As we start to head right into the summertime, one point continues to be indisputable: supplies have actually been a lot more powerful in 2023 contrasted to in 2015’s harsh proving, unquestionably an invited growth.

Several supplies have actually recoiled in a large method until now, with some bursting out to brand-new 52-week highs, consisting of Novo Nordisk NVO, Lamb Weston LW, and also Radian Team RDN. Below is a graph showing the efficiency of all 3 in 2023, with the S&P 500 combined in as a standard.

Picture Resource: Zacks Financial Investment Study

As we can see, all 3 have actually shown substantial energy year-to-date, squashing the S&P 500’s outstanding 9% gain. For those thinking about riding the family member toughness, allow’s take a better consider each.

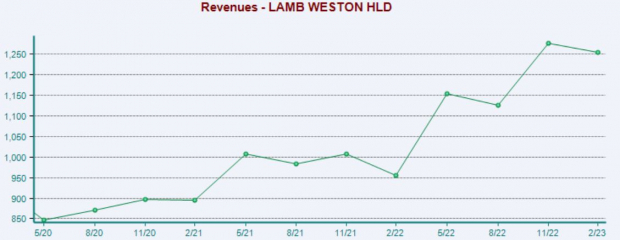

Lamb Weston

Lamb Weston is a leading international producer, marketing professional, and also representative of value-added icy potato items. The supply is currently a Zacks Ranking # 1 (Solid Buy).

Picture Resource: Zacks Financial Investment Study

LW has actually constantly uploaded solid quarterly outcomes since late, going beyond the Zacks Agreement EPS Quote by double-digit portions in 6 successive quarters. Simply in its most current launch, Lamb Weston signed up a 46% EPS beat and also reported income 6.5% over assumptions.

Picture Resource: Zacks Financial Investment Study

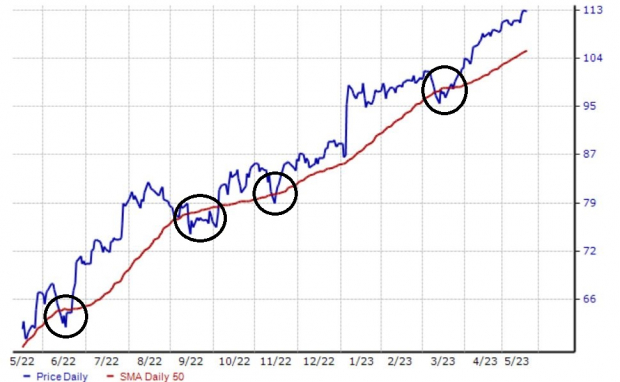

Financiers might make use of the 50-day relocating standard as a prospective access factor, as the degree has actually constantly given assistance over the in 2015. This is highlighted in the graph below.

Picture Resource: Zacks Financial Investment Study

Novo Nordisk

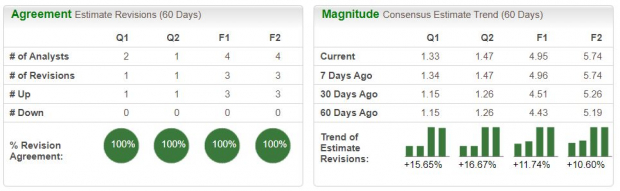

Novo Nordisk is a worldwide health care business and also a leader in the globally diabetes mellitus market. As we can see below, experts have actually enhanced their revenues assumptions over the last numerous months, assisting land the supply right into a Zacks Ranking # 1 (Solid Buy).

Picture Resource: Zacks Financial Investment Study

Additionally, NVO shares are pricey on a loved one basis, with the present 34.6 X ahead revenues several resting well over the 24.4 X five-year average and also the Zacks Medical market standard. The high assessment photo might trigger some marketing stress, a growth capitalists ought to be extremely familiar with.

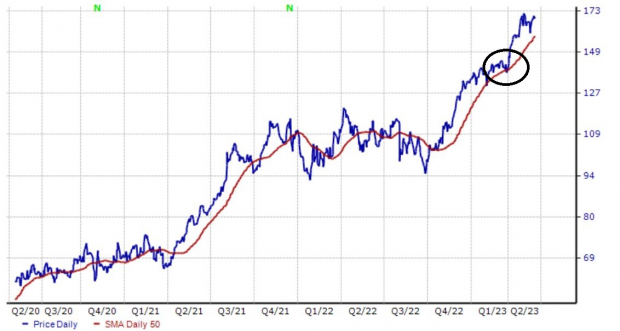

Picture Resource: Zacks Financial Investment Study

If shares see a modification, anticipate the 50-day relocating standard to come to be a location of rate of interest, a degree that shares have actually just recently jumped off of.

