Enphase Vitality Inc. ENPH not too long ago revealed that its Solargraf software program now comes with a brand new synthetic intelligence (AI)-powered do-it-yourself (DIY) allowing characteristic for its prospects in america. This DIY characteristic boasts the potential to automate the complicated photo voltaic and battery allowing course of and might thus assist decrease photo voltaic allow plan creation time by as much as 95%.

The brand new DIY allow plan characteristic transforms the Solargraf platform into a whole end-to-end answer for photo voltaic and battery system design, proposal technology and allowing. This new characteristic not solely optimizes installers’ productiveness but in addition lowers prices by minimizing cycle occasions and working bills via an environment friendly, automated workflow.

The Solargraf platform, with its new DIY allowing characteristic, is anticipated to empower photo voltaic installers to function extra effectively, which, in flip, would possibly lure photo voltaic buyers so as to add ENPH inventory to their portfolio. Nonetheless, to say if it might be worthwhile so as to add this to your portfolio proper now or wait somewhat longer, let’s delve deeper into the inventory’s year-to-date efficiency, long-term prospects in addition to dangers (if any) to investing in the identical. The thought is to assist buyers make a prudent determination.

ENPH Inventory Lags Business, Sector & S&P500

Enphase Vitality’s shares have misplaced 51.9% within the year-to-date interval, underperforming the Zacks Solar industry’s decline of 41.3% in addition to the broader Zacks Oil-Energy sector’s progress of seven.6%. The inventory additionally lagged the S&P 500’s surge of 26% in the identical interval.

The same dismal efficiency has been delivered by different business gamers, similar to Emeren Group SOL, Sunrun RUN and SolarEdge Applied sciences SEDG, whose shares have misplaced 30.1%, 44.4% and 86.3%, respectively, yr up to now.

ENPH YTD Efficiency

Picture Supply: Zacks Funding Analysis

What Led to ENPH Inventory’s Downfall?

Enphase Vitality has been persistently struggling in latest occasions as a result of dismal demand atmosphere in america and Europe. Such a sluggish demand pattern has been adversely impacting the corporate’s product gross sales and, thereby, its operational outcomes. That is additional evident from ENPH’s poor third-quarter 2024 outcomes regardless of it being a outstanding U.S. photo voltaic microinverter producer.

The corporate’s third-quarter revenues plunged 30.9% yr over yr, primarily on account of a 56% decline in microinverter cargo. The truth is, the corporate has been delivering such dismal working efficiency for the previous couple of quarters, which should have led to the notable year-to-date decline in its share value.

Will ENPH Inventory Recuperate?

Though some enhancements have been witnessed within the demand state of affairs in america and Europe these days, the general impression shouldn’t be going to vanish any time quickly. Nonetheless, with the U.S. Central Financial institution having lowered the rate of interest for the nation after a very long time, the downward strain on ENPH’s backside line is likely to be relieved to some extent in the meanwhile. So, the near-term expectations for Enphase’s working outcomes mirror combined sentiments.

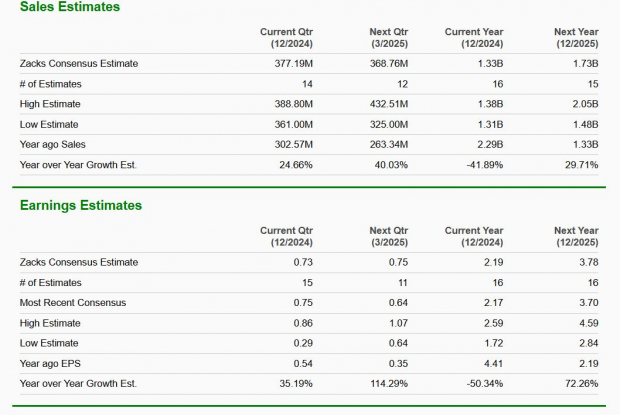

The Zacks Consensus Estimate for ENPHs’ fourth-quarter 2024 revenues and earnings signifies an enchancment of 24.7% and 35.2%, respectively, from the prior-year quarter’s degree.

