Among the many Zacks Rank #1 (Sturdy Purchase) listing, Alcoa Company AA and Kinder Morgan KMI are two shares to regulate forward of their This fall experiences on Wednesday, January 22.

To that time, the robust worth performances of those extremely ranked shares might proceed with Alcoa and Kinder Morgan shares up +80% and +40% within the final 12 months respectively.

Picture Supply: Zacks Funding Analysis

Alcoa This fall Expectations

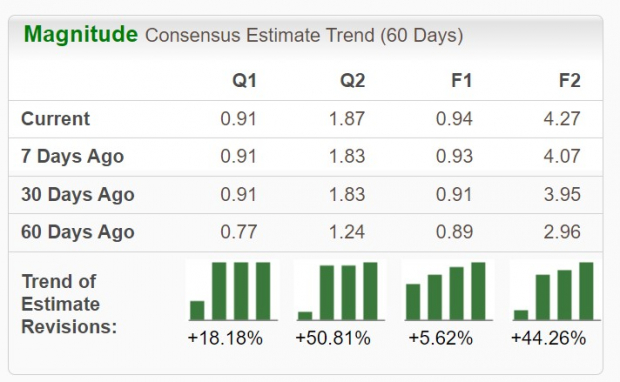

As a world chief within the manufacturing of bauxite and aluminum merchandise, Alcoa’s This fall gross sales are thought to have spiked 30% to $3.38 billion in comparison with $2.6 billion within the prior 12 months quarter. Even higher, This fall earnings are anticipated to climb swing to $0.91 per share versus an adjusted EPS lack of -$0.56 a 12 months in the past.

Alcoa is slated to spherical out fiscal 2024 with whole gross sales rising 11% to $11.76 billion. Extra importantly, annual earnings are anticipated to soar to $0.94 per share versus an adjusted lack of -$2.27 a share in 2023.

Kinder Morgan This fall Expectations

Pivoting to Kinder Morgan, a frontrunner in midstream power infrastructure, This fall gross sales are anticipated to extend 3% to $4.16 billion. Moreover, This fall EPS is anticipated at $0.33 in comparison with $0.28 per share within the comparative quarter.

Annual earnings are slated to extend 9% to $1.17 per share regardless of whole gross sales forecast of $15.27 billion versus $15.33 billion in 2023.

FY25 Outlook & EPS Revisions

Suggesting Alcoa and Kinder Morgan might provide constructive steering throughout their This fall experiences is their FY25 projections.

Primarily based on Zacks estimates, Alcoa’s whole gross sales are projected to develop one other 9% this 12 months to $12.87 billion. Higher nonetheless, FY25 EPS is anticipated to soar over 350% to $4.27. It’s additionally noteworthy that during the last 60 days, FY24 EPS estimates are up 4% whereas FY25 estimates have climbed greater than 40%.

Picture Supply: Zacks Funding Analysis

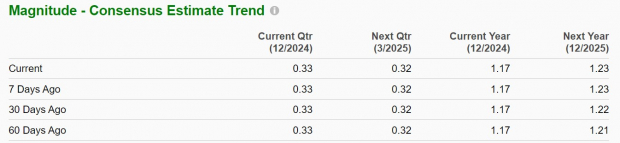

As for Kinder Morgan, its high line is forecasted to rebound and rise 5% this 12 months with FY25 gross sales projections at $15.99 billion. Plus, Kinder Morgan’s annual earnings are projected to extend one other 5% in FY25 to $1.23 per share.

Over the past 60 days, earnings estimate revisions for FY24 have remained unchanged though FY25 EPS estimates are barely up.

Picture Supply: Zacks Funding Analysis

Backside Line

Contemplating their elevated profitability, now seems to be a perfect time to purchase Alcoa Company and Kinder Morgan inventory with each shaping as much as be viable investments for 2025 and past.

7 Finest Shares for the Subsequent 30 Days

Simply launched: Specialists distill 7 elite shares from the present listing of 220 Zacks Rank #1 Sturdy Buys. They deem these tickers “Most Possible for Early Value Pops.”

Since 1988, the total listing has crushed the market greater than 2X over with a mean acquire of +24.1% per 12 months. So make sure to give these hand picked 7 your speedy consideration.

Alcoa (AA) : Free Stock Analysis Report

Kinder Morgan, Inc. (KMI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.