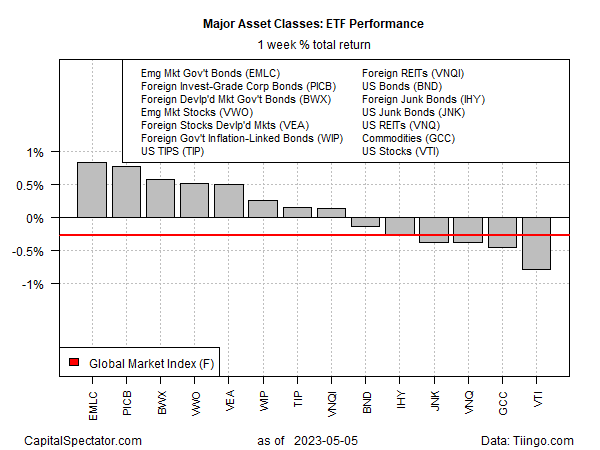

Fixed-income markets ex-US led efficiencies throughout a blended week for the significant possession courses with the close of trading on Friday, Might 5, based upon a collection of ETFs.

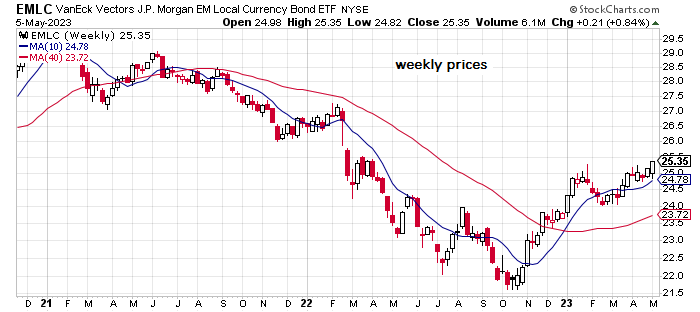

The greatest entertainer: VanEck J.P. Morgan EM Resident Money Bond ETF (NYSE:-RRB- climbed 0.8% recently, raising the fund to its highest possible once a week enclose greater than a year. The ETF’s continuous stamina considering that recoiling off its base in October equates to among the highest possible energy ratings for international markets, based upon an exclusive ranking system at The ETF Profile Planner, a sibling magazine of CapitalSpectator.com.

International bonds ex-US had an excellent week normally, providing the top-three efficiencies for the significant possession courses recently.

United States properties, by comparison, remained in the loser’s column using bonds, residential or commercial property shares, as well as supplies. American shares published the largest decrease recently using Lead Overall Stock Exchange Index Fund ETF Shares (NYSE:-RRB-, which bordered down 0.8%.

The Global Market Index (GMI.F) additionally shed ground recently, sliding 0.3%. This unmanaged criteria holds all the significant possession courses (other than money) in market-value weights using ETFs as well as stands for an affordable step for multi-asset-class profile techniques.

ETF Weekly Efficiency

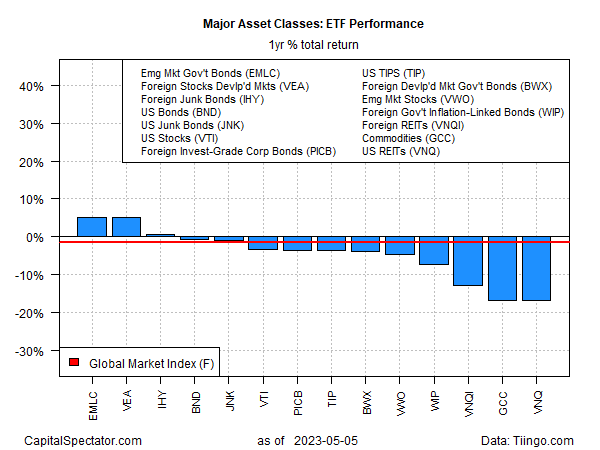

For the 1 year home window, emerging-markets bonds took the lead. EMLC shut on Friday with a 5.1% gain vs. the year-ago degree (after considering circulations). The boost is a little in advance of the 1 year gain for developed-markets supplies ex-US (VEA).

A lot of the significant possession courses, nevertheless, remain to registered nurse losses for the 1 year home window. Products (GCC) as well as Lead Realty Index Fund ETF Shares (NYSE:-RRB- are basically connected for the inmost 1 year loss at virtually -17%.

ETF Annual Efficiency

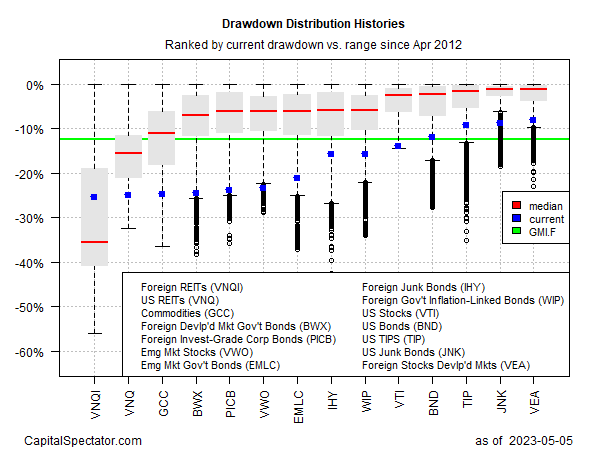

Contrasting the significant possession courses with a drawdown lens remains to reveal fairly high decreases from previous tops for markets all over the world. The softest drawdown at the end of recently: supplies in industrialized markets ex-US (Lead Created Markets Index Fund ETF Shares (NYSE:-RRB-) with a relatively moderate -8.1% peak-to-trough decrease.

Drawdown Circulation Backgrounds