Reward reinvesting is a valuable method for capitalists to intensify their returns. As the procedure of making use of money returns to purchase even more shares of the very same firm with time, this method might be ideal fit for longer-term capitalists.

This is mainly since the built up shares from reward profits change the choice of included liquidity in the profile. Keeping that being stated it is necessary for many capitalists to recognize supplies that supply trustworthy returns in addition to the capacity to have solid efficiencies.

Several reward aristocrats fit the costs as well as supply stable revenue in the profile. To that note right here is a consider the premier Zacks reward aristocrats right now that have actually increased their reward for a minimum of 25 successive years.

McDonald’s ( MCD)

We’ll begin with McDonald’s which has actually had the greatest efficiency over the last years about the various other reward aristocrats on the checklist. The convenience food leader presently sporting activities a Zacks Ranking # 1 (Solid Buy) as well as its Retail-Restaurants Sector remains in the leading 16% of over 250 Zacks markets.

McDonald’s strong reward as well as complete return efficiency make it a prime prospect to utilize for a reward reinvestment method.

Picture Resource: Zacks Financial Investment Research Study

As revealed over, McDonald’s complete return in the last ten years consisting of returns is +287% which has actually covered the wider indexes. This has actually likewise covered the Retail-Food & & Restaurants Markets +194%.

Reward Background: MCD has a 2.07% yearly reward return at $6.08 a share. The annualized reward development over the last 5 years is 7.34%. McDonald’s presently has a 58% payment proportion as well as has actually currently increased its reward for 47 successive years.

With McDonald’s development as well as expectation looking stable, currently might be a great time to include settings. And also, cost effective convenience food costs as well as the firm’s international reach make McDonald’s a practical financial investment also throughout harder market settings or amidst financial unpredictability.

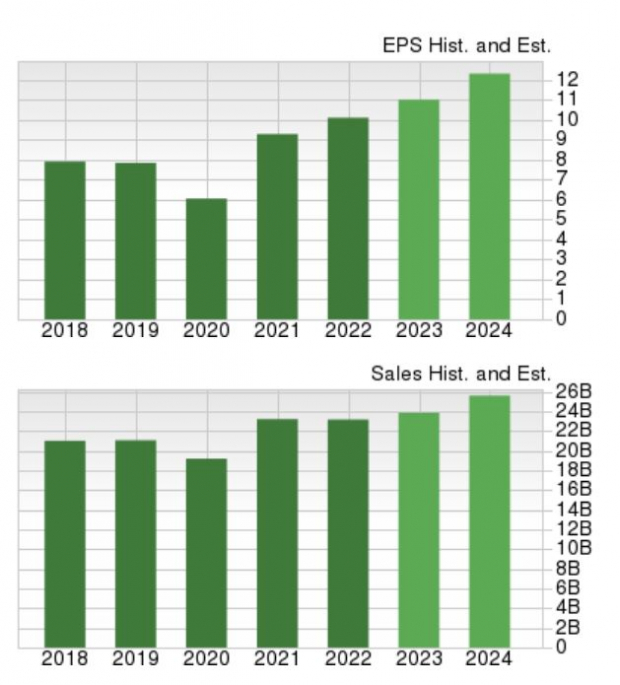

Shares of MCD profession at $294, with revenues anticipated to climb 9% this year as well as dive one more 9% in FY24 at $12.08 per share. On the leading line, sales are predicted to be up 7% in FY23 as well as increase one more 7% in FY24 to $26.71 billion.

Picture Resource: Zacks Financial Investment Research Study

Caterpillar ( PET CAT)

Among the a lot more interesting reward aristocrats right now is Caterpillar which has a Zacks Ranking # 1 (Solid Buy) as well as its Manufacturing-Construction as well as Mining Sector remains in the leading 2% of all Zacks markets.

Caterpillar supply is appealing as a leader in its area as well as the biggest international building as well as mining devices maker. Caterpillar has actually traditionally given capitalists with soaring returns with shares of feline up +228% over the last years consisting of returns.

This has actually surpassed the criteria’s +224% as well as covered the Machinery-Construction/Mining Markets’ +216%. What is most interesting concerning Caterpillar supply right now is climbing revenues price quote alterations.

