One of the vital sought-after semiconductor behemoths, NVIDIA Company NVDA, not too long ago flashed a bearish chart sample amid regulatory headwinds. So, what’s subsequent for NVIDIA buyers? Do they promote the inventory, or do they consider in NVIDIA’s inherent power and hold on to it? Let’s discover out.

Dying Cross Sample Emerges; NVIDIA Inventory Slumps

A number of chip shares, together with NVIDIA, suffered losses on Wednesday. The inventory slipped 5.7% yesterday, whereas a loss of life cross sample emerged final week. This implies NVIDIA’s short-term 50-day shifting common (DMA) has dropped under its long-term 200 DMA, signaling a looming downtrend.

On Wednesday, the NVIDIA inventory completed at $113.76, whereas the 50-DMA was $125.86 under the 200-DMA, which was $127.72. The final time NVIDIA inventory confronted a loss of life cross was in April 2022, inflicting its shares to tank 50% over the subsequent six months earlier than hitting its lowest level in October 2022.

Technical Indicator & Overlays – NVIDIA

Picture Supply: Zacks Funding Analysis

The opportunity of stricter laws on NVIDIA’s chips in China damage its shares. Compounding the decline was the U.S. authorities’s transfer so as to add a number of Chinese language firms to a commerce blacklist for nationwide safety causes, adversely impacting NVIDIA’s gross sales.

Can NVIDIA Inventory Bounce Again?

Undeniably, regulators from China are discouraging its tech corporations from shopping for NVIDIA’s H20 chips as a consequence of power effectivity violations. Nonetheless, gross sales of H20s are unaffected as guidelines aren’t strictly enforced, and NVIDIA intends to satisfy with regulators to handle the difficulty.

Equally, NVIDIA has efficiently navigated U.S. regulatory challenges prior to now and proven resilience to such points. Anyhow, $100 is a robust help degree for the NVIDIA inventory. If it breaks under this, it may sign a long-term downward development. NVIDIA had beforehand examined this degree in August and September, solely to rebound to an all-time excessive of $150.

In actuality, insane demand for NVIDIA’s next-generation cutting-edge Blackwell chips and dominance within the graphic processing models (GPUs) market would drive its share worth upward. Magnificent-7 shares reminiscent of Alphabet Inc. GOOGL and Microsoft Company MSFT have chosen Blackwell chips as a consequence of their stable power effectivity degree and sooner AI interface.

A market share of greater than 80% within the discrete GPU house offers NVIDIA a aggressive edge, and its CUDA software program platform continues to realize prominence amongst builders over Superior Micro Units, Inc.’s AMD ROCm software program platform.

NVIDIA is Financially Sturdy

Regardless of the present worth fluctuations, NVIDIA stays a financially robust firm. It noticed its revenues climb 114% to $130 billion in fiscal 2025 (led to January) and expects gross sales to leap 65% yr over yr within the first quarter.

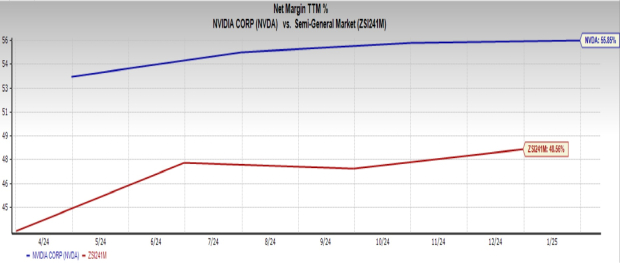

NVIDIA has usually generated income effectively. It is because the agency’s web revenue margin of 55.9% is greater than the Semiconductor – General business’s 48.6%, indicating a excessive margin.

Picture Supply: Zacks Funding Analysis

Easy methods to Commerce NVIDIA Inventory Now

Given robust financials, excessive demand for the Blackwell chip, and GPU dominance, the latest share worth dip shouldn’t concern NVIDIA stakeholders. As an alternative, they need to maintain onto the inventory for robust features sooner or later.

Nonetheless, new consumers ought to look ahead to an opportune second to spend money on the NVIDIA inventory as a consequence of its present volatility. NVDA, at the moment, has a Zacks Rank #3 (Maintain). You may see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Solely $1 to See All Zacks’ Buys and Sells

We’re not kidding.

A number of years in the past, we shocked our members by providing them 30-day entry to all our picks for the overall sum of solely $1. No obligation to spend one other cent.

1000’s have taken benefit of this chance. 1000’s didn’t – they thought there have to be a catch. Sure, we do have a cause. We wish you to get acquainted with our portfolio providers like Shock Dealer, Shares Beneath $10, Know-how Innovators,and extra, that closed 256 positions with double- and triple-digit features in 2024 alone.

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.