All people loves dividends, as they supply a passive revenue stream, restrict drawdowns in different positions, and supply a couple of option to revenue from an funding.

And when contemplating dividend-paying shares, these with a historical past of boosting their payout are prime concerns, reflecting their dedication to more and more rewarding shareholders.

As well as, constant dividend hikes replicate the corporate’s profitable nature, opting to share income with shareholders.

For these in search of firms which have just lately boosted payouts, two favorably ranked firms, American Specific AXP and Pearson PSO, match the standards. Let’s take a better take a look at every.

AXP Retains Paying Traders

AXP has lengthy been acknowledged as a powerful income-focused play because of constant payouts over time, with the corporate sporting a shareholder-friendly 12.5% five-year annualized dividend development charge. Under is a chart illustrating the corporate’s dividends/share on an annual foundation.

Picture Supply: Zacks Funding Analysis

As well as, analysts have turn into bullish on the corporate’s present yr EPS outlook, with the $15.31 per share estimate up 4% over the past yr and suggesting 15% year-over-year development. The inventory sports activities a positive Zacks Rank #2 (Purchase).

Picture Supply: Zacks Funding Analysis

AXP just lately upped its quarterly payout by 17%, bringing the quarterly complete to $0.82 per share. Shares at present yield 1.1% yearly in comparison with a 1.3% annual yield from the S&P 500.

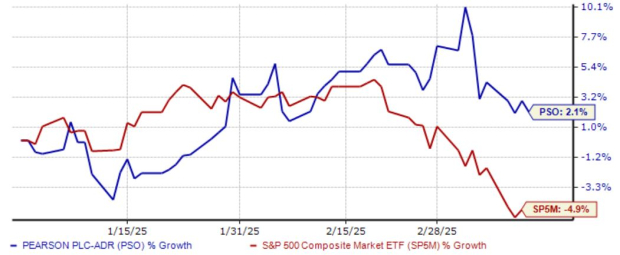

PSO Shares Present Relative Energy

Pearson shares have proven a pleasant degree of relative power in 2025, gaining 2% in comparison with a 5% decline from the S&P 500. The corporate unveiled an enormous 120% enhance to its quarterly payout in late February, with the quarterly payout now totaling $0.21 per share.

Picture Supply: Zacks Funding Analysis

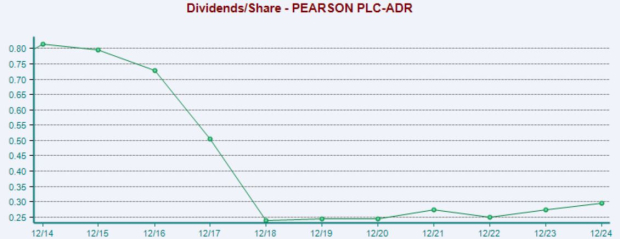

As proven under, the corporate is slowly returning to a extra shareholder-friendly nature over latest years following payout cuts all through the 2015 – 2019 interval.

Picture Supply: Zacks Funding Analysis

Like AXP, Pearson has loved optimistic earnings estimate revisions for its present fiscal yr, serving to land the inventory into a positive Zacks Rank #2 (Purchase). The present $0.88 Zacks Consensus EPS estimate suggests 13% development YoY.

Backside Line

Dividends result in many nice perks to traders, resembling passive revenue and the flexibility to realize most returns via dividend reinvestment.

Corporations enhance payouts when enterprise is fruitful, general sending a optimistic message in regards to the longer-term image. As well as, persistently increased payouts owe to an organization’s cash-generating skills, undoubtedly an enormous optimistic.

And for these in search of firms trying to pay their shareholders a better paycheck, each firms above – American Specific AXP and Pearson PSO – match the standards.

Zacks’ Analysis Chief Names “Inventory Most More likely to Double”

Our workforce of consultants has simply launched the 5 shares with the best chance of gaining +100% or extra within the coming months. Of these 5, Director of Analysis Sheraz Mian highlights the one inventory set to climb highest.

This prime choose is among the many most modern monetary corporations. With a fast-growing buyer base (already 50+ million) and a various set of leading edge options, this inventory is poised for giant features. In fact, all our elite picks aren’t winners however this one may far surpass earlier Zacks’ Shares Set to Double like Nano-X Imaging which shot up +129.6% in little greater than 9 months.

Free: See Our Top Stock And 4 Runners Up

American Express Company (AXP) : Free Stock Analysis Report

Pearson, PLC (PSO) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.