Alleviating rising cost of living is beginning to make international financial headwinds go away as well as might cause more powerful customers. A number of customer staples as well as customer optional supplies are ending up being a lot more eye-catching as well as worthwhile of financiers’ factor to consider.

Below are 3 consumer-focused supplies that financiers might wish to take into consideration as they use variety to customers in a selection of international markets.

Aaron’s ( AAN)

Touchdown a Zacks Ranking # 2 (Buy) Aaron’s Business deserves an appearance as an Atlanta-based omnichannel company of lease-to-own acquisition options to underserved as well as credit-challenged consumers. Aaron’s offers lease possession as well as specialized selling of furnishings, residence devices, electronic devices, as well as computer systems to name a few items as well as devices.

With rising cost of living starting to reduce profits price quotes are visibly greater as well as Aaron’s rate to profits evaluation is beginning to stand apart. Trading at $13 a share, financial 2023 profits price quotes have actually skyrocketed 33% over the last 2 months to $1.20 per share contrasted to $0.90 a share 60 days back.

Additionally, Aaron’s supply professions at 11.8 X onward profits which is somewhat under its market standard of 12.5 X as well as well listed below the S&P 500’s 20.3 X. A lot more fascinating, Aaron’s seems in excellent economic wellness when checking out rate to capital. Aaron’s P/CF of 0.67 is well listed below the optimal degree of much less than 20 as well as the market standard of 9.86.

Picture Resource: Zacks Financial Investment Study

Ahold ( ADRNY)

Based in the Netherlands, Ahold supply additionally sporting activities a Zacks Ranking # 2 (Buy) with the firm running stores that use food as well as non-food items in the USA as well as Europe.

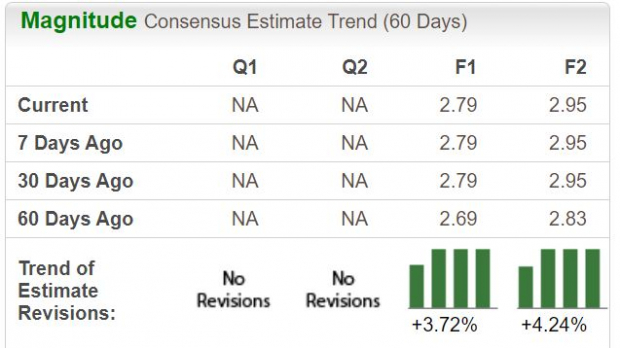

Trading at $32 a share, Ahold’s leading as well as fundamental development is consistent with profits price quotes somewhat up over the last 2 months. Ahold’s profits are currently anticipated to be up 4% this year as well as surge one more 6% in FY24 at $2.95 per share.

At existing degrees, Ahold trades at 11.4 X onward profits which is well under the market standard of 17.2 X as well as the criteria. On the leading line, sales are predicted to leap 8% in FY23 as well as surge one more 2% in FY24 to $100.82 billion.

Picture Resource: Zacks Financial Investment Study

Embotelladora Andina ( AKO.B)

Finally, Embotelladora Andina supply presently sporting activities a Zacks Ranking # 1 (Solid Buy) with the firm dispersing Coca-Cola items in Chile, Brazil, as well as Argentina. Via subsidiaries, Embotelladora additionally generates pet product packaging as well as disperses juice as well as mineral water together with container fruits as well as tomato items.

At $15 a share, Embotelladora’s EPS development is really eye-catching right now with profits anticipated to rise 58% this year at $1.39 per share contrasted to EPS of $0.88 in 2022. Financial 2024 profits are anticipated to leap one more 19% at $1.66 per share.

Also much better, Embotelladora’s supply professions at simply 10.7 X onward profits which is a substantial discount rate to its market standard of 23.5 X as well as the criteria’s 20.3 X.

Picture Resource: Zacks Financial Investment Study

Profits

Currently these supplies have a general “A” VGM Zacks Design Ratings quality for the mix of Worth, Development, as well as Energy. With these consumer-centric supplies particularly attracting attention in regards to worth currently seems a great time to get as international financial problems support as well as rising cost of living relieves.

Zacks Discloses ChatGPT “Sleeper” Supply

One obscure firm goes to the heart of a particularly fantastic Expert system market. By 2030, the AI market is forecasted to have a web as well as iPhone-scale financial influence of $15.7 Trillion.

As a solution to visitors, Zacks is giving a bonus offer record that names as well as clarifies this eruptive development supply as well as 4 various other “need to gets.” Plus a lot more.

Download Free ChatGPT Stock Report Right Now >>

The Aaron’s Company, Inc. (AAN) : Free Stock Analysis Report

Embotelladora Andina S.A. (AKO.B) : Free Stock Analysis Report

Ahold NV (ADRNY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as point of views shared here are the sights as well as point of views of the writer as well as do not always mirror those of Nasdaq, Inc.