- GBP/USD has damaged beneath a long-term ascending trendline, signaling potential additional draw back.

- UK finances considerations and a drop in manufacturing PMI have contributed to the Pound’s wrestle.

- The continued decline in orders from overseas raises considerations concerning the UK economic system’s restoration and Pound stability.

has struggled this week following the UK finances. The Pound Sterling ought to have appreciated towards the , contemplating the paring again of fee lower expectations from the (BoE).

Following the UK finances expectations for the Financial institution of England to decrease rates of interest, they’ve dropped. This alteration got here after the UK Chancellor introduced the most important tax enhance since 1993, value 40 billion kilos, together with plans to extend authorities spending and funding by elevating the fiscal deficit. Moreover, the Workplace for Enterprise Accountability predicted greater inflation charges of two.5% in 2024 and a pair of.6% in 2025, main merchants to cut back their bets on fee cuts by the Financial institution.

There are another considerations across the UK finances, which Moody’s additionally raised and will clarify the British Pound’s wrestle. There are considerations that the added borrowing will affect the UK’s means to carry its funds so as. Moody’s additionally acknowledged that the UK finances creates challenges and cautioned that we may see muted progress from the UK transferring ahead.

The continued selloff within the US Greenback was not sufficient to arrest the slide in GBP/USD earlier than a bounce occurred this morning. The discharge of the dropped to 49.9 in October 2024, down from 51.5 the earlier month. This was decrease than anticipated and exhibits the primary drop in manufacturing facility exercise since April. New orders decreased as shoppers waited for the UK finances.

Orders from overseas additionally fell for the thirty third month, with fewer orders from Europe, China, and the US. Manufacturing elevated barely as factories labored by their backlog of orders. Manufacturing jobs grew for the third time in 4 months, however extra slowly due to fewer new orders.

Prices for supplies dropped to their lowest in ten months, and promoting costs went up the least since February. Enterprise optimism improved a bit from a nine-month low in September. The information nevertheless appeared to have little affect on GBP/USD forward of the US session

Supply: FinancialJuice (click on to enlarge)

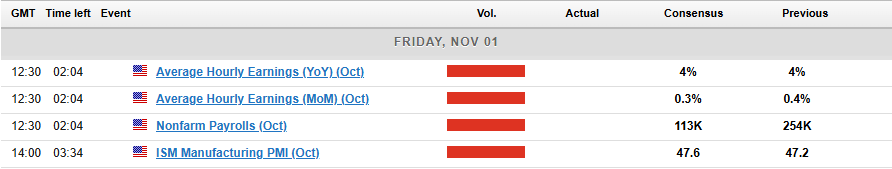

A batch of US information awaits later within the day with the chief amongst them. Markets are anticipating a robust quantity following labor information seen earlier within the week and may this come to cross, it will likely be attention-grabbing to gauge if cable can shrug off the US information and proceed its transfer greater in the present day.

GBP/USD Technical Evaluation

GBP/USD is now at an attention-grabbing place because it has damaged beneath the long-term ascending trendline which started again in April.

This trendline break opens up a bunch of situations and potential alternatives in cable transferring ahead. I may see a retest of the trendline growing earlier than a continuation of the transfer decrease with a deeper pullback to the 1.300 deal with additionally a risk.

Any such pullback could also be most well-liked for any would-be-shorts trying to become involved. A break and each day candle shut above the 1.30150 deal with would invalidate the bearish setup.

Wanting on the draw back, assist rests on the 200-day MA round 1.2800 earlier than the 1.2750 and 1.2681 handles come into focus.