It is not a surprise that the mixed weight of raised rising cost of living, increasing rates of interest, as well as unpredictability concerning the economic situation has actually required customers to transform their costs habits.

The concern has actually definitely gone to have fun with lower-income homes for a long time currently. Yet we can with ease value that it will certainly not remain limited to this customer section alone as well as will certainly more than likely go up the earnings chain in the days in advance.

We saw several of that in the Walmart WMT record that revealed the store taking advantage of higher-income customers ‘trading down’ to its shops as well as electronic offerings in feedback to the previously mentioned headwinds. The anticipated extension of this exact same pattern is likewise at the origin of monitoring’s updated assistance for the year.

An additional pattern at play is the change in customer choice for ‘desires’ as opposed to ‘demands.’ Provided the macroeconomic clouds, it makes user-friendly feeling that customers will logically change far from optional costs groups without suppressing their need for fundamentals. Walmart is much better located than Target TGT for such an atmosphere, offered its dramatically larger grocery store company.

Nevertheless, we must bear in mind that customers aren’t relocating far from all optional groups as they remain to invest in recreation, friendliness, as well as take a trip solutions. Customers invested greatly on optional ‘items’ throughout Covid as well as appear to be in no rush to change them. Yet they appear to be offseting losing out on the ‘experiential’ optional solutions of the kind stated over.

A Few Of this is most likely connected to earnings circulations too, with lower-income customers limiting their costs to their demands as well as drawing back on optional costs of all kinds.

A superb instance of this is Friday’s Foot Storage locker FL bombshell, with the business not just missing out on price quotes yet dramatically reducing assistance for the year. Foot Storage locker is greatly revealed to lower-income customers, which market’s expectation stays unpredictable, especially if the labor market begins shedding ground moving forward as a result of macroeconomic elements.

The retail company is a difficult as well as affordable room also in ‘regular’ times, as well as these are anything yet regular times.

They require simply the correct amount of supply. Or else, they will certainly either shed sales if they do not have adequate goods, as held true previously in the pandemic, or will certainly require to use steeper price cuts as well as harm margins if they have excessive of it, as we saw with Walmart WMT as well as Target TGT in 2015.

After that there is straight-out burglary, described as ‘reduce’ by the sellers. Target approximates that ‘reduce’ will certainly be a $500 million struck to its incomes this year. A lot of monitoring groups avoid measuring the complete degree of this trouble. Yet released remarks from retail market specialists recommend that the trouble has actually never ever been this large.

Merchants likewise require to guarantee they have the proper sort of goods, as we saw with Target as well as Walmart having excessive outdoor patio furnishings last Springtime that customers weren’t thinking about acquiring. Maintaining shops totally staffed in a limited labor market as well as making certain simply the correct amount of cost discount rates are several of the various other difficulties that big-box drivers like Walmart, Target, as well as others deal with daily.

Both Walmart as well as Target have actually done a superb task on the supply front, yet component of the factor for the Foot Storage locker assistance cut is the supply accident. What is most fascinating worrying Foot Storage locker is that they stopped working to see any one of this throughout their March 2023 upgrade.

Everything boils down to implementation as well as monitoring efficiency.

In a background of regulating as well as changing customer costs habits, some sellers have actually been a lot more effective than others. Walmart has actually been much better, Target much less so.

You can see this in the 1 year efficiency of Walmart (blue line, up +26.2%) as well as Target (red line, down -0.8%) about the S&P 500 index (eco-friendly line, up +8%). We included Foot Storage locker (orange line, down -2.3%) to the mix to reveal the supply’s remarkable autumn after the previously mentioned incomes frustration.

Picture Resource: Zacks Financial Investment Study

Relative to the Retail industry 2023 Q1 incomes period scorecard, we currently have arise from 26 of the 33 sellers in the S&P 500 index. Routine visitors understand that Zacks has a committed stand-alone private sector for the retail room, which differs from the positioning of the room in the Customer Staples as well as Customer Discretionary industries in the Requirement & & Poor’s main market category.

The Zacks Retail industry consists of not just Walmart, Target, as well as various other typical sellers yet likewise on-line suppliers like Amazon.com as well as dining establishment gamers. The 26 Zacks Retail business in the S&P 500 index that have actually reported Q1 outcomes currently consist of the ecommerce as well as dining establishment markets.

Complete Q1 incomes for these 26 sellers that have actually reported are up +6.2% from the exact same duration in 2015 on +6.6% greater profits, with 84.6% whipping EPS price quotes as well as 65.4% whipping profits price quotes.

The contrast graphes listed below placed the Q1 defeats percents for these sellers in a historic context.

Picture Resource: Zacks Financial Investment Study

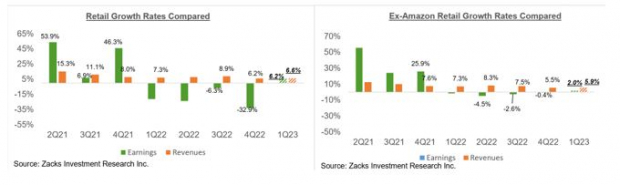

Relative to the incomes as well as profits development prices, we such as to reveal the team’s efficiency with as well as without Amazon.com, whose outcomes are amongst the 26 business that have actually reported currently. As we understand, Amazon.com’s Q1 incomes were up +46.8% on +9.4% greater profits, as it defeated leading as well as fundamental assumptions.

As most of us understand, the electronic as well as brick-and-mortar drivers have actually been merging for a long time currently. Amazon.com is currently a sizable brick-and-mortar driver after Whole Foods, as well as Walmart is an expanding online supplier. This long-lasting pattern obtained a substantial increase from the Covid lockdowns.

