U.S. Pharmaceutical big Eli Lilly And Co LLY is driving excessive on the recognition of weight reduction medication and is on the point of changing into the world’s first trillion-dollar pharmaceutical firm.

In response to knowledge from Benzinga Professional, the corporate’s market cap stood at $796.4 billion, and its enterprise worth at $821.9 billion.

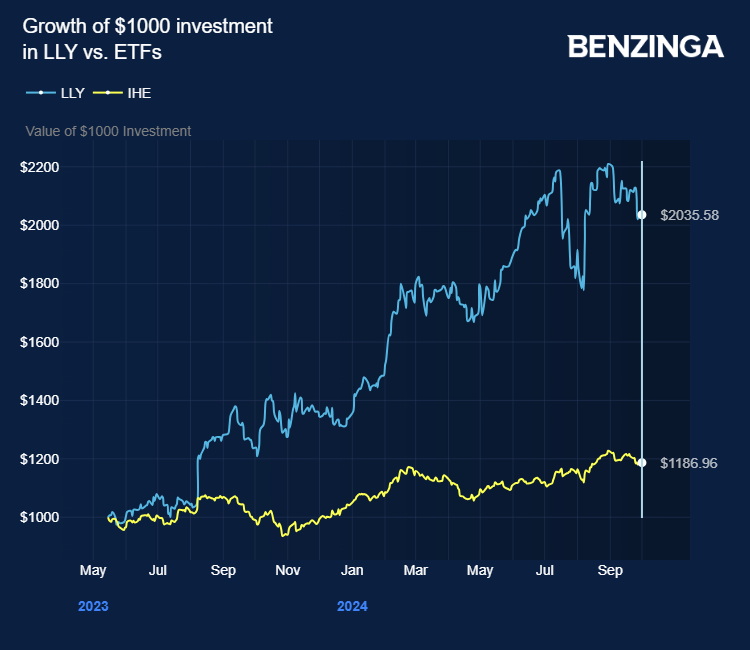

The inventory had virtually doubled since Might 2022 and outpaced S&P500 and NASDAQ when the corporate obtained FDA approval for Mounjaro (tirzepatide) as an adjunct to weight loss program and train for sort 2 diabetes.

In November, the FDA accepted tirzepatide, dubbed Zepbound, for weight reduction.

In a Monetary Occasions report, CEO Dave Ricks remembers a time when Eli Lilly was struggling. Within the late 2000s, the lack of patents on its psychiatric medication, together with Prozac and Cymbalta, pushed the corporate close to all-time lows.

Additionally Learn: Eli Lilly Eyes New Trials For Weight-Loss Medicine In Non-Overweight Sufferers.

Nonetheless, the corporate’s fortunes have since reversed, with Eli Lilly now investing $20 billion in manufacturing amenities to satisfy the rising demand for its blockbuster medication, and it’s attempting to remain forward of its shut competitor Novo Nordisk A/S NVO.

The corporate can be creating orforglipron, which may very well be the primary small-molecule weight-loss tablet when it launches in 2026, giving Eli Lilly a two-year lead earlier than rivals catch up.

Nonetheless, buyers are cautious, noting that Eli Lilly’s valuation is lofty, presently at $842 billion, 54x projected earnings over the subsequent 12 months.

A top-10 shareholder of Eli Lilly informed the Monetary Occasions that buyers are dashing into Eli Lilly, pushing it larger, but it surely’s already priced for perfection. The shareholder warned that buyers might face vital dangers if issues come up about competitors from the ten different firms with weight-loss medication or potential pricing pressures.

The corporate goals to strengthen its standing as one of many prime 10 most dear companies within the U.S. by outpacing its rivals.

Eli Lilly plans to reinvest its revenues into R&D, aiming to flee the pharmaceutical business’s conventional boom-and-bust cycle.

CEO Ricks says the corporate is making ready for the longer term, significantly because it nears a “patent cliff” for its weight-loss medication within the mid-2030s. By then, competitors and pricing stress might considerably have an effect on earnings.

The corporate is engaged on new therapies for obesity-related circumstances, corresponding to sleep apnea and heart problems, which might safe broader insurance coverage protection for its medication.

Worth Motion: LLY inventory closed at $884.55 on Tuesday.

Learn Subsequent:

Photograph by way of Eli Lilly and Firm

This content material was partially produced with the assistance of AI instruments and was reviewed and revealed by Benzinga editors.

Market Information and Knowledge delivered to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.