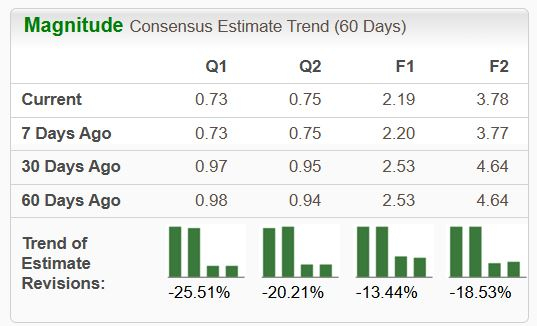

Nonetheless, the highest and bottom-line estimates for 2024 mirror a disappointing image. Furthermore, the downward revision in its earnings estimate implies buyers’ declining confidence on this inventory. On a brighter word, the consensus estimate for ENPH’s long-term earnings progress fee is 9.7%. The consensus mark for 2025 earnings implies strong progress prospects. So, we could count on ENPH to get well from its present ordeal within the coming years.

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

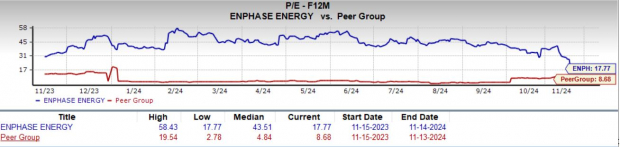

ENPH Buying and selling at a Premium

When it comes to valuation, ENPH’s ahead 12-month price-to-earnings (P/E) is 17.77X, a premium to its peer group’s common of 15.57X. This means that buyers can be paying the next value than the corporate’s anticipated earnings progress in comparison with that of its peer group.

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

Dangers to Contemplate Earlier than Shopping for ENPH

The worldwide provide marketplace for semiconductors, built-in circuits and different digital elements utilized in a few of Enphase’s merchandise has not too long ago skilled important constraints and disruptions. This constrained provide atmosphere has adversely impacted and will additional have an effect on element availability, lead occasions and prices. It may additionally enhance the chance of surprising cancellations or delays within the beforehand dedicated provide of key elements for Enphase Vitality.

In america, ENPH has been witnessing a requirement slowdown on account of greater rates of interest, excessive channel stock and the transition from Web Vitality Metering 2.0 (“NEM 2.0”) to Web Vitality Metering 3.0 (“NEM 3.0”) in California, which elevated the payback interval for Enphase Vitality’s prospects within the state. In Europe, the corporate confronted a slowdown on account of softer buyer demand as utility charges dropped and coverage modifications have been applied. The corporate expects a few of these challenges to proceed to have an effect on its operational leads to the close to time period, which, in flip, is prone to have an antagonistic impression on its fourth-quarter and full-year 2024 outcomes.

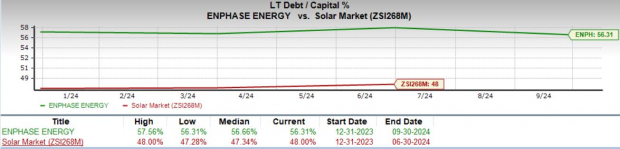

Furthermore, ENPH is extremely debt-ridden, as evident from its long-term debt-to-capital ratio of 56.31X, a lot greater than its business’s 48X.

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

Last Ideas

To summarize, it’s not advisable so as to add this inventory to at least one’s portfolio proper now, contemplating its premium valuation, dismal year-to-date efficiency and excessive leverage.

However, those that already personal this Zacks Rank #3 (Maintain) firm’s shares could proceed to take action, contemplating its long-term progress prospects. You possibly can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Should-See: Photo voltaic Shares Poised to Skyrocket

The photo voltaic business stands to bounce again as tech corporations and the financial system transition away from fossil fuels to energy the AI increase.

Trillions of {dollars} can be invested in clear vitality over the approaching years – and analysts predict photo voltaic will account for 80% of the renewable vitality growth. This creates an outsized alternative to revenue within the near-term and for years to come back. However you must decide the best shares to get into.

Discover Zacks’ hottest solar stock recommendation FREE.

Emeren Group Ltd. Sponsored ADR (SOL) : Free Stock Analysis Report

Enphase Energy, Inc. (ENPH) : Free Stock Analysis Report

SolarEdge Technologies, Inc. (SEDG) : Free Stock Analysis Report

Sunrun Inc. (RUN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.