As 2025 will get underway, traders trying to refresh their portfolios with some attractively valued corporations is likely to be eyeing shares that lagged the market in 2024. Beverage giants Coca-Cola (NYSE: KO) and PepsiCo (NASDAQ: PEP) have been underneath strain over the previous yr, and each have fallen by round 14% from their 52-week highs.

Given the overlapping companies, it most likely does not make sense for many traders to have each shares of their portfolios. So which one is the higher purchase now?

Begin Your Mornings Smarter! Get up with Breakfast information in your inbox each market day. Sign Up For Free »

How far have PepsiCo and Coca-Cola actually fallen?

PepsiCo’s 2024 has been a little bit worse than Coca-Cola’s. Not solely was its dip from its peak barely steeper, it is really down greater than 10% yr up to now, whereas Coca-Cola is up by about 5%.

Nevertheless, if you happen to pull the lens additional again, PepsiCo’s drop from its three-year excessive is round 22%, whereas Coca-Cola’s is round 14%. However Coke loved a rally from late 2023 that lasted into 2024, whereas PepsiCo did not. All in, traders seem to have been a little bit extra destructive about PepsiCo general.

That negativity hole extends to their relative valuations. PepsiCo’s price-to-sales ratio is sort of 18% under its five-year common. Coca-Cola’s P/S ratio is simply about 7% decrease than its five-year common. Equally, PepsiCo’s price-to-earnings ratio is about 14% under its five-year common whereas Coca-Cola’s P/E is roughly 2% under its common.

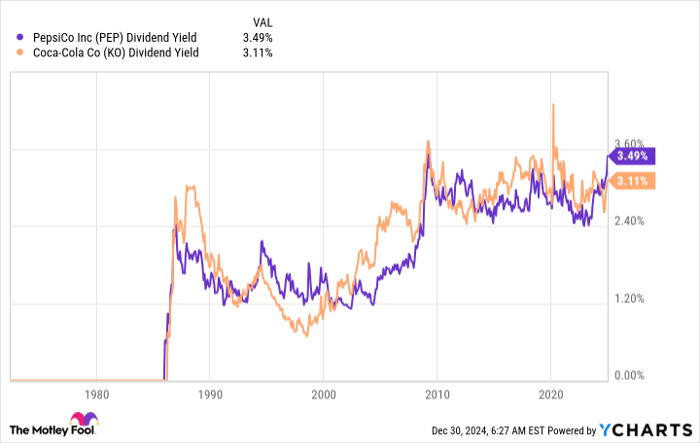

After which there are their dividend yields. At their present share costs, PepsiCo yields 3.5% whereas Coca-Cola yields 3.1%. On an absolute stage, PepsiCo’s yield is extra engaging, however there’s extra to the story. Whereas Coca-Cola’s present yield is roughly center of the street for the inventory over latest years, PepsiCo’s is close to its all-time excessive. All in all, PepsiCo seems like the higher worth if in case you have a worth bias if you make investments.

PEP Dividend Yield information by YCharts.

Similarities and variations

To be truthful, these corporations are usually not precisely interchangeable although their beverage companies have materials overlap. That stated, they’re related in some ways. For instance, each have elevated their dividends yearly for over 50 years, incomes them each spots among the many Dividend Kings. Members of that elite group have confirmed they’ll climate the inevitable ups and downs within the enterprise world and maintain rewarding their shareholders alongside the way in which.

However take into account the distinction between them. Coca-Cola has grown its income at a barely sooner clip over the previous few years, and its earnings have elevated at a dramatically sooner tempo. PepsiCo’s full-year earnings development charges have been caught within the low single digits whereas Coca-Cola has been rising earnings at paces within the low double digits. In that mild, it is smart why traders seem to love Coca-Cola greater than PepsiCo proper now.

However there’s one other, extra basic distinction between the 2 corporations. Coca-Cola sells drinks and solely drinks. It is good at what it does, however it does not have a lot diversification. PepsiCo, in contrast, sells drinks, snacks, and packaged meals merchandise, and it is a main participant in every of these companies. For an investor who needs to achieve broad portfolio publicity to the consumer staples sector, PepsiCo may present that with a single funding. Coca-Cola cannot. If diversification is essential to you, you may seemingly favor PepsiCo.

Neither is a foul selection

The reality is that Coca-Cola and PepsiCo are each well-run corporations that traders may comfortably purchase and maintain for many years. However in case you are making an attempt to maximise the earnings your portfolio generates, have a choice for worth shares, or prefer to personal diversified companies, PepsiCo is prone to be the higher selection to your portfolio in 2025.

Don’t miss this second probability at a doubtlessly profitable alternative

Ever really feel such as you missed the boat in shopping for probably the most profitable shares? Then you definately’ll need to hear this.

On uncommon events, our professional crew of analysts points a “Double Down” stock suggestion for corporations that they suppose are about to pop. When you’re frightened you’ve already missed your probability to speculate, now could be one of the best time to purchase earlier than it’s too late. And the numbers communicate for themselves:

- Nvidia: if you happen to invested $1,000 after we doubled down in 2009, you’d have $356,514!*

- Apple: if you happen to invested $1,000 after we doubled down in 2008, you’d have $47,762!*

- Netflix: if you happen to invested $1,000 after we doubled down in 2004, you’d have $485,594!*

Proper now, we’re issuing “Double Down” alerts for 3 unbelievable corporations, and there might not be one other probability like this anytime quickly.

*Inventory Advisor returns as of December 30, 2024

Reuben Gregg Brewer has positions in PepsiCo. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.