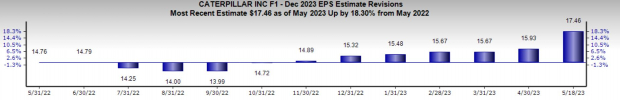

Picture Resource: Zacks Financial Investment Research Study

Monetary 2023 revenues quotes are greatly up over the last 6 months as received the graph above. Additionally, over the last 90 days, FY23 revenues quotes have actually increased 12% with FY24 EPS approximates up 8%.

With shares of feline trading at $214, Caterpillar’s revenues are currently anticipated to rise 26% this year at $17.46 per share contrasted to EPS of $13.84 in 2022. Monetary 2024 revenues are predicted to climb one more 2%.

Reward Background: feline has a 2.24% yearly reward return at $4.80 a share. Caterpillar’s reward development over the last 5 years is 8.19% with a payment proportion of 30%. Caterpillar has actually increased its reward for 29 successive years.

Significantly, Caterpillar’s reward return is well over the market standard of 1.59% along with covering the S&P 500’s 1.51% standard.

Picture Resource: Zacks Financial Investment Research Study

W.W. Grainer ( GWW)

Last But Not Least, W.W. Grainger likewise attracts attention amongst reward aristocrats with a Zacks Ranking # 1 (Solid Buy). The broad-line business-to-business representative of upkeep, fixing, as well as operating (MRO) product or services is likewise gaining from a solid service setting with the Industrial Solutions Sector in Zacks leading 37%.

Grainger’s solid efficiency in recent times makes the supply worthwhile of factor to consider for collecting shares in respect to reward reinvesting.

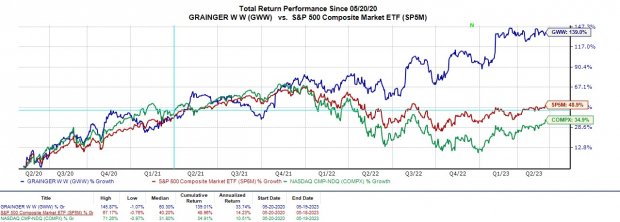

Picture Resource: Zacks Financial Investment Research Study

In the last 3 years, shares of GWW are up +139% consisting of returns to greatly surpass the S&P 500 as well as the Nasdaq while squashing the Industrial Solutions Markets -30%. Over the last years, Grainger’s complete return of +266% has actually likewise surpassed the criteria’s +224% as well as its Zacks Subindustry’s -36%.

Reward Background: GWW has a 1.10% annualized reward return at $7.44 a share. Grainger’s annualized reward development over the last 5 years is 5.87% with a payment proportion of 21%. Grainger has actually increased its reward for 51 successive years identifying the firm as a reward king too.

As a leading market leader, Grainger’s supply professions at $681 with revenues currently anticipated to leap 20% this year at $35.53 per share contrasted to EPS of $29.66 in 2022. Monetary 2024 revenues are anticipated to climb one more 5%. And also, revenues price quote alterations are significantly up over the last thirty day.

Picture Resource: Zacks Financial Investment Research Study

Takeaway

The stable as well as extensive development of these business makes a reward reinvestment method really interesting to capitalists that purchase their supplies. Purchasing McDonald’s, Caterpillar, as well as Grainger supply or collecting even more shares with reward reinvesting makes a great deal of feeling when thinking about the trustworthy revenue they supply as aristocrats as well as their solid complete return efficiencies.

Free Record: Top EV Battery Supplies to Get Currently

Just-released record exposes 5 supplies to make money as countless EV batteries are made. Elon Musk tweeted that lithium costs have actually mosted likely to “outrageous degrees,” as well as they’re most likely to maintain climbing up. Consequently, a handful of lithium battery supplies are readied to escalate. Accessibility this record to find which battery supplies to purchase as well as which to prevent.

Caterpillar Inc. (CAT) : Free Stock Analysis Report

McDonald’s Corporation (MCD) : Free Stock Analysis Report

W.W. Grainger, Inc. (GWW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as point of views shared here are the sights as well as point of views of the writer as well as do not always mirror those of Nasdaq, Inc.