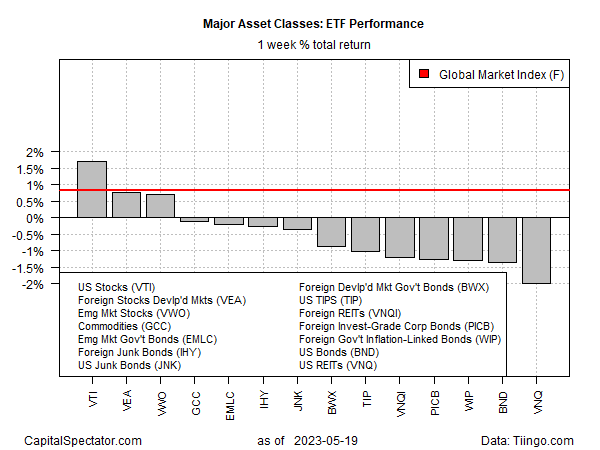

united state shares led rallies in equities markets worldwide in the trading week with Friday, May 19, based upon a collection of ETFs. The remainder of the significant property courses shed ground.

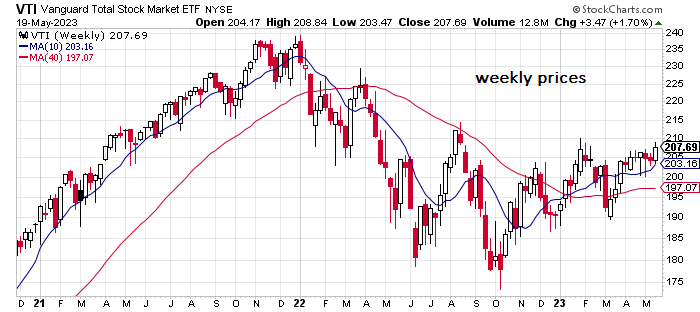

Lead Total Amount Stock Exchange Index Fund (NYSE:-RRB- obtained 1.7%, climbing to the highest degree considering that February. The most up to date boost establishes the fund for greater chances of a favorable outbreak if it can relocate emphatically over the existing rate.

The prompt headwind for danger possessions is the advancing unpredictability bordering the united state financial debt ceiling as well as the capacity for a default of Treasuries. Head Of State Biden as well as Residence Audio speaker McCarty are set up to reunite today to talk about opportunities for a political concession. Markets will certainly be acutely concentrated on the result for examining the danger of a united state default, which might strike as early as following month without a bargain, according to some price quotes.

Recently’s most significant loss for the significant property courses: united state property through the Lead Property Index Fund (NYSE:-RRB- sagged 2.0%. The decrease recommends that the ETF continues to be captured in a bearish pattern that’s continued for more than a year.

The Global Market Index (GMI.F) recoiled recently, climbing 0.8%. This unmanaged standard holds all the significant property courses (other than cash money) in market-value weights through ETFs as well as stands for an affordable action for multi-asset-class-portfolio methods.

ETF Efficiency – Weekly Total Amount Returns

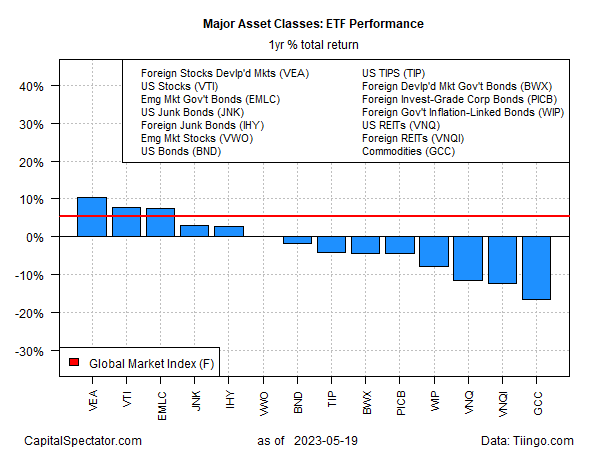

The significant property courses remain to publish blended outcomes for the 1 year home window, with a lot of ETF proxies reporting a loss. The efficiency leader over the previous year: international shares in established markets ex-U.S. (), which is up greater than 10% over the routing 1 year duration. Products () are the loss leader with a 16.5% decrease.

ETF Efficiency – Annual Overall Returns

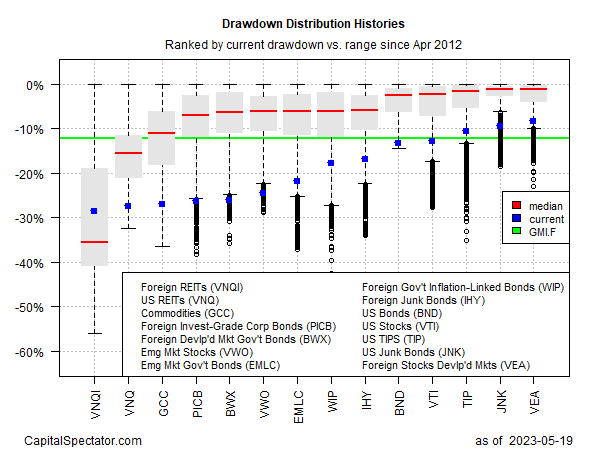

The majority of the significant property courses are still publishing reasonably deep drawdowns. The inmost: international property shares (), which finished recently with a near-30% peak-to-trough decrease. Supplies in international established markets (VEA) show the softest drawdown for the significant property courses: -9.5%.

Drawdown Circulation Backgrounds