Traditionally, Coca-Cola KO and PepsiCo PEP have been standard shares amongst hedge funds and institutional buyers.

Chatting with the credibility of Coca-Cola and Pepsi inventory, each are owned by famend institutional buyers equivalent to Vanguard Group and BlackRock BLK.

That stated, let’s see which of those iconic beverage makers will be the higher funding as we start 2025.

Low Beta Ratios

Due to their stability throughout financial downturns, Coca-Cola and Pepsi inventory are sometimes sought out for defensive security within the portfolio.

With Beta being a measure of threat generally used to match the volatility of shares, KO and PEP have beta ratios below the bottom S&P 500 Index’s worth of 1.0. As proven within the chart beneath, Pepsi does have the sting with a calculated beta rating of 0.54 with Coca-Cola at 0.61.

Picture Supply: Zacks Funding Analysis

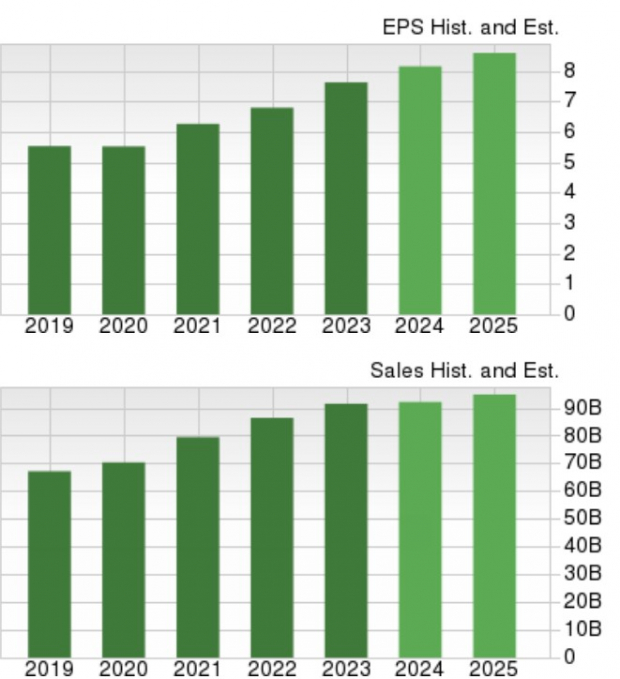

Progress & Outlook

Attributed to its attain within the shopper snacking market, Pepsi additionally has the sting with reference to progress. Because the operator of iconic snack manufacturers equivalent to Frito-Lay and Solar Chips, Pepsi’s whole gross sales are anticipated to be up 1% in fiscal 2024 and are projected to rise one other 3% in FY25 to $94.8 billion.

Even higher, Pepsi’s annual earnings are slated to extend 7% in FY24 and are forecasted to broaden one other 5% in FY25 to $8.59 per share.

Picture Supply: Zacks Funding Analysis

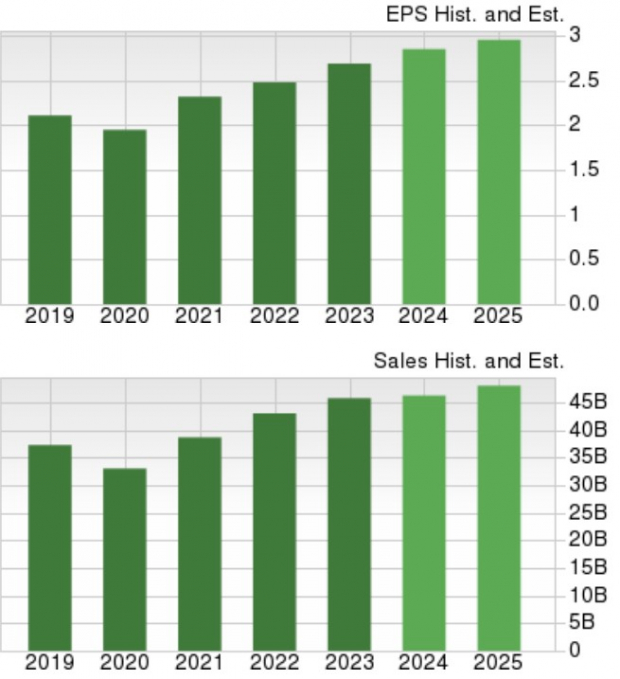

Pivoting to Coca-Cola, its prime line is projected to extend by 1% in FY24 and is predicted to broaden one other 4% in FY25 to $48.02 billion. Coca-Cola is now anticipated to put up 6% EPS progress in FY24 with annual earnings projected to extend one other 3% in FY25 to $2.96 per share.

Picture Supply: Zacks Funding Analysis

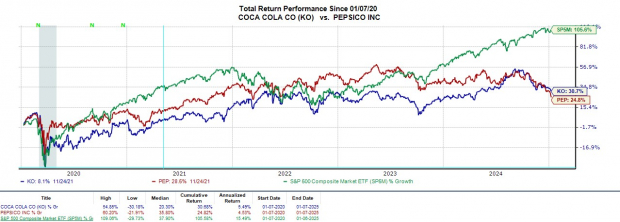

Efficiency & Valuation Comparability

During the last 12 months, Coca-Cola inventory has had the sting by way of efficiency with KO having a complete return of +4% when together with dividends. This has noticeably lagged the benchmark S&P 500’s +27% however has topped Pepsi’s -11%.

Sadly, over the past 5 years, the efficiency of those shopper staples titans has additionally vastly trailed the broader market’s whole return of +105%.

Picture Supply: Zacks Funding Analysis

At their present ranges, KO and PEP do commerce at slight reductions to the benchmark’s ahead P/E a number of at 20.5X and 17X respectively. Notably, Pepsi inventory trades close to the optimum degree of lower than 2X gross sales versus Coca-Cola’s 5.6X.

Picture Supply: Zacks Funding Analysis

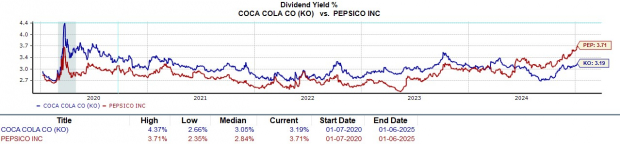

Dividend Comparability

Bolstering its extra engaging valuation is that Pepsi’s 3.71% annual dividend yield tops Coca-Cola’s 3.19%. Nevertheless, each have payouts that trounce the S&P 500’s 1.2% common.

Picture Supply: Zacks Funding Analysis

Takeaway

For now, Coca-Cola and Pepsi inventory land a Zacks Rank #3 (Maintain). Whereas Pepsi shares have a transparent benefit with reference to a number of monetary metrics, Coca-Cola inventory could also be viable to long-term buyers as properly.

Nonetheless, there may very well be higher choices among the many shopper staples sector in the intervening time though buyers might need to be conscious of those beverage giants within the occasion of elevated market volatility in 2025.

5 Shares Set to Double

Every was handpicked by a Zacks knowledgeable because the #1 favourite inventory to realize +100% or extra in 2024. Whereas not all picks will be winners, earlier suggestions have soared +143.0%, +175.9%, +498.3% and +673.0%.

Many of the shares on this report are flying below Wall Road radar, which gives an important alternative to get in on the bottom ground.

Today, See These 5 Potential Home Runs >>

CocaCola Company (The) (KO) : Free Stock Analysis Report

PepsiCo, Inc. (PEP) : Free Stock Analysis Report

BlackRock, Inc. (BLK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.