Tomorrow, we’ll obtain the most up to date dosage of CPI information. After that, on Thursday, we’ll obtain an additional dose of rising cost of living information with the Manufacturer Consumer Price Index (PPI).

As several have actually realised, CPI days have actually constantly been a critical factor for the marketplace. Points will certainly be no various this moment about, specifically as several look for information on the future rate of price walks adhering to a historic year-long tightening up project.

For those aiming to protect themselves from the unpreventable volatility, low-beta supplies, such as– Interactive Brokers IBKR, The Kroger Co. KR, and also Cisco Equipments CSCO– might be of passion.

The graph listed below shows the efficiency of all 3 supplies year-to-date, with the S&P 500 mixed in as a criteria.

Photo Resource: Zacks Financial Investment Study

Allow’s take a more detailed check out every one.

Interactive Brokers

Interactive Brokers Team runs as an automated worldwide digital market manufacturer and also broker. Experts have actually upped their incomes assumptions throughout almost all durations over the last 60 days, aiding land the supply right into a Zacks Ranking # 2 (Buy).

Photo Resource: Zacks Financial Investment Study

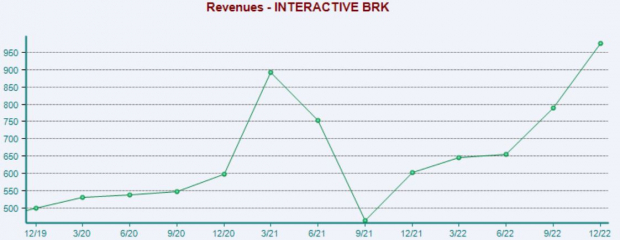

IBKR uploaded solid quarterly lead to its newest launch, surpassing the Zacks Agreement EPS Quote by greater than 12% and also supplying a 5.3% income shock. Below is a graph highlighting the firm’s income on a quarterly basis.

Photo Resource: Zacks Financial Investment Study

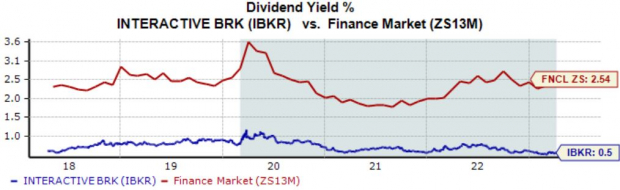

On top of that, IBKR shares offer an easy earnings stream, restricting the effect of drawdowns in various other settings; presently, the firm’s yearly returns returns 0.5%, listed below the Zacks Money market standard.

Photo Resource: Zacks Financial Investment Study

The Kroger Co.

Established In 1883, the veteran merchant runs roughly 2,700 retailers under its different banners and also departments in 35 states. Currently, KR sporting activities a beneficial Zacks Ranking # 1 (Solid Buy).

Photo Resource: Zacks Financial Investment Study

Kroger shares aren’t costly whatsoever, with the firm’s 10.8 X ahead incomes numerous resting well underneath the 12.4 X five-year typical and also the Zacks Retail and also Wholesale market standard.

KR lugs a Design Rating of “B” for Worth.

Photo Resource: Zacks Financial Investment Study

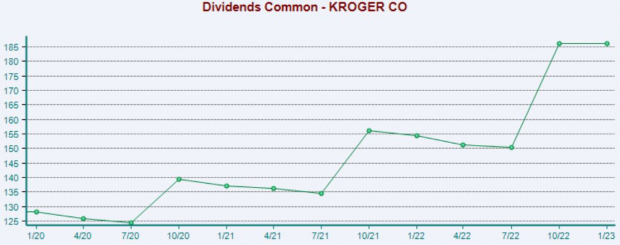

Like IBKR, Kroger compensates its investors handsomely; the firm’s yearly returns currently produces 2.2%, well over the Zacks market standard of 1.1%.

Remarkably, Kroger has actually shown a dedication to significantly awarding its investors, flaunting a large 15% five-year annualized returns development price.

Photo Resource: Zacks Financial Investment Study

Cisco Equipment

Cisco Equipments is an IP-based networking firm offering product or services to company, firms, industrial customers, and also people. Experts have actually taken a favorable position on the firm’s incomes expectation, touchdown it right into a Zacks Ranking # 2 (Buy).

Photo Resource: Zacks Financial Investment Study

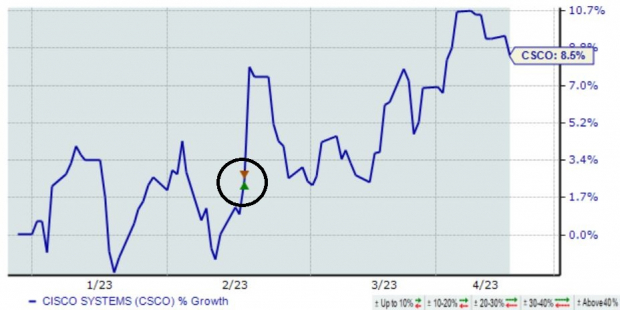

The marketplace took the firm’s newest incomes launch in stride, sending out shares on a higher trajectory post-earnings. Cisco surpassed the Zacks Agreement EPS Quote by about 2.3% and also reported income decently over assumptions.

Photo Resource: Zacks Financial Investment Study

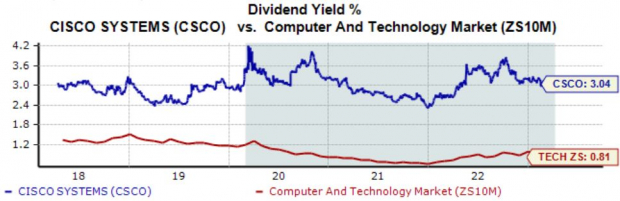

CSCO shares offer direct exposure to innovation combined with an easy earnings stream; Cisco’s returns presently generates 3% yearly, greater than three-way that of the Zacks Computer system and also Innovation market standard.

Photo Resource: Zacks Financial Investment Study

Profits

With CPI impending, capitalists might wish to see low-beta supplies as a guard versus volatility. As most of us understand now, CPI days have actually ended up being fairly a market-moving occasion.

All 3 low-beta supplies above– Interactive Brokers IBKR, The Kroger Co. KR, and also Cisco Equipments CSCO– might be factors to consider for those searching for a guard versus volatility.

All 3 sporting activity enhanced incomes overviews, suggesting desirable near-term organization overviews.

Simply Launched: Free Record Discloses Obscure Techniques to Aid Make Money From the$ 30 Trillion Metaverse Boom

It’s indisputable. The metaverse is obtaining vapor each day. Simply comply with the cash. Google. Microsoft. Adobe. Nike. Facebook also rebranded itself as Meta since Mark Zuckerberg thinks the metaverse is the following model of the net. The unpreventable outcome? Several capitalists will certainly obtain abundant as the metaverse develops. What do they understand that you do not? They understand the firms finest positioned to expand as the metaverse does. And also in a brand-new FREE record, Zacks is disclosing those supplies to you. Today, you can download and install, The Metaverse – What is it? And also Just how to Revenue with These 5 Pioneering Supplies It exposes particular supplies readied to escalate as this arising innovation creates and also broadens. Do not miss your possibility to accessibility it absolutely free without any commitment.

>>Show me how I could profit from the metaverse!

Cisco Systems, Inc. (CSCO) : Free Stock Analysis Report

Interactive Brokers Group, Inc. (IBKR) : Free Stock Analysis Report

The Kroger Co. (KR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights and also point of views shared here are the sights and also point of views of the writer and also do not always mirror those of Nasdaq, Inc.