For the time being, the Zacks Leisure and Recreation Providers Business is within the prime 7% out of 250 Zacks industries. Moreover, a number of Chinese language ADRs (American Depository Receipts) are standing out amongst this top-rated trade specifically.

Beginning to profit from the vacation journey season, right here’s a take a look at two of those leisure shares that at present boast a Zacks Rank #1 (Sturdy Purchase).

Atour Life-style Holdings – ATAT

Working the most important midscale lodge chain in China, Atour Life-style Holdings ATAT is worthy of traders’ consideration. ATAT shares are engaging by way of development and momentum as Atour reported Q3 outcomes final Tuesday with appreciable enlargement on its prime and backside traces.

Atour’s Q3 earnings of $0.39 a share elevated 44% from EPS of $0.27 within the prior-year quarter. This got here on Q3 gross sales of $270.55 million, a 52% enhance from $177.37 million a 12 months in the past. Moreover, Atour beat Q3 EPS and gross sales estimates by 2% respectively with ATAT being one of many hottest IPOs in recent times after going public on the finish of 2022.

Picture Supply: Zacks Funding Analysis

Journey.com – TCOM

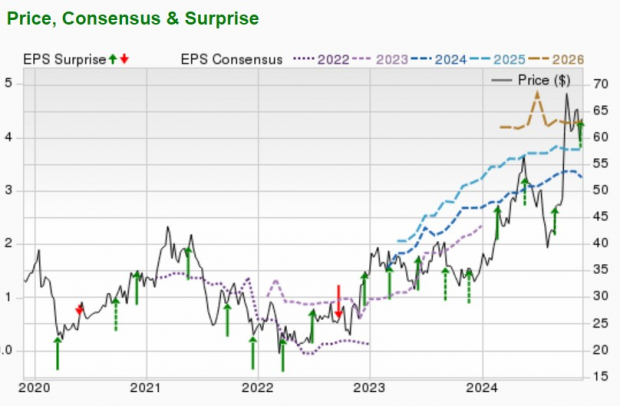

Based mostly in Shanghai, Journey.com TCOM is one other Chinese language leisure and recreation companies firm whose inventory may have extra upside. Providing a one-stop reserving service for travel-related packages, Journey.com impressively exceeded Q3 EPS expectations by 37% final Monday with earnings at $1.25 per share in comparison with Zacks estimates of $0.91.

Journey.com’s EPS spiked from $1.00 within the comparative quarter whereas Q3 gross sales of $2.26 billion rose 20% and exceeded estimates of $2.19 billion. TCOM has been a top-performing inventory this 12 months, hovering over +70% in 2024 with Journey.com now surpassing earnings expectations for 9 consecutive quarters as proven within the EPS shock chart beneath.

Picture Supply: Zacks Funding Analysis

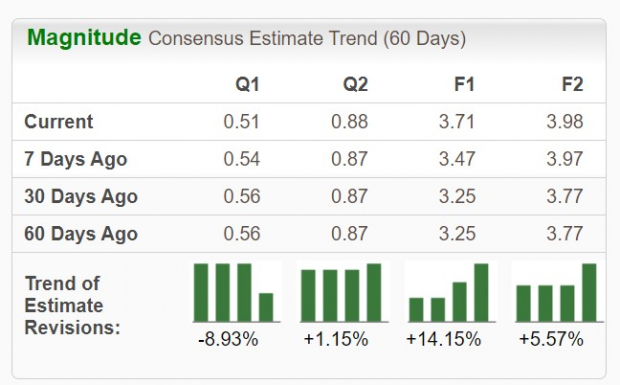

Seeing robust journey demand for the height vacation season, earnings estimate revisions are noticeably larger for Journey.com over the past 60 days and are properly up within the final week.

Picture Supply: Zacks Funding Analysis

Backside Line

Like Journey.com, Atour Life-style Holdings is benefiting from a optimistic development of earnings estimate revisions which suggests theirstellar priceperformances may proceed. That stated, it could be no shock if these prime leisure shares preserve hovering by way of the vacation season.

7 Finest Shares for the Subsequent 30 Days

Simply launched: Consultants distill 7 elite shares from the present checklist of 220 Zacks Rank #1 Sturdy Buys. They deem these tickers “Most Possible for Early Value Pops.”

Since 1988, the total checklist has crushed the market greater than 2X over with a mean acquire of +24.1% per 12 months. So you’ll want to give these hand picked 7 your instant consideration.

Trip.com Group Limited Sponsored ADR (TCOM) : Free Stock Analysis Report

Atour Lifestyle Holdings Limited Sponsored ADR (ATAT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.