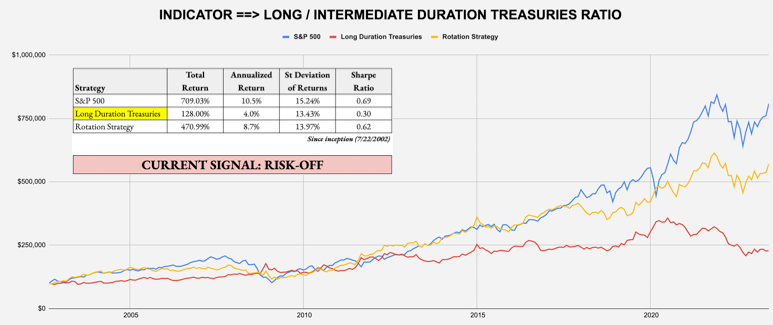

The Treasuries signal is the very first to damage as well as turn to risk-off in numerous weeks, recommending that the first fifty percent rally in supplies is kicking back. The outperformance in long-duration Treasuries has actually been developing for a month, with the most significant gains originating from the bond, the location where financiers looking for a safe house commonly land. The outperformance would certainly still rather be referred to as moderate now, yet the fad has actually been constant as well as structure.

Just How To Translate the Signals: Within each approach, there is a risk-on as well as risk-off financial investment suggestion, with the risk-off choice being the extra traditional of both. When a specific signal suggests that financiers ought to be risk-off, as an example, clients ought to take into consideration buying the risk-off choice as well as preventing the risk-on choice. The contrary, for that reason, would certainly hold true when the signal turns to risk-on. In each approach, you would certainly constantly be bought one choice or the various other.

Below’s exactly how to check out the scorecard for every approach:

Target Capitalist

A few of the techniques will certainly be extra hostile than others. The “Take advantage of For The Future” approach, as an example, utilizes the as well as 2x-leveraged S&P 500. The even more traditional “Lumber/Gold Bond” approach, nevertheless, utilizes intermediate-term Treasuries as well as the S&P 500. In every instance, a risk-off signal suggests that you ought to be bought the extra traditional of both choices, while a risk-on signal suggests you ought to be bought the extra hostile one.

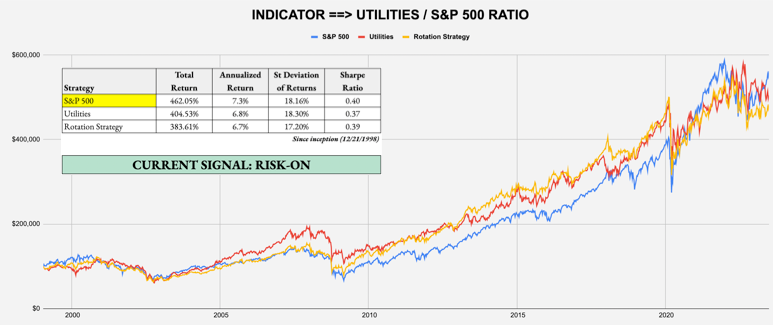

TEMPORARY SIGNAL: UTILITIES/S&& P 500 PROPORTION

This is for temporary investors with a greater threat resistance that want making use of an equity energy approach to prepare for adjustments in market threat resistance.

Present Sign: Risk-On

Technique: Beta Turning – Instance: Purchase S&P 500 (SPY) over Energies (XLU)

TEMPORARY SIGNAL: LONG DURATION/INTERMEDIATE PERIOD TREASURIES PROPORTION

This is for temporary investors with a greater threat resistance that intend to make use of the task in the united state Treasury market to evaluate general threat degrees.

Present Sign: Risk-Off

Technique: Tactical Threat Turning – Instance: Purchase Long-Duration Treasuries () over S&P 500 (SPY)

INTERMEDIATE-TERM SIGNAL: LUMBER/GOLD PROPORTION

For brief- as well as lasting financiers going to trade extra regularly making use of the timeless intermittent vs. protective possession contrast.