Among the many Zacks Rank #1 (Sturdy Purchase) listing, a number of shares had been scorching earlier than extra volatility hit the broader market however now could also be time to begin eying their rebounds.

With illustration from a wide range of sectors listed below are three of those extremely ranked shares to think about.

Dream Finders Properties DFH: Contemplating the robust efficiency of many homebuilder shares, Dream Finders Properties has been one of many extra moderately priced and valued names regardless of DFH skyrocketing over +138% within the final 12 months. That stated, DFH has now dipped -3% 12 months up to now and has fallen -29% from its 52-week highs of $44.38 in late March.

Picture Supply: Zacks Funding Analysis

There’s actually a case that the current pullback was a market overaction given Dream Finders’ very cheap P/E valuation at 9.9X ahead earnings with EPS forecasted to climb 23% in fiscal 2024 to $3.45 per share. Whereas Dream Finders’ earnings progress is anticipated to be nearly flat subsequent 12 months, EPS estimates for each FY24 and FY25 are nonetheless up 23% and 12% over the past 60 days respectively.

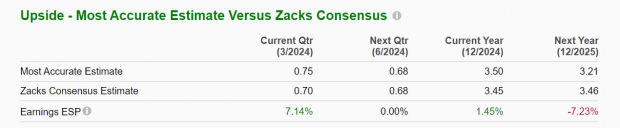

Plus, Dream Finders has crushed earnings expectations by a median of 144.88% in its final 4 quarterly studies with This autumn EPS of $1.00 most lately beating estimates of $0.67 a share by 49%. This makes it noteworthy that the Zacks ESP (Anticipated Shock Prediction) presently suggests Dream Finders might beat Q1 earnings estimates by 7% when the corporate studies on Could 2. To that time, the Zacks Consensus has Q1 EPS pegged at $0.70 with the Most Correct Estimate at $0.75 a share.

Picture Supply: Zacks Funding Analysis

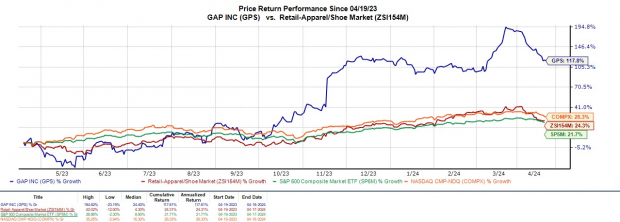

The Hole GPS: The Hole’s inventory has an identical situation to Dream Finders amongst attire retailers. GPS has been one of many top-performing however pretty valued retail attire shares at 15.6X ahead earnings which is roughly on par with its business common and properly beneath the S&P 500’s 21.2X.

Making the case for a shopping for alternative, The Hole’s annual earnings are anticipated to dip -5% this 12 months however then rebound and rise 10% in FY25 to $1.50 per share.

Picture Supply: Zacks Funding Analysis

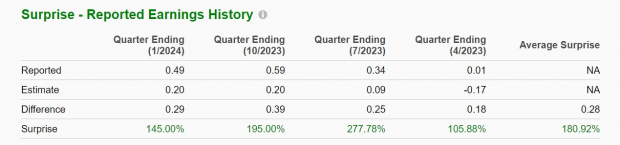

This comes as GPS has soared +118% over the past 12 months however now has a flat YTD efficiency. Buying and selling at $21, GPS has fallen -26% from its 52-week excessive of $28.59 in March. Nonetheless, GPS has exceeded earnings expectations in every of its final 4 quarterly studies as effectively and has posted an impressive common EPS shock of 180.92%.

Moreover, The Zacks ESP signifies The Hole ought to attain Q1 earnings estimates of $0.12 a share on Could 23. Higher nonetheless, earnings estimate revisions are properly up for The Hole’s present FY25 and FY26 over the past two months and GPS has a beneficiant 2.83% annual dividend yield to assist affected person buyers.

Picture Supply: Zacks Funding Analysis

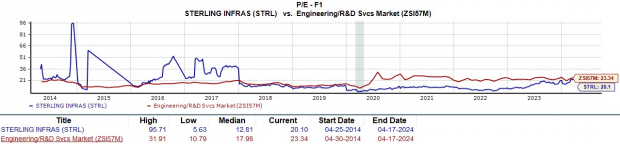

Sterling Infrastructure STRL: With the USA dedicating over $1 trillion to constructing out its infrastructure over the following few years, many buyers could have been ready for higher shopping for alternatives in Sterling Infrastructure”s inventory.

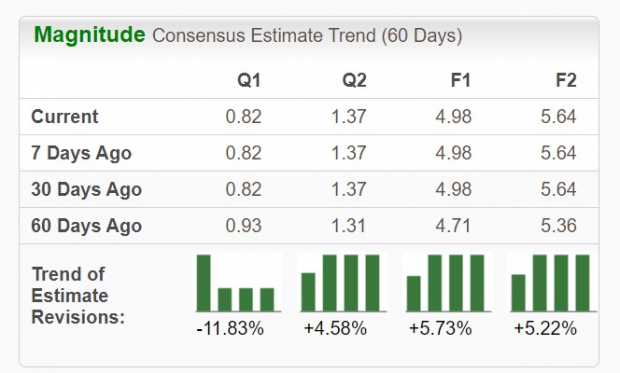

STRL has ascended +164% within the final 12 months however has dipped -15% from its 52-week excessive of $116.36 a share it hit final month. Nonetheless, STRL continues to be sitting on +12% features this 12 months and double-digit high and bottom-line progress is anticipated in FY24 and FY25. Reassuringly, earnings estimate revisions are modestly greater.

Picture Supply: Zacks Funding Analysis

Extra persuading is that Sterling Infrastructure has crushed EPS estimates for 4 straight quarters posting a median earnings shock of 20.41%. Sterling Infrastructure is scheduled to report its Q1 earnings on Could 6 and the Zacks ESP displays that expectations of $0.82 a share needs to be met.

In fact, there may be a lot hype for shares that may profit from President Biden’s infrastructure invoice and STRL trades at 20.1X ahead earnings which is beneath the benchmark and the Zacks Engineering-R and D Providers Business common of 23.3X.

Picture Supply: Zacks Funding Analysis

Backside Line

Dream Finders Properties, The Hole, and Sterling Infrastructure are the expample of shares that buyers could wish to get their palms on follownig a market correction. Moreover, these highly-rated shares ought to begin seeing some good momentum as their Q1 outcomes apprach.

Zacks Names #1 Semiconductor Inventory

It is only one/9,000th the scale of NVIDIA which skyrocketed greater than +800% since we advisable it. NVIDIA continues to be robust, however our new high chip inventory has way more room to increase.

With robust earnings progress and an increasing buyer base, it is positioned to feed the rampant demand for Synthetic Intelligence, Machine Studying, and Web of Issues. International semiconductor manufacturing is projected to blow up from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

The Gap, Inc. (GPS) : Free Stock Analysis Report

Sterling Infrastructure, Inc. (STRL) : Free Stock Analysis Report

Dream Finders Homes, Inc. (DFH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.