Different extra well-known names will probably be reporting their quarterly outcomes this week, however Dorian LPG (LPG) and Titan Equipment (TITN) are two shares that traders will wish to take note of.

Let’s see why now could also be time to purchase Dorian LPG and Titan Equipment inventory as their quarterly reviews method on Could 24 and 25 respectively.

Dorian LPG This autumn Preview

Sporting a Zacks Rank #1 (Robust Purchase) Dorian LPG is predicted to launch its fiscal fourth-quarter outcomes on Wednesday, Could 24. Dorian LPG’s Transportation-Transport Business can also be within the high 47% of over 250 Zacks industries.

Buying and selling round $23 a share, Dorian LPG’s inventory has edged towards 52-week highs and is benefiting from its robust enterprise trade as a liquified petroleum fuel delivery firm. Dorian LPG is primarily targeted on proudly owning and working Very Massive Gasoline Carriers (VLGCs).

Fiscal fourth-quarter earnings are anticipated to soar 232% from the prior-year quarter at $2.06 per share in comparison with EPS of $0.62 in This autumn 2022. Gross sales are projected to be up 74% 12 months over 12 months at $138.96 million.

The Zacks Anticipated Shock Prediction (ESP) signifies Dorian LPG ought to attain its This autumn earnings expectations with the Most Correct Estimate additionally having EPS pegged at $2.06.

Picture Supply: Zacks Funding Analysis

Titan Equipment Q1 Preview

With a Zacks Rank #2 (Purchase) Titan Equipment is ready to launch its first-quarter earnings on Thursday, Could 25 with its Automotive-Retail and Complete Gross sales Business within the high 40% of all Zacks industries.

Titan Equipment inventory trades at $34 a share and nonetheless 28% from its 52-week highs with its outlook and enterprise atmosphere beginning to strengthen. Titan Equipment operates a diversified mixture of agricultural, building, and client merchandise dealerships situated within the midwestern United States.

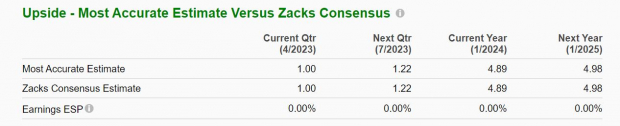

First-quarter earnings are anticipated to leap 26% YoY at $1.00 per share in comparison with EPS of $0.79 in Titan Equipment’s fiscal Q1 2023. Gross sales for Q1 are projected to be $585.59 million and up 27% from the prior-year quarter. The Zacks ESP additionally signifies Titan Equipment ought to attain its Q1 earnings expectations.

Picture Supply: Zacks Funding Analysis

Earnings Outlook

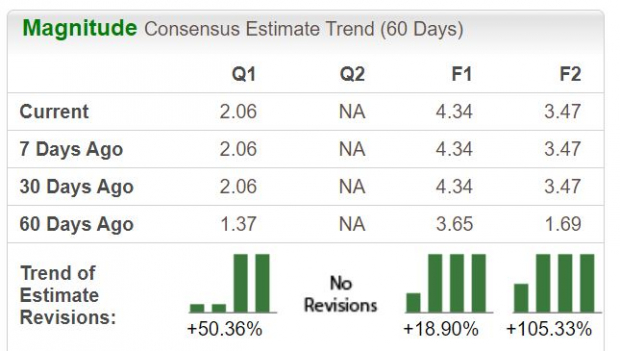

Primarily based on Zacks estimates, Dorian LPG’s earnings at the moment are forecasted to skyrocket 226% this 12 months at $4.34 per share in comparison with EPS of $1.33 in 2022. Fiscal 2024 earnings are projected to chill off and decline -20% at $3.47 per share after what could be a really robust 12 months to comply with.

With that being stated, earnings estimate revisions have soared for each FY23 and FY24 over the past two months which is a robust indication that Dorian LPG might supply better-than-expected steerage throughout its This autumn report.

Picture Supply: Zacks Funding Analysis

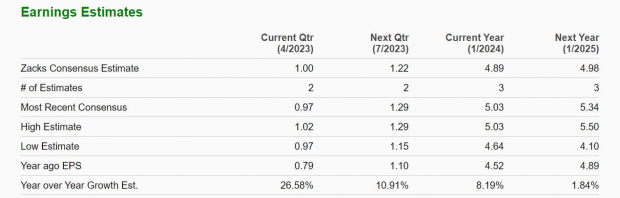

Taking a look at Titan Equipment, earnings are projected to leap 8% in its present fiscal 2024 and rise one other 2% in FY25 at $4.98 per share. Notably, fiscal 2025 projections symbolize a really spectacular 295% EPS development over the past 5 years with 2021 earnings at $1.26 per share.

Picture Supply: Zacks Funding Analysis

Takeaway

Dorian LPG and Titan Equipment inventory are very intriguing in the meanwhile. Together with the anticipation of robust quarterly reviews, it’s fairly doable these corporations could supply optimistic steerage when their earnings outlook and this might result in extra upside in shares of LPG and TITN.

The New Gold Rush: How Lithium Batteries Will Make Millionaires

As the electrical car revolution expands, traders have an opportunity to focus on big features. Thousands and thousands of lithium batteries are being made & demand is predicted to extend 889%.

Download the brand-new FREE report revealing 5 EV battery stocks set to soar.

Titan Machinery Inc. (TITN) : Free Stock Analysis Report

Dorian LPG Ltd. (LPG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.