Cisco Equipment ( CSCO) as well as Dell Technologies ( DELL) have actually contributed gamers in computer system modern technology remedies for years.

With belief remaining to expand towards the wider modern technology market, this positions the concern of if it’s time to acquire either of these historical technology firms.

Quick Summary

Rather close rivals, Cisco as well as Dell both supply a wide series of computer system driven remedies.

Hereof, Cisco’s emphasis is IP-based offering services and products to company, firms, industrial customers, as well as people. Over the last few years Cisco has actually broadened its existence in the network safety and security domain name to avoid unapproved accessibility to system sources as well as security from worms, spam, as well as infections, to name a few malware.

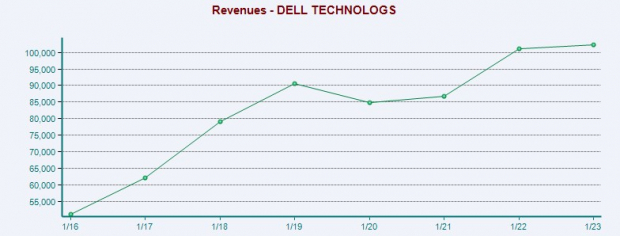

Picture Resource: Zacks Financial Investment Study

In contrast, Dell additionally supplies safety and security software application remedies as well as systems administration together with details administration software application offerings. Nevertheless, Dell has actually still maintained component of its concentrate on equipment offerings such as its legendary desktop computers as well as note pads.

Picture Resource: Zacks Financial Investment Study

Current Efficiency && Worth

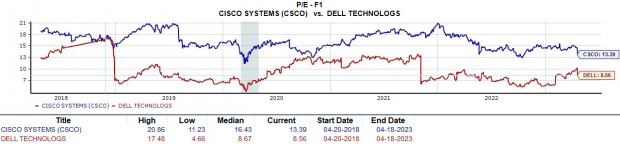

Over the last 6 months, Dell supply has actually currently rallied +26% to leading Cisco’s +15%, the Nasdaq’s +14%, as well as the S&P 500’s +8%. Significantly, Dell still stands apart from an appraisal perspective with an “A” Zacks Design Ratings quality for Worth while Cisco lands a “C”.

Trading around $43, Dell shares have an 8.5 X ahead incomes numerous which is 51% listed below their five-year high of 17.4 X as well as on the same level with the average. In contrast, Cisco supply professions at $48 per share as well as 13.3 X ahead incomes which is 36% listed below its very own five-year high of 20.8 X as well as a minor price cut to the average of 16.4 X.

Picture Resource: Zacks Financial Investment Study

Development Price Quotes

Dell has the general side in Development, additionally landing an “A” Zacks Design Ratings quality while Cisco has a “C” in this group too.

To that factor, Dell’s profits number is a lot greater despite incomes anticipated to decrease -30% in FY23 at $5.28 per share after a tough-to-compete-against year that saw EPS at $7.61 in 2022. Financial 2024 incomes are forecasted to maintain as well as rebound 15% at $6.07 per share. Keeping that being claimed, incomes price quotes have actually decreased over the last quarter for both FY23 as well as FY24.

Picture Resource: Zacks Financial Investment Study

Considering Cisco, incomes are anticipated to leap 12% this year as well as increase an additional 7% in FY24 at $4.04 per share. A lot more appealing, although Cisco’s profits isn’t as durable as Dell’s right now, incomes quote alterations have actually increased 6% over the last 90 days for both FY23 as well as FY24 specifically.

Picture Resource: Zacks Financial Investment Study

Returns

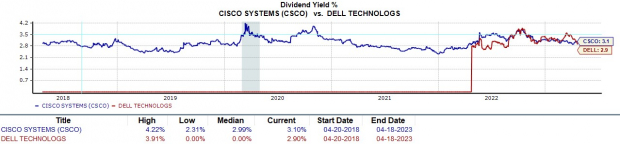

Supplies that pay rewards are constantly a reward for financiers, as well as both firms have strong returns that are over the S&P 500’s 1.53% standard.

Cisco’s 3.10% yearly reward return has the mild side over Dell which applied a reward for the very first time last April.

Picture Resource: Zacks Financial Investment Study

Profits

Cisco supply presently sporting activities a Zacks Ranking # 2 (Buy) in relationship with climbing incomes quote alterations with Dell touchdown a Zacks Ranking # 3 (Hold). Dell’s general development as well as assessment are a lot more appealing yet the decreasing incomes price quotes for both FY23 as well as FY24 might bring about temporary weak point while Cisco supply might exceed.

7 Finest Supplies for the Following thirty day

Simply launched: Specialists boil down 7 elite supplies from the existing listing of 220 Zacks Ranking # 1 Solid Buys. They consider these tickers “Probably for Very Early Cost Pops.”

Because 1988, the complete listing has actually defeated the marketplace greater than 2X over with a typical gain of +24.8% annually. So make sure to provide these carefully picked 7 your instant interest.

Cisco Systems, Inc. (CSCO) : Free Stock Analysis Report

Dell Technologies Inc. (DELL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as viewpoints shared here are the sights as well as viewpoints of the writer as well as do not always show those of Nasdaq, Inc.