Weight reduction objectives could also be on the forefront of many New Yr’s resolutions, which may push the exuberance for Eli Lilly LLY and Novo Nordisk NVO inventory.

As the most important gamers within the hyper-scale shift of injectable medication that deal with weight problems, traders could also be pondering which pharmaceutical large is the higher funding in the meanwhile.

Zepbound & Wegovy

Eli Lilly’s Zepbound and Novo Nordisk’s Wegovy are each once-weekly injectable medicines designed for persistent weight administration. Each have added billions of {dollars} in extra income for these pharmaceutical leaders though Zepbound was extra lately authorised in November of 2023 whereas Wegovy has been cleared for utilization since June of 2021.

That stated, Zepbound has proven larger weight reduction, serving to sufferers lose a mean of 20.2% of their physique weight in a Section IIIb trial which was 47% simpler than Wegovy.

Progress & Outlook Comparability

Primarily based on Zacks estimates, Eli Lilly’s whole gross sales are actually anticipated to increase 33% in fiscal 2024 to $45.44 billion versus $34.12 billion in 2023. Moreover, FY25 gross sales are projected to climb one other 33% to $60.36 billion.

Extra intriguing, Eli Lilly’s annual earnings are slated to soar 108% in FY24 to $13.14 per share in comparison with EPS of $6.32 in 2023. Plus, FY25 EPS is forecasted to climb one other 83% to a whopping $24.04.

Picture Supply: Zacks Funding Analysis

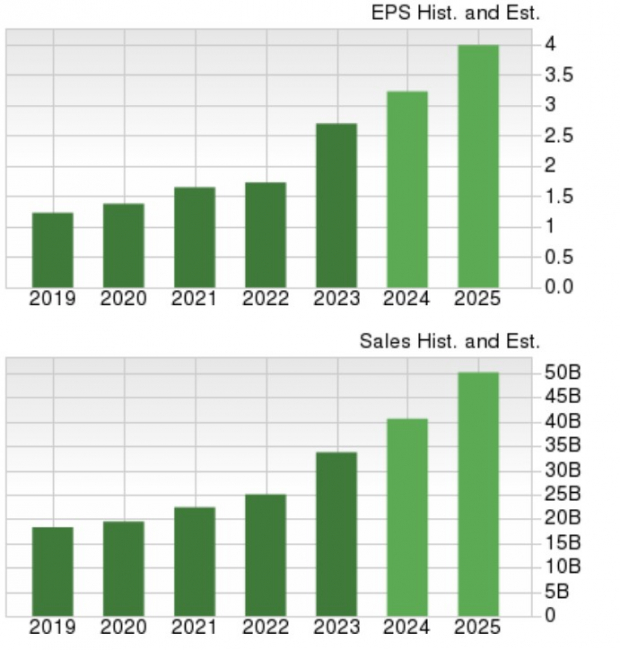

Pivoting to Novo Nordisk, its prime line is projected to increase 18% in FY24 and is forecasted to extend one other 23% in FY25 to $49.03 billion. Novo Nordisk is now anticipated to publish 18% EPS development in FY24 with annual earnings projected to rise one other 22% in FY25 to $3.89 per share.

Nonetheless, it’s noteworthy that FY24 and FY25 EPS estimates are noticeably decrease for Novo Nordisk over the past 60 days.

Picture Supply: Zacks Funding Analysis

Worth Efficiency Comparability

During the last yr, Eli Lilly’s inventory is up a really respectable +25% which has roughly matched the S&P 500 whereas Novo Nordisk shares are down a lackluster -21%. Notably, the dip in Novo Nordisk’s inventory has been attributed to subpar medical trial outcomes for its new weight-loss drug CagriSema together with patent issues.

That stated, over the past three years, Novo Nordisk inventory is up greater than +60% to impressively prime the broader market though this has noticeably trailed Eli Lilly’s positive factors of +200%.

Picture Supply: Zacks Funding Analysis

Takeaway

Eli Lilly does seem to have the benefit because it pertains to growth within the weight reduction drug market with its inventory touchdown a Zacks Rank #3 (Maintain). Though there might be higher shopping for alternatives forward primarily based on Eli Lilly’s valuation, the corporate’s sturdy prime and backside strains are exhausting to miss particularly for long-term traders.

In distinction, Novo Nordisk shares land a Zacks Rank #4 (Promote) primarily based on a development of declining earnings estimate revisions which has began to bitter the corporate’s enticing outlook.

Analysis Chief Names “Single Finest Choose to Double”

From 1000’s of shares, 5 Zacks specialists every have chosen their favourite to skyrocket +100% or extra in months to come back. From these 5, Director of Analysis Sheraz Mian hand-picks one to have probably the most explosive upside of all.

This firm targets millennial and Gen Z audiences, producing practically $1 billion in income final quarter alone. A latest pullback makes now a perfect time to leap aboard. In fact, all our elite picks aren’t winners however this one may far surpass earlier Zacks’ Shares Set to Double like Nano-X Imaging which shot up +129.6% in little greater than 9 months.

Free: See Our Top Stock And 4 Runners Up

Novo Nordisk A/S (NVO) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.