GBP/USD Rises After Trump’s U-Flip and Forward of US CPI

is rising for a 3rd straight day because the weakened amid rank commerce confusion surrounding U.S. commerce coverage

President Trump introduced a 90-day pause on reciprocal tariffs for many international locations however elevated tariffs on China to 125%. The transfer produced a full-blown commerce struggle that retains dangers elevated.

Common commerce tariffs additionally stay in place. Nevertheless, threat sentiment has improved significantly, serving to the pound increased. International inventory markets are additionally rising amid a aid rally.

The market is reassessing the outlook for , with Financial institution of England price minimize expectations being scaled again. The markets are pricing in 66 foundation factors of easing down from 79 foundation factors yesterday.

In the meantime, information is due tomorrow and is anticipated to point out that the UK financial system grew by 0.1% Month over Month in February after contracting -0.1 % month over month.

The USD is underneath stress because the mud settles on Trump’s shock announcement, which shocked the markers. Maybe you flip issue aid Riley into threat belongings, serving to the greenback briefly elevate from session lows yesterday. Nevertheless, promoting has resumed given {that a} commerce struggle with China and common 10% tariffs may nonetheless damage the US financial system.

Consideration now turns to information, which is due out later at the moment and is anticipated to point out that inflation is at 2.6% yr on yr, down from 2.8%. is anticipated to ease to three%, down from 3.1%.

GBP/USD Forecast – Technical Evaluation

GBP/USD bumped into resistance at 1.32 and rebounded decrease to assist at 1.2725, the 50 SMA, earlier than recovering above the 200 SMA in direction of 1.29. Ought to the restoration prolong above right here, 1.30 comes into focus.

Help is seen on the 200 SMA at 1.28. Beneath right here, sellers may achieve momentum in direction of 1.2775 and the 100 SMA at 1.2640.

DAX Rebounds as Threat Property Get well however Positive factors Might Be Capped

Donald Trump’s shock 90-day pause in reciprocal tariffs has helped the market rebound. His announcement left traders shocked, marking excessive shifts out there temper. U.S. inventory indices closed 10% increased after Trump reacted to the market ache.

A sell-off in U.S. authorities debt seemed to be a tipping level for Trump. This was doubtless a part of the explanations that prompted him to stroll again reciprocal tariffs – you don’t mess with the bond market. Nevertheless, Trump wasn’t so beneficiant with China, as an alternative lifting tariffs on the world’s second-largest financial system to 125%.

Whereas the aid rally is in full swing. US futures are falling as warning is anticipated to prevail. Tariffs on automobiles and metal and aluminium nonetheless exist, as do common tariffs of 10%, In the meantime, the China-US commerce struggle is escalating additional. These measures will nonetheless doubtless gradual the US financial system, though a recession could possibly be averted.

While we had been now not wanting on the doomsday situation, however we had been taking a look at yesterday. There may be nonetheless a lot uncertainty which may see positive aspects capped from right here.

DAX Forecast – Technical Evaluation

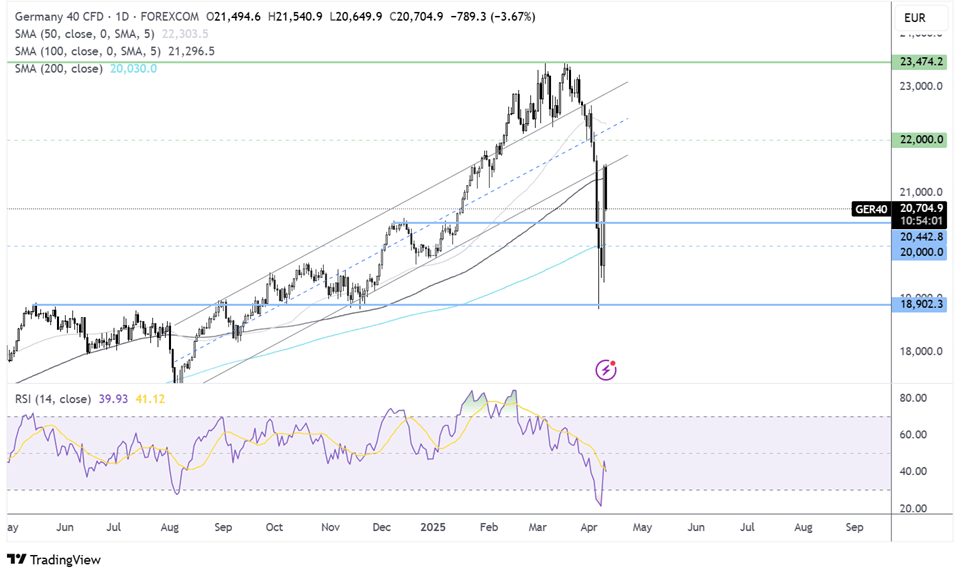

The fell to a low of 18,800, the Might 2024 excessive and November 2024 low earlier than rebounding sharply, helped by the RSI recovering from deeply oversold circumstances. The restoration noticed the value rise above the 200 SMA and 20,500 to a peak of 21,500, the rising trendline resistance, negating the downtrend. The value has eased decrease again beneath the 100 SMA at 21,300.

Consumers will look to increase the restoration in direction of 22,000. Help could be seen at 20,500, the spherical quantity, and the 200 SMA.