Some capitalists might be unconvinced of the wider economic industry after the collapse of Silicon Valley Financial Institution yet there are some wonderful chances developing.

Right here are 2 fin-tech firms that are premier Zacks supplies right now as currently resembles the moment to purchase.

Fiserv ( FISV)

As a company of economic innovation solutions, Fiserv supply sticks out right now showing off a Zacks Ranking # 2 (Buy). Fiserv’s Financial Deal Solutions Sector is additionally in the leading 28% of over 250 Zacks Industries.

Fiserv mainly supplies account gathering, company innovation, as well as individual repayment solutions to a varied customer base with its core emphasis locations being profile monitoring, customer connection worth improvement, functional performance, funding technique, as well as technology.

Fiserv is anticipated to see solid leading as well as fundamental development over the following couple of years. Revenues are currently forecasted to increase 13% this year as well as dive an additional 14% in FY24 at $8.37 per share. Revenues approximate modifications are a little greater over the last quarter.

Photo Resource: Zacks Financial Investment Study

Sales are anticipated to be up 6% in FY23 as well as surge an additional 8% in FY24 to $19.38 billion. Much more Outstanding, monetary 2024 would certainly stand for 90% development from pre-pandemic sales of $10.18 billion in 2019.

Making Fiserv’s stable development look extra eye-catching is its price-to-earnings assessment which is really interesting from a historic point ofview. Fiserv supply professions at $115 per share as well as 15.8 X ahead profits which is 46% listed below its decade-long high of 29.4 X while supplying a 28% price cut to the mean of 22.1 X. Fiserv supply additionally trades on the same level with its sector standard as well as perfectly underneath the S&P 500’s 19.2 X.

Photo Resource: Zacks Financial Investment Study

Interactive Brokers ( IBKR)

Operating as an automated international digital market manufacturer as well as broker, Interactive Brokers supply is additionally beginning to attract attention with a Zacks Ranking # 2 (Buy).

Interactive Brokers concentrates on directing orders, performing as well as refining sell safety and securities, futures, fx tools, bonds, as well as common funds on greater than 150 digital exchanges as well as market facilities worldwide.

Especially, monetary 2023 profits quotes have actually climbed 9% over the last 90 days with FY24 EPS approximates leaping 12%.

Photo Resource: Zacks Financial Investment Study

Interactive Brokers’ profits are currently forecasted to climb up 38% this year at $5.58 per share contrasted to EPS of $4.05 in 2022. Financial 2024 profits are anticipated to a little border up at $5.61 per share.

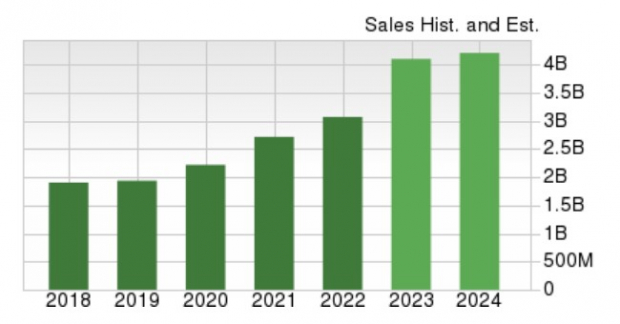

On the leading line, sales are anticipated to rise 34% this year as well as surge an additional 1% in FY24 to $4.17 billion. And also, monetary 2024 would certainly be an extremely remarkable 116% rise from pre-pandemic sales of $1.93 billion in 2019.

Photo Resource: Zacks Financial Investment Study

Also much better, Interactive Broker’s P/E assessment is really eye-catching about its past. Trading at $83 per share as well as 14.7 X ahead profits, shares of IBKR are 79% listed below their years high of 66.2 X as well as use a 36% price cut to the mean of 22.9 X. This is currently closer to the Financial Financial investment Financial institution’s sector standard of 12.4 X as well as underneath the criteria.

Photo Resource: Zacks Financial Investment Study

Takeaway

Bearing in mind that Fiserv as well as Interactive Brokers supplies have both increased over +400% in the last years makes their existing potential customers really interesting. This has actually conveniently covered the S&P 500’s +163% with both firms remaining to increase as well as currently trade much more beautifully from a price-to-earnings viewpoint.

This definitely makes it more probable that Fiserv as well as Interactive Brokers’ solid efficiencies might proceed as we advance with the 2020s as well as capitalists should not neglect these money trendsetters.

Interactive Brokers Group, Inc. (IBKR) : Free Stock Analysis Report

Fiserv, Inc. (FISV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as point of views shared here are the sights as well as point of views of the writer as well as do not always mirror those of Nasdaq, Inc.