Picture Resource: Zacks Financial Investment Study

Radian Team

Radian Team, a credit report improvement business, sustains buyers, home loan loan providers, financing servicers, and also capitalists with a collection of personal home loan insurance policy and also relevant risk-management services and products. Like the supplies over, RDN sporting activities the highly-coveted Zacks Ranking # 1 (Solid Buy).

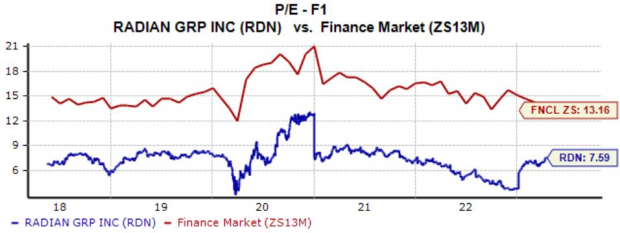

Shares do not show up extended in regards to assessment, with the present 7.6 X ahead revenues several resting a couple of ticks listed below the five-year average and also the Zacks Financing market standard.

The supply lugs a Design Rating of “B” for Worth.

Picture Resource: Zacks Financial Investment Study

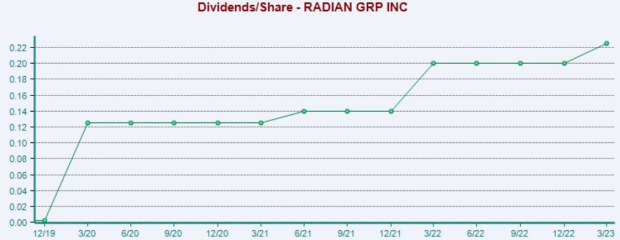

Additionally, shares do pay a strong reward, presently generating 3.6% every year. Remarkably, the business has greater than increased its payment over the ins 2015, completely showing a dedication to progressively compensating its investors.

Picture Resource: Zacks Financial Investment Study

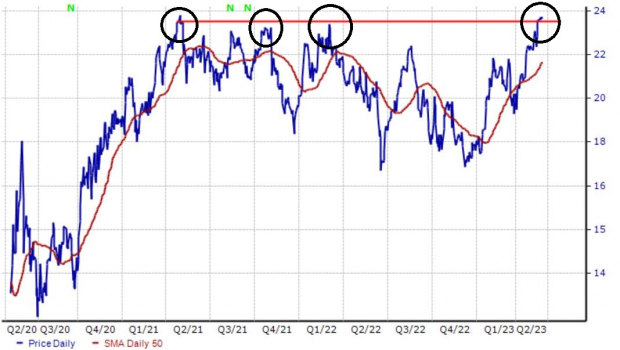

Shares are currently bursting out of a several-year-long array, as we can see detailed listed below. Formerly, RDN shares have actually stopped working to hold their energy at this degree, yet the business’s enhanced revenues expectation might sustain shares well over.

Picture Resource: Zacks Financial Investment Study

Profits

Energy investing is focused around targeting supplies showing outperformance. And also when you include the Zacks Ranking, the method can come to be a lot more effective.

Which’s specifically what all 3 supplies above– Novo Nordisk NVO, Lamb Weston LW, and also Radian Team RDN– have actually shown, bursting out to brand-new 52-week high up on the rear of enhanced revenues expectations.

Still, it’s important for capitalists to thoroughly put quit losses at comfy limits, as the energy swing can rapidly transform unfavorable.

This Obscure Semiconductor Supply Might Be Your Profile’s Bush Versus Rising cost of living

Every person utilizes semiconductors. However just a handful of individuals recognize what they are and also what they do. If you make use of a mobile phone, computer system, microwave, electronic electronic camera or fridge (which’s simply the suggestion of the iceberg), you have a requirement for semiconductors. That’s why their relevance can not be overemphasized and also their interruption in the supply chain has such a worldwide result. However every cloud has a positive side. Shockwaves to the global supply chain from the international pandemic have actually discovered a significant chance for capitalists. And also today, Zacks’ prominent supply planner is disclosing the one semiconductor supply that stands to get one of the most in a brand-new FREE record. It’s your own at no charge and also without commitment.

>>Yes, I Want to Help Protect My Portfolio During the Recession

Novo Nordisk A/S (NVO) : Free Stock Analysis Report

Radian Group Inc. (RDN) : Free Stock Analysis Report

Lamb Weston (LW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights and also viewpoints shared here are the sights and also viewpoints of the writer and also do not always mirror those of Nasdaq, Inc.