As incomes period discolors, something holds– the supposed incomes “armageddon” really did not reveal its face.

Lots of firms have actually uploaded better-than-expected outcomes, assisting to press favorable view right into capitalists.

Obviously, there have actually been some laggards also, yet the total bearish view appeared means exaggerated.

Quickly, we’ll speak with Casey’s General Shops CASY on March 7 th, after the marketplace close.

Casey’s General Shops runs corner store under the Casey’s as well as Casey’s General Shop names in 16 midwestern states.

Just how does the business tone up heading right into incomes? We can make use of arise from a peer, Costco Wholesale Price, as a tiny scale. Allow’s take a more detailed look.

Costco Wholesale

Costco reported incomes of $3.30 per share, 3% over the Zacks Agreement Price quote as well as expanding perfectly from the year-ago quarter.

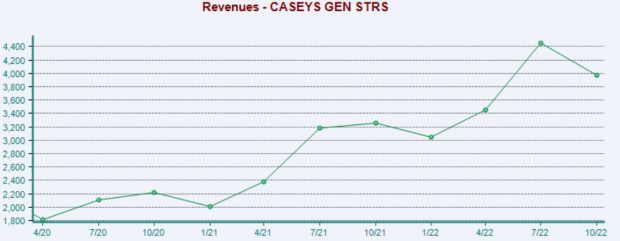

Quarterly profits completed $55.3 billion, partially listed below assumptions as well as expanding virtually 7% year-over-year. Below is a graph showing the business’s profits on a quarterly basis.

Photo Resource: Zacks Financial Investment Study

Furthermore, equivalent ecommerce sales slid by around 9.6% from the year-ago quarter, yet complete equivalent sales climbed up greater than 5% year-over-year. As well as running revenue completed $1.9 billion throughout the quarter, 5% more than the year-ago quarter.

Better, united state equivalent sales enhanced 5.7% year-over-year, as well as Various other International equivalent sales likewise saw a great increase, climbing up virtually 4%.

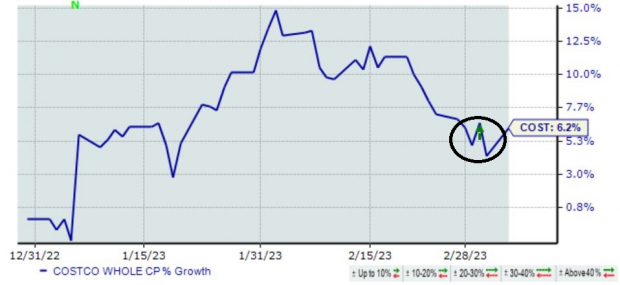

Shares dealt with marketing adhering to the launch, as highlighted by the environment-friendly arrowhead in the graph below.

Photo Resource: Zacks Financial Investment Study

Currently, onto Casey’s General Shops.

Casey’s General Shops

Quarterly Price Quotes–

Experts have actually been favorable for the quarter to be reported, with 3 higher incomes quote modifications striking the tape over the last numerous months. The Zacks Agreement EPS Price Quote of $1.67 shows a 2% pullback year-over-year.

Photo Resource: Zacks Financial Investment Study

Our agreement profits quote currently rests at $3.4 billion, recommending a renovation of greater than 10% from year-ago quarterly sales of $3.1 billion.

Quarterly Efficiency–

CASY has actually largely gone beyond profits assumptions, booking 3 EPS defeats throughout its last 4 quarters.

Leading line outcomes have actually left some to be wanted, with the business disappointing profits assumptions in back-to-back quarters.

Photo Resource: Zacks Financial Investment Study

Assessment–

CASY shares presently trade at an 18.6 X onward incomes numerous, underneath the 24.9 X five-year typical as well as the Zacks Retail as well as Wholesale market standard.

Photo Resource: Zacks Financial Investment Study

Better, the business’s onward price-to-sales currently rests at 0.5 X, a tick underneath the five-year typical as well as once more listed below the Zacks market standard.

Photo Resource: Zacks Financial Investment Study

The supply lugs a Design Rating of “A” for Worth.

Placing Every Little Thing With Each Other

Incomes period remains to unwind, with a handful of firms slated to report in the coming weeks.

It goes without saying, the been afraid incomes armageddon really did not appear, with lots of firms favorably shocking capitalists.

Quickly, we’ll speak with Casey’s General Shops CASY. A peer, Costco Wholesale price, currently reported its outcomes, with the business publishing blended leading as well as profits outcomes.

Experts have actually been favorable for CASY’s upcoming launch, with price quotes suggesting a mild pullback in incomes yet an uptick in profits.

Heading right into the launch, Casey’s is a Zacks Ranking # 3 (Hold) with a Profits ESP Rating of 8.3%.

5 Supplies Ready To Dual

Each was handpicked by a Zacks specialist as the # 1 favored supply to obtain +100% or even more in 2021. Previous suggestions have actually skyrocketed +143.0%, +175.9%, +498.3% as well as +673.0%.

A lot of the supplies in this record are flying under Wall surface Road radar, which offers an excellent possibility to participate the first stage.

Today, See These 5 Potential Home Runs >>

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

Casey’s General Stores, Inc. (CASY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as point of views shared here are the sights as well as point of views of the writer as well as do not always show those of Nasdaq, Inc.