Youthful traders discover themselves in a dilemma. The brand new blockchain area of cryptocurrencies provides easy accessibility to capital and fast valuation cycles which can be inherently speculative and excessive in revenue potential.

However, conventional dividend investing is right when beginning younger. If uncovered to dependable dividend-paying firms, the chance is minimized whereas the returns are constant. Ought to traders choose one over the opposite or discover a center floor?

Why Dividend Investing is a No-Brainer

For a corporation to even entertain dividend payouts to shareholders, its earnings have to be sufficiently in keeping with loads of money reserves allotted for growth. This beginning place supplies a cushion for investing publicity as a result of such firms have intrinsic worth.

One thing that can’t be mentioned of memecoins that depend on hype-driven hypothesis and will be created ex nihilo. Furthermore, dividend investing is on the prime of the crop within the type of dividend aristocrats. These firms have a monitor file of accelerating dividend payouts yearly for at the least 25 consecutive years.

In different phrases, dividend growers and payers usually have decrease volatility and better returns in comparison with firms that both don’t pay or lower dividends. Between 1973 and 2023, each dividend growers/initiators and payers outperformed the index in common annual returns.

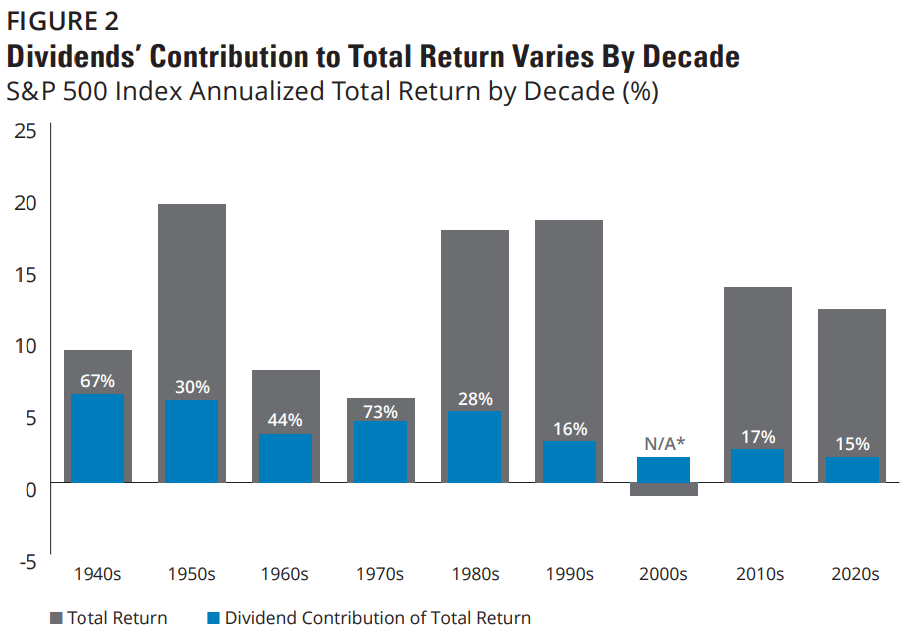

Nevertheless, it bears noting that the dividend contribution to whole inventory returns is on a downward trajectory. After the dot-com bubble popped in March 2000, the market disruption yielded adverse S&P 500 returns for the 2000s decade.

This ultimately leveled up the dividend contribution to the earlier decade’s degree. But, it’s doubtless that progress shares, this time carried on the again of the AI hype, will as soon as once more de-emphasize dividend shares within the 2020s decade.

This tells us that traders lean on progress belongings over dependable, low-risk dividend investing. Even so, such investing nonetheless resides throughout the US inventory market as an expression of the US hegemony.

Particularly, the acts because the de facto world central financial institution. Using as a worldwide reserve foreign money, the Fed can monetize extra spending as international governments purchase US debt. In flip, the ever-increasing Fed stability sheet trickles into the US inventory market with record-breaking market caps that overshadow complete nations.

This fortifying dynamic exempts the world of blockchain belongings, however they might ultimately construct up right into a blockchain mirror of the S&P 500.

Good points in Tokenized Property Too Good to Cross?

All indicators level to the incoming Trump admin because the friendliest for blockchain belongings. Not solely did Trump attend the 2024 convention in Miami, however Trump’s choose for brand new Securities and Alternate Fee Chair, Paul Atkins, has been famous as a crypto advocate.

And as Bitcoin nonetheless assessments the $100k vary, the whole crypto market cap reached $3.77 trillion, having outpaced the November 2021 peak of $2.98 trillion. The issue is that the crypto market has a coin dilution drawback. There are at the moment over 16,000 tokens to be tracked for efficiency.

This monitoring is impractical, and crypto traders have issue pinpointing which of them have staying liquidity energy. Finally, this advantages Bitcoin because the first-mover coin. Bitcoin can be the beneficiary of its proof-of-work algorithm that ties Bitcoin to a broader ecosystem of vitality and {hardware} belongings miners use.

On the similar time, it stays the case that Bitcoin’s giant market cap makes it troublesome to maneuver its value. This isn’t the issue of altcoins, particularly memecoins, as their market caps can balloon in a single day. Conversely, 2024 has been the yr of memecoin narrative dominance.

Actual-world asset (RWA) tokens comply with intently behind memecoins, with AI tokens rating third in efficiency. But, regardless of memecoin beneficial properties, it’s exceedingly troublesome to reliably time their tops (market exits) and bottoms (market entries). In spite of everything, these belongings derive worth from social media buzz as an alternative of earnings present in dividend shares.

In different phrases, memecoin investing is simply too fickle and must be prevented.

Within the face of token inflation and memecoin uncertainty, the crypto market is seeing a return to the familiarity of older altcoins, equivalent to (ADA), (XRP), (AVAX), Chainlink (LINK), Immutable (IMX), (DOT), Algorand (ALGO), and others.

time period publicity.

As inflation continues to erode USD in perpetuity, which hedge tactic is your favourite? Tell us within the feedback beneath.

The submit Dividend Investing in an Altcoin Era: Complementary or Redundant? appeared first on Tokenist.