Shares of Constancy Nationwide Monetary FNF have rallied 24.5% 12 months up to now, outperforming the Finance sector’s enhance of twenty-two.8%. It, nevertheless, underperformed the industry’s enhance of 35.3% in addition to the S&P 500 composite’s rise of 26%.

FNF inventory is buying and selling nicely above the 50-day shifting common, indicating a bullish pattern, and is close to its 52-week excessive.

With a capitalization of $17.4 billion, FNF has a market-leading place in residential buy, refinance and business markets. Market share development, stable margin, aggressive benefits, robust monitor file of know-how innovation and wealth distribution are driving this title insurer.

FNF vs. Business, Sector, S&P 500

Picture Supply: Zacks Funding Analysis

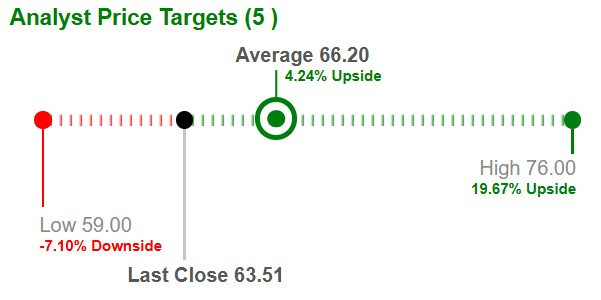

Common Goal Value for FNF Suggests an Upside

Based mostly on short-term value targets provided by 5 analysts, the Zacks common value goal is at $66.20 per share. The common suggests a possible 4.2% upside from Wednesday’s closing value of $65.01.

Picture Supply: Zacks Funding Analysis

Combined Analyst Sentiments

One of many three analysts masking the inventory lowered estimates for 2024, whereas one elevated the identical for 2025 over the previous 30 days. The consensus estimate for 2024 has moved 0.7% south for 2024 and 0.9% north for 2025 prior to now 30 days.

Picture Supply: Zacks Funding Analysis

The Zacks Consensus Estimate for 2024 implies a 26.7% year-over-year enhance, whereas the identical for 2025 suggests a 28% enhance.

Elements Impacting FNF Inventory

Constancy Nationwide, by advantage of its robust market presence, enjoys a scale benefit. Its scale and quantity gas revenues and decrease prices present a aggressive benefit. Additionally it is investing in know-how to widen its market-leading place.

FNF expects greater business volumes because the workplace sector begins to transact and continued energy within the industrial, multifamily and vitality sectors, amongst others, in 2025.

Actual estate-related companies complement its core title enterprise. The title insurer’s strategic transfer to purchase F&G Annuities & Life, a number one supplier of annuity and life insurance coverage concentrated within the middle-income market with a diversified development technique, shields it from the volatility integral to the core title insurance coverage enterprise.

The property beneath administration ought to profit from stable retail annuity gross sales and F&G’s presence in institutional markets profit. F&G invests in a high-quality and well-diversified portfolio and its common property beneath administration development drives earnings.

Banking on operational experience, FNF has a stable capital place that helps wealth distribution, mergers and acquisitions, natural development initiatives and debt funds.

With the Federal Reserve slicing rate of interest, FNF estimates quarterly curiosity and funding revenue to pattern down. Anticipating Fed funds fee cuts of 100 foundation factors over the following 9 months, this title insurer estimates web funding revenue to be all the way down to $95 million within the fourth quarter of 2024 to $85 million within the third quarter of 2025. Actually, FNF said that each 25-basis level lower in Fed funds is predicted to lead to an approximate $15 million annualized decline in its curiosity and funding revenue.

Notes payable elevated 7.7% as of Sept. 30, 2024. Although leverage of 52 improved 447 foundation factors, it in contrast unfavorably with the business common of 1.4. Occasions curiosity earned too in contrast unfavorably with the business common.

FNF’s Dividend Historical past Spectacular

FNF’s distribution of wealth to shareholders through dividend hikes is spectacular. Constancy Nationwide has elevated dividends at a 10-year CAGR of 9.7%. The dividend yield is 3.3%, higher than the business common of 0.3%.

FNF’s dividend yield betters different business gamers like Stewart Data Companies STC and Previous Republic Worldwide ORI.

Constancy Nationwide’s Return on Capital

FNF’s return on fairness within the trailing 12 months was 13.7%, higher than the business common of seven.6%, reflecting effectivity in using shareholders’ funds.

Nonetheless, its return on invested capital (ROIC), which displays an organization’s effectivity in using funds to generate revenue compares unfavorably with the business. FNF’s ROIC within the trailing 12 months was 5.9%, decrease than the business common of 5.8%.

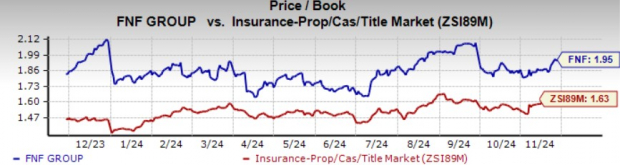

FNF Shares Are Overvalued

FNF shares are buying and selling at a price-to-book a number of of 1.95, greater than the business common of 1.63. But, it has a Value Score of A.

Picture Supply: Zacks Funding Analysis

To Conclude

FNF is ready to develop on greater direct and company premiums, robust origination demand and efficient capital deployment. Because the nation’s largest title insurance coverage firm, Constancy Nationwide ought to profit from stable long-term fundamentals for U.S. residential and business actual property markets, given its largest and deepest actual property knowledge networks.

A powerful dividend historical past and a VGM Score of B are different positives for the inventory.

But, premium valuation, unfavorable leverage and occasions curiosity earned, and rate of interest minimize weigh on curiosity and funding revenue.

It’s thus smart to undertake a wait-and-see strategy for this Zacks Rank #3 (Maintain) insurer. You’ll be able to see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Free: 5 Shares to Purchase As Infrastructure Spending Soars

Trillions of {dollars} in Federal funds have been earmarked to restore and improve America’s infrastructure. Along with roads and bridges, this flood of money will pour into AI knowledge facilities, renewable vitality sources and extra.

In, you’ll uncover 5 shocking shares positioned to revenue essentially the most from the spending spree that’s simply getting began on this area.

Download How to Profit from the Trillion-Dollar Infrastructure Boom absolutely free today.

Fidelity National Financial, Inc. (FNF) : Free Stock Analysis Report

Stewart Information Services Corporation (STC) : Free Stock Analysis Report

Old Republic International Corporation (ORI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.