Human capital administration (HCM) shares could also be catching buyers’ consideration as fears of an escalating commerce battle and hotter-than-expected Private Consumption Expenditures (PCE) information led to a pointy decline among the many broader indexes on Friday.

That mentioned, the need for HCM resolution suppliers is intriguing, particularly those who supply payroll companies as they need to be comparatively unaffected by tariffs. Optimistically, the unemployment charge has remained close to pre-pandemic ranges at round 4%, with the necessity to fulfill payroll and different workforce obligations resulting in constant demand for corporations like Paychex PAYX and Automated Knowledge Processing ADP.

Picture Supply: Federal Reserve Financial Knowledge

Paychex CEO Feedback on the Labor Market

Making an look on CNBC’s Mad Cash this week, Paychex CEO John Gibson acknowledged there are not any indicators of recession within the firm’s information with the underlying labor market remaining essentially wholesome regardless of market uncertainty. Indicative of such, average job and wage development amongst small companies helped Paychex edge high and backside line expectations for its fiscal third quarter on Wednesday.

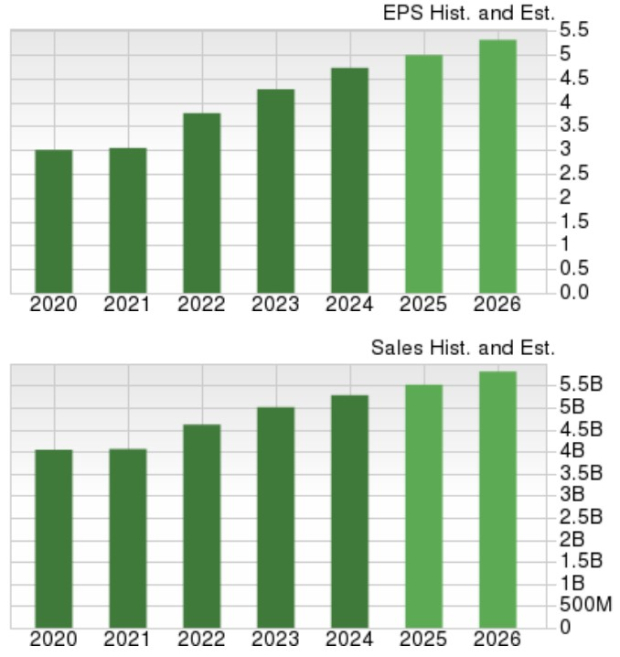

Paychex & ADP’s Regular Development

Notably, Paychex’s complete gross sales at the moment are anticipated to rise 4% in fiscal 2025 and are projected to extend one other 5% in FY26 to $5.81 billion. Annual earnings are at the moment slated to extend 6% this yr and are projected to rise one other 6% in FY26 to $5.30 per share.

Picture Supply: Zacks Funding Analysis

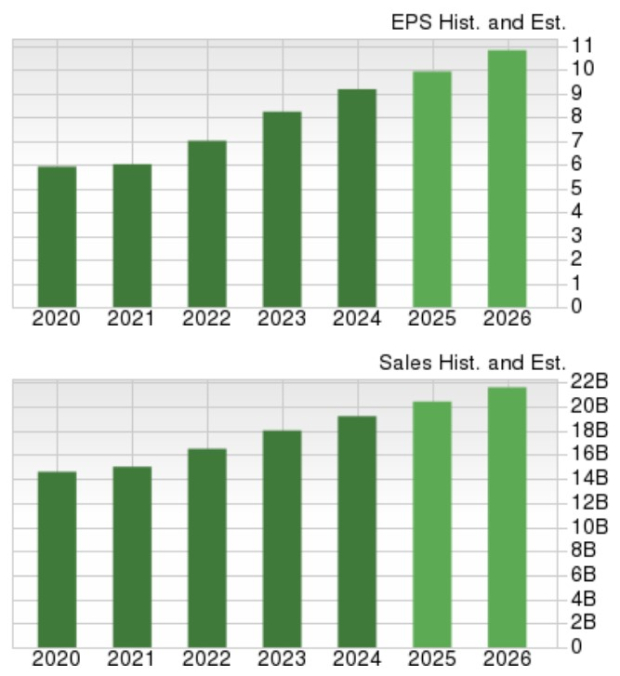

Pivoting to ADP which is without doubt one of the leaders in cloud-based HCM together with payroll and expertise administration, its high line is forecasted to broaden by 6% in FY25 and FY26 with projections edging north of $21 billion. Extra spectacular, ADP’s EPS is projected to be up 8% in FY25 and is forecasted to spike one other 9% subsequent yr to $10.82.

