nook, undoubtedly behind many minds as they search items and different experiences related to the day.

The vacation doesn’t characterize something notably necessary in regards to the inventory market, however a number of corporations may see a short-term gross sales bump and a focus amid a persistently robust shopper backdrop.

Let’s take a more in-depth have a look at just a few corporations that would see their high line profit from the vacation, together with a journey inventory like Royal Caribbean Cruises RCL and a inventory that may profit from each singles and {couples}, Netflix NFLX.

Royal Caribbean Sees Document Bookings

Royal Caribbean Cruises is a cruise firm that owns and operates three world manufacturers: Royal Caribbean Worldwide, Celeb Cruises, and Azamara Membership Cruises. Its latest set of outcomes had been underpinned by continued power in shopper demand, a longtime pattern over the previous few years total.

Regarding headline figures within the launch, adjusted EPS of $1.63 exceeded the corporate’s prior steering, whereas gross sales of $3.8 billion grew 11% year-over-year. RCL’s gross sales development has been stellar post-pandemic, as we are able to see within the annual chart beneath.

Picture Supply: Zacks Funding Analysis

The corporate supplied constructive steering for its FY25, with WAVE season bookings off to a report begin. Analysts have already dialed their earnings estimates increased following the favorable print, touchdown the inventory right into a bullish Zacks Rank #2 (Purchase).

Picture Supply: Zacks Funding Analysis

Netflix Retains Including Subscribers

Like RCL, Netflix shares have been scorching-hot over the previous yr on the again of robust quarterly outcomes, gaining almost 80% in comparison with the S&P 500’s 23% achieve. Its newest set of outcomes added to the positivity, with continued consumer development and tailwinds from ad-supported memberships pleasing traders.

The corporate’s high line power has remained stellar, as proven within the chart beneath.

Picture Supply: Zacks Funding Analysis

Regarding key metrics, Paid Web Membership Additions all through the interval reached a large 18.9 million, crushing our consensus estimate of 9.1 million handily. As proven beneath, subscriber additions for Netflix have remained rock-solid, exceeding our consensus estimate in seven consecutive releases.

The favorable reads on subscriber additions have fueled the inventory’s bullish run over the previous yr, with margin growth additionally brightening its profitability image.

Picture Supply: Zacks Funding Analysis

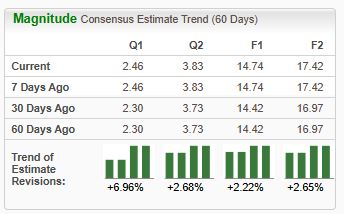

The inventory at the moment sports activities a positive Zacks Rank #2 (Purchase), with the revisions pattern for its present fiscal yr transferring increased following its newest outcomes.

Picture Supply: Zacks Funding Analysis

Backside Line

With a powerful shopper, a number of corporations – Netflix NFLX and Royal Caribbean Cruises RCL – may see their high traces see a small bump from the upcoming Valentine’s Day vacation.

Simply Launched: Zacks High 10 Shares for 2025

Hurry – you may nonetheless get in early on our 10 high tickers for 2025. Handpicked by Zacks Director of Analysis Sheraz Mian, this portfolio has been stunningly and persistently profitable. From inception in 2012 via November, 2024, the Zacks High 10 Shares gained +2,112.6%, greater than QUADRUPLING the S&P 500’s +475.6%. Sheraz has combed via 4,400 corporations coated by the Zacks Rank and handpicked the perfect 10 to purchase and maintain in 2025. You possibly can nonetheless be among the many first to see these just-released shares with monumental potential.

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.