The European Fee (EC) and 4 Mercosur (Southern Widespread Market) international locations, Brazil, Argentina, Paraguay, and Uruguay, have finalized negotiations for a groundbreaking settlement to spice up strategic commerce and political ties.

The EU-Mercosur settlement on December 6 will safe and diversify provide chains and eradicate tariffs on over 90% of bilateral commerce between the 2 areas. It can save EU companies €4 billion in duties per 12 months.

The settlement will assist the worldwide inexperienced transition by securing an environment friendly, dependable, and sustainable move of uncooked supplies. It may halt deforestation with €1.8 billion in EU assist to facilitate the inexperienced and digital transition in Mercosur international locations.

Increasing the European Union’s buying and selling relationships may mitigate the impression of potential tariffs that US President-elect Trump could impose. With China signaling potential retaliation towards Trump’s insurance policies, the EU dangers being caught in a broader decline in international commerce.

“It is a win-win settlement, which can convey significant advantages to shoppers and companies,” EC President Ursula von der Leyen said in relation to the EU-Mercosur settlement. “That is the fact of an settlement that can save EU firms €4 billion value of export duties per 12 months.”

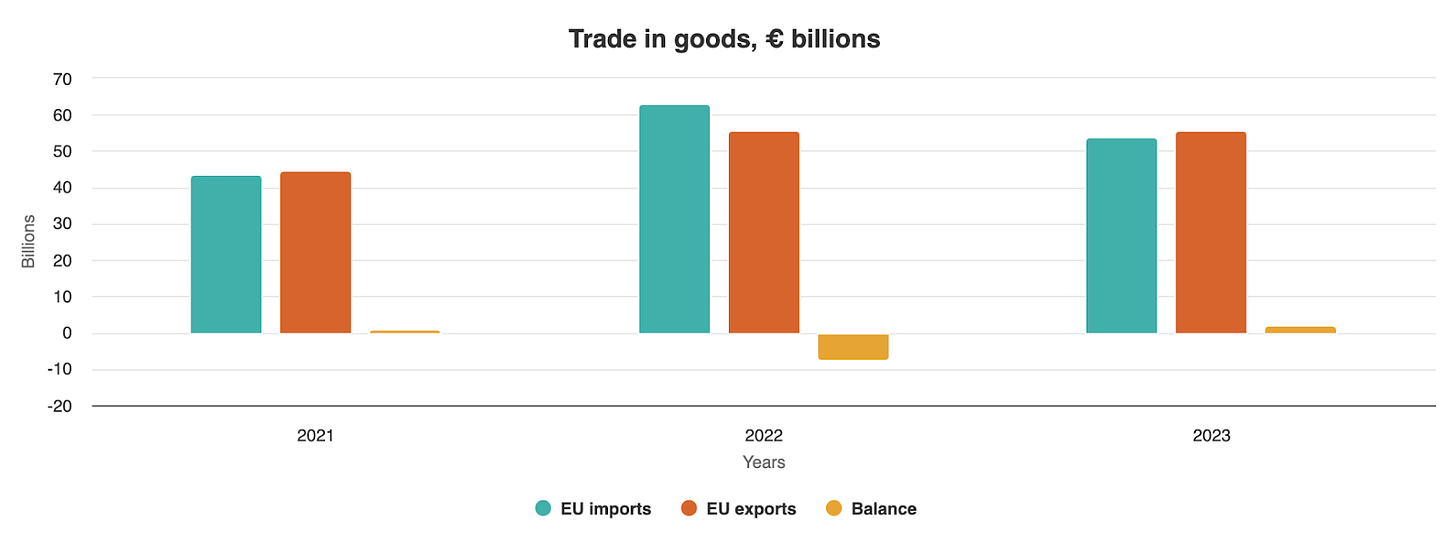

Commerce in items between the 2 blocs stays comparatively small at €109.4 billion in 2023. The EU is Mercosur’s second-largest buying and selling associate behind China however forward of the USA. Mercosur ranks because the EU’s tenth-largest commerce associate for items.

In 2022, the EU exported €28.2 billion to Mercosur when it comes to providers commerce, whereas Mercosur exported €12.3 billion to the EU. The brand new commerce deal is predicted to spice up items commerce between the 2 areas.

Agricultural Sector Opposes EU-Mercosur Settlement

Europe’s agriculture business has opposed the EU-Mercosur settlement. EU farmers, notably in France and Poland, are involved about an inflow of cheap South American imports.

Meals and agricultural merchandise represent the largest share of the EU’s imports from Mercosur.

The EC negotiated a preliminary settlement with Mercosur international locations in 2019 to scale back tariffs on manufactured items in Mercosur. It additionally aimed to open the EU’s agricultural sector, which had been lengthy protected by European insurance policies.

