Two of the worst-performing shares within the retail sector over the previous yr have been Greenback Basic (NYSE: DG) and 5 Under (NASDAQ: FIVE), with each shares’ worth reduce in half over the previous 12 months, as of this writing.

Whereas each retail ideas revolve round promoting low cost items, their core demographics and the issues they’ve been going through are fairly totally different. With that in thoughts, let’s look at which inventory is perhaps the higher rebound candidate in 2025.

Begin Your Mornings Smarter! Get up with Breakfast information in your inbox each market day. Sign Up For Free »

Getting squished

Greenback Basic’s latest points have largely stemmed from the stress its core, lower-income prospects have been experiencing attributable to inflation, in addition to competitors from Walmart (NYSE: WMT). Quite a lot of 5 Under’s issues, in the meantime, will be traced again to Squishmallows.

In case you are unfamiliar with Squishmallows, they’re form of a mixture of a stuffed animal and pillow made by an organization known as Jazwares, which is a subsidiary of Berkshire Hathaway. First launched in 2017, these plush toys started to achieve a cult-like following very similar to Beanie Infants within the Nineties. This in flip led to sure Squishmallows turning into highly regarded and promoting for giant costs on the secondary market. This grew to become an enormous enterprise, with people and resellers scouring shops to search out widespread Squishmallows.

5 Under was one of many retailers caught up in Squishmallow mania, nevertheless it received caught on the incorrect facet of the pattern when the mania light and it was left with means an excessive amount of Squishmallow stock that was now not widespread. As well as, it confronted robust comparisons as Squishmallows helped drive gross sales and likewise introduced in a whole lot of prospects that had been largely curious about simply Squishmallows. Its same-store gross sales turned damaging in its fiscal first quarter (ended early Might) earlier than turning barely constructive in fiscal Q3. Nonetheless, they had been again to damaging for fiscal This autumn, largely attributable to 5 fewer vacation buying days.

General, 5 Under’s same-store gross sales fell about 3% for the yr. Nonetheless, the corporate is seeing total income and income develop because it continues to increase its retailer base. Initially of November, it had 1,749 shops in 44 states, an 18% enhance over a yr in the past. The corporate plans so as to add about 150 new shops in fiscal 2026 (ending early February), which might be a few 9% enhance.

Whereas 5 Under is way more targeted on merchandise for teenagers and tweens, Greenback Basic’s assortment is centered on primary requirements. It caters extra towards low-income customers, with about 60% of its prospects having a family revenue of lower than $35,000 a yr. Not surprisingly, these customers have been extra impacted by the latest ranges of excessive inflation over the previous few years.

Greenback Basic has been modestly rising its same-store gross sales, nevertheless it wants same-store gross sales development of greater than 3% with a view to leverage its bills and develop its earnings. In the meantime, its prospects have turned extra towards lower-margin consumable gadgets, which has led to margin stress. Final quarter (Q3 2024), it reported a 5% enhance in income and a same-store gross sales enhance of 1.3%, however its diluted earnings per share plunged 29.4%.

The greenback retailer retailer has carved a distinct segment by constructing places in smaller rural cities. Nonetheless, with its lower-income prospects struggling, many have turned to Walmart, the place they will usually discover higher worth. In the meantime, 90% of the U.S. inhabitants is now inside 10 miles of a Walmart or Sam’s Membership. Walmart has additionally launched same-day supply.

In response, Greenback Basic introduced in December that it was testing its personal same-day supply at 75 places. The corporate thinks this is also a chance to develop its advert enterprise, as prospects would have interaction with its app extra. Advertisements are typically excessive margin, and Walmart has seen robust development on this space.

Transferring forward, Greenback Basic is continuous to increase its retailer base, with plans to open 575 shops within the U.S. and as much as 15 in Mexico. It additionally plans to totally renovate 2,000 shops and partially renovate one other 2,250 places by means of its Undertaking Elevate, which will not embrace cooler expansions or contemporary produce just like the totally renovated shops will. The corporate presently operates greater than 20,000 shops.

Picture supply: Getty Pictures.

Valuations and verdict

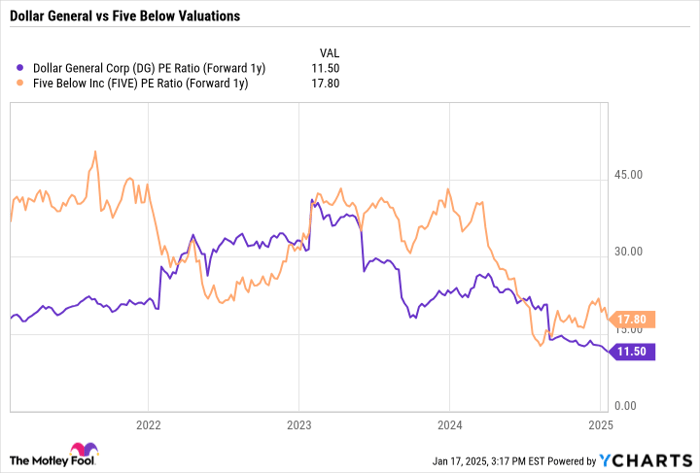

From a valuation perspective, Greenback Basic is the cheaper of the 2 shares, buying and selling at a forward price-to-earnings (P/E) ratio of 11.5 versus 17.8 for 5 Under. Nonetheless, it is usually value noting that Greenback Basic does have $5.7 billion in web debt, whereas 5 Under is presently debt free.

DG PE Ratio (Forward 1y) information by YCharts

General, regardless of the upper valuation I want 5 Under as the higher rebound candidate. I believe its challenges might be simpler to beat, and the corporate has a brand new CEO in Winnie Park who has a whole lot of retail expertise catering to youthful demographics. Because it laps the Squishmallow overhang and corrects another merchandizing errors, it ought to be capable to return to stable development.

Greenback Basic, in the meantime, remains to be going through a weakened atmosphere for low-income customers and fierce competitors from Walmart. These challenges might be tougher to beat, for my part.

Don’t miss this second likelihood at a probably profitable alternative

Ever really feel such as you missed the boat in shopping for probably the most profitable shares? Then you definately’ll wish to hear this.

On uncommon events, our knowledgeable group of analysts points a “Double Down” stock suggestion for firms that they assume are about to pop. When you’re frightened you’ve already missed your likelihood to speculate, now could be the most effective time to purchase earlier than it’s too late. And the numbers communicate for themselves:

- Nvidia: when you invested $1,000 after we doubled down in 2009, you’d have $357,084!*

- Apple: when you invested $1,000 after we doubled down in 2008, you’d have $43,554!*

- Netflix: when you invested $1,000 after we doubled down in 2004, you’d have $462,766!*

Proper now, we’re issuing “Double Down” alerts for 3 unimaginable firms, and there is probably not one other likelihood like this anytime quickly.

*Inventory Advisor returns as of January 13, 2025

Geoffrey Seiler has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Berkshire Hathaway and Walmart. The Motley Idiot recommends 5 Under. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.