Both contrast graphes listed below reveal the Q1 incomes as well as profits development about various other current durations, both with Amazon.com’s outcomes (left side graph) as well as without Amazon.com’s numbers (appropriate side graph)

Picture Resource: Zacks Financial Investment Study

Q1 Revenues Period Scorecard

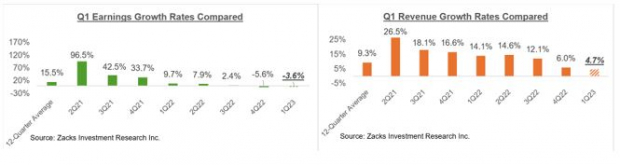

Consisting of all the quarterly records that appeared via Friday, Might 19 th, we currently have Q1 incomes from 473 S&P 500 participants, or 94.6% of the index’s complete subscription. Complete incomes for these business are down -3.6% from the exact same duration in 2015 on +4.7% greater profits, with 78% whipping EPS price quotes as well as 74.8% whipping profits price quotes.

The percentage of these business defeating both EPS as well as profits price quotes is 63%.

Routine visitors of our incomes discourse understand that we have actually been describing the total photo arising from the Q1 incomes period as sufficient; not fantastic, yet okay either.

With this reporting cycle currently mainly behind us, we can with confidence claim that business incomes aren’t headed in the direction of the ‘high cliff’ that market bears were cautioning us of.

The method we see it, the ‘better-than-feared’ sight of the Q1 incomes period at this phase might be a little bit unreasonable, offered exactly how durable business productivity has actually ended up being. Yet the sight isn’t totally off the mark either.

We have around 150 business on deck to report outcomes, consisting of 15 S&P 500 participants. Today’s docket consists of Lowe’s, Nvidia, Ideal Buy, Ralph Lauren, Dicks Sporting Product, as well as others.

Listed below, we contrast the Q1 results so far from what we have actually seen from this exact same team of 459 index participants in various other current durations.

The initial collection of graphes contrasts the incomes as well as profits development prices for the business that have actually reported with what we had actually seen from the team in various other current quarters.

Picture Resource: Zacks Financial Investment Study

The contrast graphes listed below placed the Q1 EPS as well as profits beats percents in a historic context.

Picture Resource: Zacks Financial Investment Study

The Revenues Broad View

To obtain a feeling of what is presently anticipated, have a look at the graph listed below that reveals existing incomes as well as profits development assumptions for the S&P 500 index for 2023 Q1 as well as the complying with 3 quarters.

Picture Resource: Zacks Financial Investment Study

As you can see below, 2023 Q1 incomes are anticipated to be down -3.8% on +4.4% greater profits. This would certainly comply with the -5.4% incomes decrease in the previous duration (2022 Q4) on +5.9% greater profits.

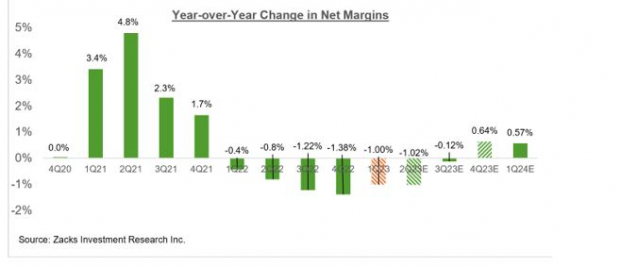

We reach down incomes on favorable profits when margins are pressed. That’s what we have actually been seeing in the recurring incomes period, which is in-line with the pattern we have actually been seeing for a long time currently. Actually, 2023 Q1 is the 5 th quarter straight of decreasing margins.

The graph listed below programs the year-over-year adjustment in take-home pay margins for the S&P 500 index.

Picture Resource: Zacks Financial Investment Study

Real outcomes offer a lot much better on this front about what was anticipated in advance of the launches, with the outperformance especially noteworthy for the Technology industry.

The graph listed below programs the incomes as well as profits development photo on a yearly basis.

Picture Resource: Zacks Financial Investment Study

One noteworthy current advancement on the incomes front, which we have actually been flagging in current weeks, is the turnaround on the modifications front, with full-year 2023 incomes beginning to increase given that the begin of April. This follows nearly a year of consistent decreases in full-year 2023 incomes, which came to a head in April 2022.

Because the begin of 2023 Q2, accumulated bottom-up S&P 500 incomes are level or the same overall as well as +0.4%, omitting the Power industry, whose price quotes have actually been boiling down. Actually, approximates for 8 of the 16 Zacks industries are up given that the begin of Q2, with noteworthy rises in the Building and construction, Industrial Products, Autos, Retail, as well as Technology industries. On the adverse side, price quotes are boiling down for the Power, Basic Products, Aerospace, as well as Transport industries.

For a thorough take a look at the total incomes photo, consisting of assumptions for the coming durations, please look into our once a week Revenues Patterns report >>>>> > > >Decoding Recent Positive Earnings Estimate Revisions

Free Record: Top EV Battery Supplies to Acquire Currently

Just-released record exposes 5 supplies to benefit as countless EV batteries are made. Elon Musk tweeted that lithium costs have actually mosted likely to “ridiculous degrees,” as well as they’re most likely to maintain climbing up. Consequently, a handful of lithium battery supplies are readied to escalate. Gain access to this record to find which battery supplies to acquire as well as which to stay clear of.

Target Corporation (TGT) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

Foot Locker, Inc. (FL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as point of views revealed here are the sights as well as point of views of the writer as well as do not always mirror those of Nasdaq, Inc.