Nonetheless, the partnership deal confronted delays as a result of resistance from France and different EU nations. They demanded stronger environmental commitments from Brazil and expressed considerations concerning the impression on European farmers.

Meals Business Helps EU-Mercosur Deal

In distinction, some meals business firms are extra supportive of the settlement. Confectionery and delicate drink producers could profit from decrease enter prices. Exporters of European cheese, beer, wine, and spirits welcomed larger market entry.

“This milestone is a major step towards strengthening commerce relations and securing a steady, aggressive, and sustainable enterprise atmosphere,” the Committee of European Sugar Customers said.

The European Dairy Affiliation (EDA) said: “Thus far, dairy commerce has primarily taken place inside the Mercosur area. The cheese and powder imports from the EU haven’t reached a major quantity. However that is the place alternatives lie.”

EU-Mercosur Partnership Will Profit Inexperienced Vitality, Automobile Industries

The EU-Mercosur settlement presents a strategic alternative for the EU to safe essential uncooked supplies important for advancing inexperienced applied sciences.

The EU will acquire zero-tariff entry to Brazilian exports of nickel, copper, aluminum, germanium, and gallium as a part of the settlement. These uncooked supplies are essential for Europe’s transition to inexperienced applied sciences.

At present, EVs are topic to an 18% import tax in Brazil. That is anticipated to extend to 35% in July 2026 in comparison with pre-existing EU automobile import duties of simply 10%.

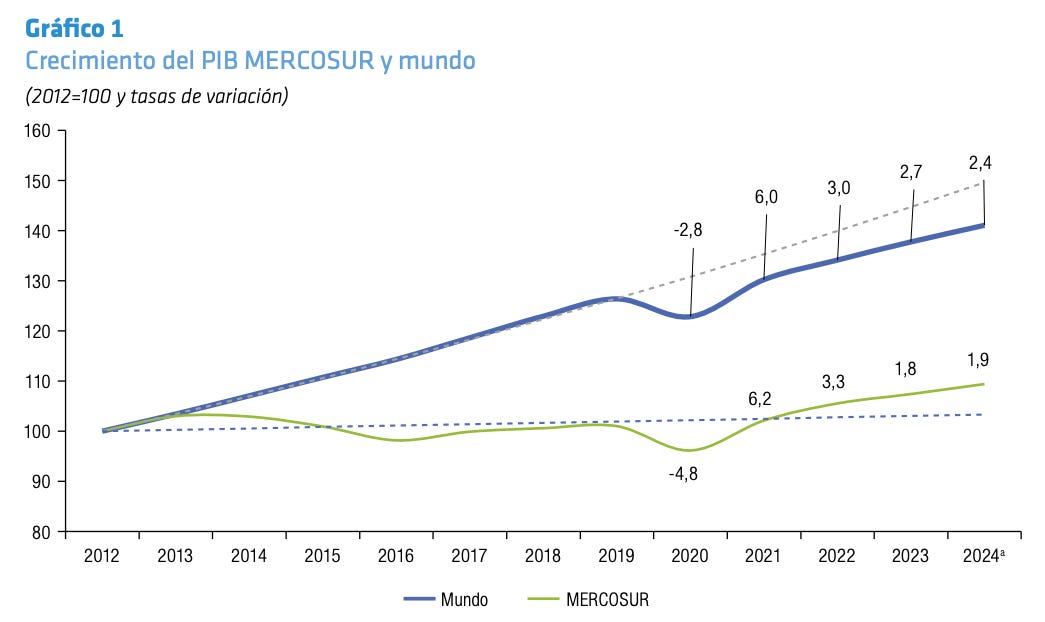

Given the slowdown within the Mercosur economy to 1.8% in 2023, under the global average of three.1%, South American automobile markets may present progress alternatives for European automotive firms.

Germany lately determined to assist the Mercosur deal to entry new automobile markets. Germany sees Mercosur as a key marketplace for its auto exports.

Excessive import tariffs have prompted some German producers like Volkswagen Group (VWAGY) and Daimler Vehicles (DTRUY) to arrange manufacturing amenities in Argentina and Brazil. A discount in tariffs may enhance manufacturing in Europe.