Picture Supply: Zacks Funding Analysis

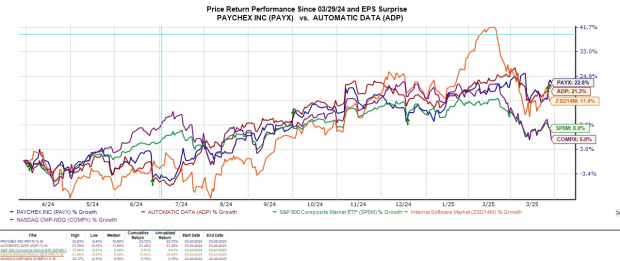

Latest Inventory Efficiency

Correlating with the notion that buyers could wish to use payroll shares as a defensive hedge is that PAYX and ADP shares are up +7% and +3% in 2025 respectively. These modest good points have been comforting contemplating the broader indexes have flirted with correction territory because the S&P 500 has fallen 4% yr up to now with the Nasdaq falling 10%.

Picture Supply: Zacks Funding Analysis

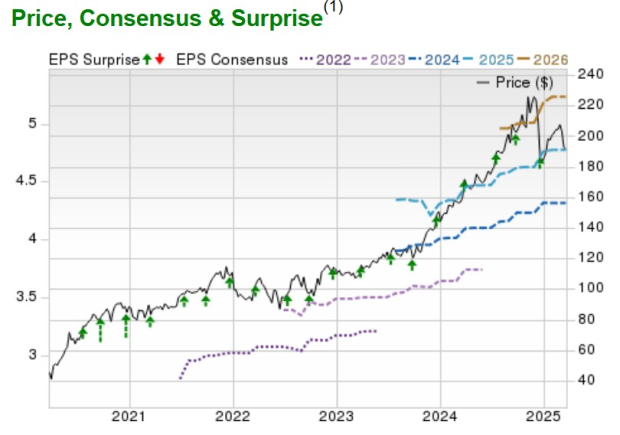

Cintas is one other HCM Supplier to Think about

Whereas Cintas CTA doesn’t present payroll companies, investor curiosity has shifted to the corporate’s development narrative as a human capital supplier. With its fill up +11% YTD, Cintas has seen a constant demand for its specialised enterprise companies which embrace company id uniform applications, restroom provides, and first help/security merchandise for diversified companies all through North America in addition to Europe, Asia, and Latin America.

Like Paychex, Cintas was in a position to exceed expectations for its fiscal third quarter on Wednesday. Moreover, Cintas continued a formidable streak of surpassing earnings estimates (quarterly) as illustrated by the inexperienced arrows within the worth efficiency chart under. Because of its constant operational efficiency, Cintas inventory has been one of many market’s high performers within the final 5 years with CTA sitting on good points of over +300% throughout this era.

Picture Supply: Zacks Funding Analysis

Conclusion & Ultimate Ideas

It is going to be essential to concentrate to payroll corporations like Paychex and ADP for perception into the state of the financial system and the chance of a possible recession. Cintas may additionally present worthwhile perception on this regard and for now, recessionary fears could also be overblown as these HCM shares have outperformed the broader market though sure companies and areas of the financial system will wrestle with excessive tariffs.

Zacks’ Analysis Chief Names “Inventory Most Prone to Double”

Our group of consultants has simply launched the 5 shares with the best chance of gaining +100% or extra within the coming months. Of these 5, Director of Analysis Sheraz Mian highlights the one inventory set to climb highest.

This high decide is among the many most revolutionary monetary companies. With a fast-growing buyer base (already 50+ million) and a various set of innovative options, this inventory is poised for large good points. In fact, all our elite picks aren’t winners however this one may far surpass earlier Zacks’ Shares Set to Double like Nano-X Imaging which shot up +129.6% in little greater than 9 months.

Free: See Our Top Stock And 4 Runners Up

Paychex, Inc. (PAYX) : Free Stock Analysis Report

Automatic Data Processing, Inc. (ADP) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.