The software program house has typically been an awesome place to search for profitable shares over the previous decade or so. However some buyers are unaware of lots of the software program shares on the market. The explanation for that is that not all software program is for on a regular basis folks; loads of software program is constructed particularly for enterprise wants.

That is referred to as enterprise software program. And Asana (NYSE: ASAN), Atlassian (NASDAQ: TEAM), and Docusign (NASDAQ: DOCU) make some well-known software program utilized by companies worldwide. That stated, for individuals who purchased at the beginning of 2022 and dutifully held via the top of 2023, returns have been fairly dangerous.

The place to speculate $1,000 proper now? Our analyst group simply revealed what they imagine are the 10 greatest shares to purchase proper now. See the 10 stocks »

Information by YCharts.

Macroeconomic headwinds and uncertainty had enterprises rethinking how a lot they needed to spend on software program, which harm income development charges for corporations comparable to Asana, Atlassian, and Docusign. Because of this all underperformed the S&P 500 throughout this two-year span.

That stated, these shares are perking up because the ice in enterprise software program spend begins to thaw. That is why all three have crushed the S&P 500 over the past six months and why now’s a well timed second to think about which of those shares is the very best purchase for 2025.

Asana is tapping into the AI development pattern

Asana lets companies assign duties to sure folks, setting due dates and linking particular person duties to bigger-picture objectives. The corporate talks about answering the who, what, when, and why. That is one thing many companies can profit from. And for its half, Asana has greater than 150,000 paying clients in over 200 international locations.

When you paid any consideration to the inventory market this 12 months, it would really feel like a damaged document at this level. However Asana, like nearly all software program corporations, is launching artificial intelligence (AI) products. Administration expects its AI studio to be huge — maybe even greater than the dimensions of its present enterprise. Furthermore, Asana’s AI studio is simply now launching, however some clients prefer it a lot that they’re skipping a pilot interval and going straight to a subscription.

To make certain, Asana’s development is sluggish. In its fiscal third quarter of 2025, the corporate’s income was solely up by 10% and that is the identical development fee it expects for the fourth quarter. However fiscal 2026 (overlapping with a lot of calendar 12 months 2025) may get pleasure from an accelerated development fee as its clients purchase its AI merchandise.

Atlassian could also be downplaying its development potential

Atlassian is a multiproduct enterprise software program firm. It has Confluence for content material creation, Jira for workflow administration (not in contrast to Asana), and different instruments. The corporate is not new and the massive pattern in recent times has been its shift away from its legacy enterprise to a cloud software subscription enterprise mannequin.

Atlassian’s fiscal 2025 started in July and goes via the top of June 2025. For the 12 months, administration expects 17% top-line development in comparison with fiscal 2024. That is slower than its 23% development in fiscal 2024, which is not preferrred.

That stated, Atlassian could also be downplaying its potential for development. Administration stated its steering is conservative and considers loads of issues that might go flawed.

Moreover, Atlassian’s deferred income for the primary quarter of fiscal 2025 jumped 34% 12 months over 12 months, representing future spending commitments from its clients. In the identical quarter of its fiscal 2024, deferred income was solely up by 28%. So this 12 months is already off to a greater begin than final 12 months, which once more means that its development will probably be higher than marketed.

Docusign clients like the brand new AIM platform

Docusign’s e-signature software program is probably going probably the most well-known product of those three enterprise software program corporations — many individuals have doubtless carried out enterprise with an organization that is requested for a signature utilizing a Docusign product. However as established as it’s on this house, buyers could be stunned by a current surge in its enterprise traits.

Though it has been round some time, Docusign up to date its platform in 2024, calling its new AI-powered platform Intelligent Agreement Management (IAM). Key options embrace AI summaries of what is being signed, reminders of when issues expire, and extra. And CEO Allan Thygesen believes it’s going to push it towards sustaining “long-term double-digit development.”

To underscore the optimistic reception right here, Docusign closed 10 instances extra IAM offers in its fiscal third quarter of 2025 as in comparison with the second quarter. That is fairly the sequential leap and reveals that clients have an urge for food for this new platform.

Shareholders are blissful to see Docusign’s refresh off to a very good begin. That stated, the corporate is enjoying the lengthy sport and the promise of double-digit development continues to be someplace down the highway. For now, its fiscal Q3 income was solely up by 8% and it solely expects 7% development within the upcoming fourth quarter, which ends Jan. 31.

Which is the very best purchase for 2025?

As talked about, it is doable that Atlassian is understating its development potential within the coming 12 months. However taking the three outlooks at face worth, Atlassian and Docusign are nonetheless decelerating whereas Asana’s development is stabilizing and will probably reaccelerate as its AI instruments generate some pleasure.

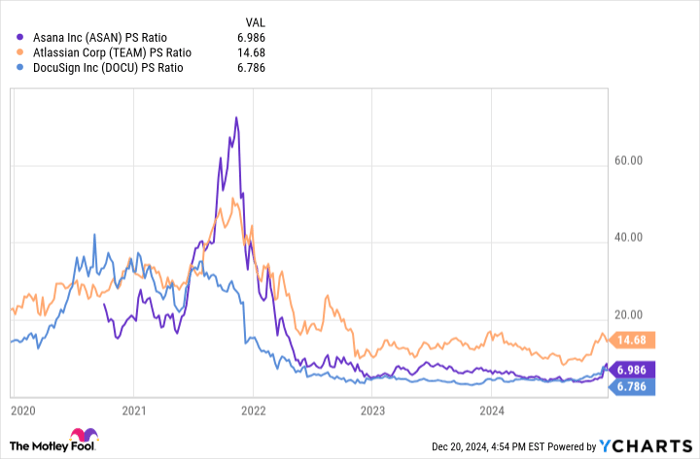

Turning to valuation, Docusign and Asana commerce at a just about an identical price-to-sales (P/S) ratio of virtually 7 whereas the P/S valuation for Atlassian is greater than double this.

Information by YCharts.

Atlassian has higher profitability so it arguably deserves a premium over the opposite two. But when I had to decide on a inventory right here, I would select Asana. Its valuation is comparatively low, its development is stabilizing, and AI may increase the enterprise pretty quickly given its promising launch.

Don’t miss this second likelihood at a probably profitable alternative

Ever really feel such as you missed the boat in shopping for probably the most profitable shares? Then you definately’ll wish to hear this.

On uncommon events, our knowledgeable group of analysts points a “Double Down” stock suggestion for corporations that they suppose are about to pop. When you’re frightened you’ve already missed your likelihood to speculate, now’s the very best time to purchase earlier than it’s too late. And the numbers converse for themselves:

- Nvidia: in case you invested $1,000 after we doubled down in 2009, you’d have $349,279!*

- Apple: in case you invested $1,000 after we doubled down in 2008, you’d have $48,196!*

- Netflix: in case you invested $1,000 after we doubled down in 2004, you’d have $490,243!*

Proper now, we’re issuing “Double Down” alerts for 3 unimaginable corporations, and there is probably not one other likelihood like this anytime quickly.

*Inventory Advisor returns as of December 23, 2024

Jon Quast has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Atlassian and Docusign. The Motley Idiot recommends Asana. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.