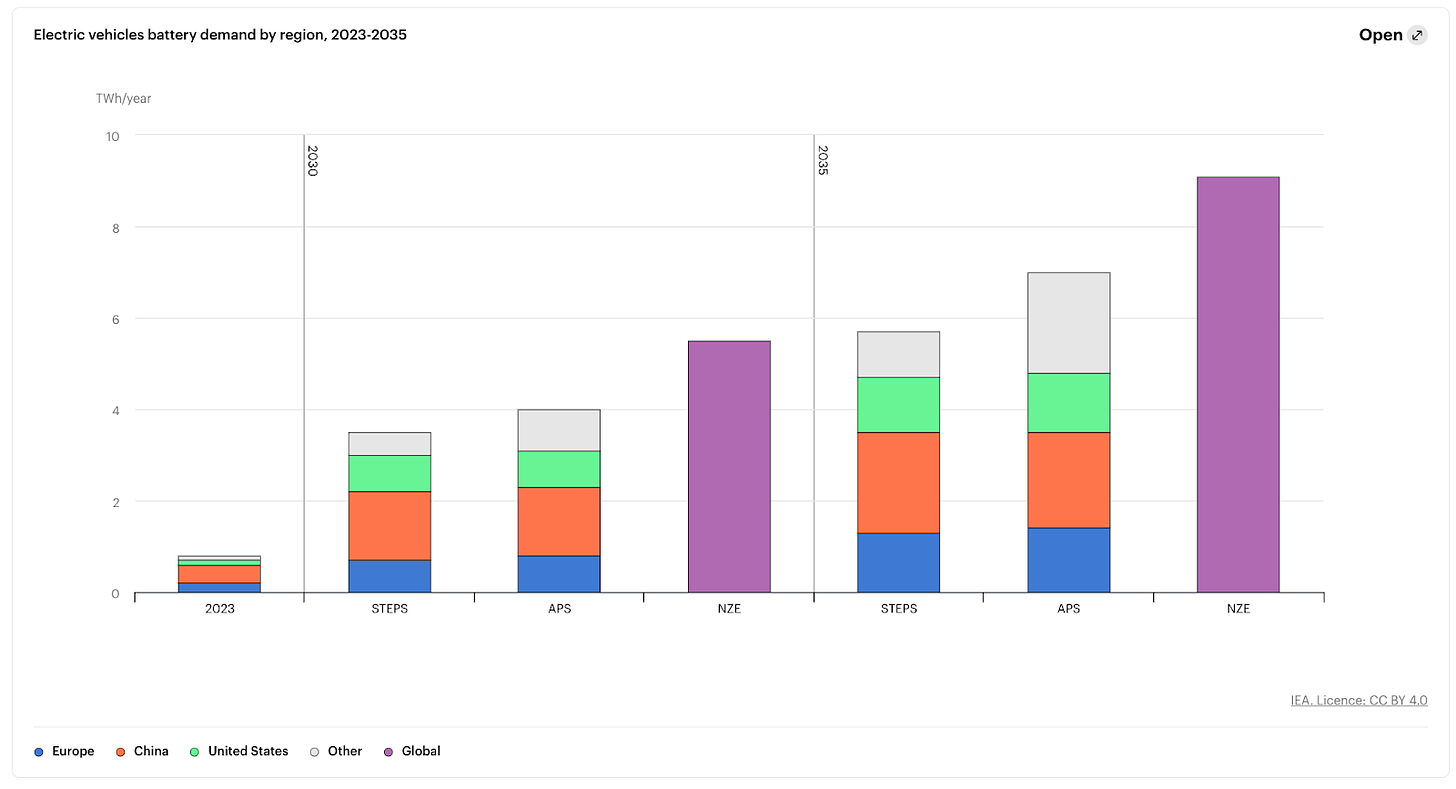

The demand for lithium batteries is predicted to increase. EV battery demand is predicted to develop four-and-a-half occasions by 2030 and nearly seven occasions by 2035 in comparison with 2023, in line with the Said Insurance policies Situation (STEPS).

Equally, the EU’s requirement for uncommon earth metals wanted for wind generators and EVs can also be anticipated to extend over the identical interval.

EU-Mercosur Settlement Faces Political Problem

Regardless of the finalized negotiations, the EU-Mercosur settlement nonetheless must be signed off by the 27 EU member states, which is predicted by mid-2025.

Whereas France and Poland overtly opposed the deal, 11 international locations referred to as for its conclusion in a letter to the President of the Fee. They embody Germany, Spain, Portugal, Sweden, Denmark, Finland, Croatia, Estonia, Latvia, Luxembourg, and the Czech Republic.

With the settlement set to be despatched to the European Council for ratification within the first half of 2025, France, Austria, and Poland mentioned they might oppose it. Nonetheless, they would want one other supporting nation to desert the settlement to succeed in the 35% of the EU inhabitants threshold to dam the deal.

Disclaimer:

Any opinions expressed on this article are to not be thought-about funding recommendation and are solely these of the authors. European Capital Insights will not be accountable for any monetary selections made based mostly on the contents of this text. Readers could use this text for info and academic functions solely.

This text is from an unpaid exterior contributor. It doesn’t characterize Benzinga’s reporting and has not been edited for content material or accuracy.

© 2025 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.