Normal Motors GM and Tesla TSLA highlighted an thrilling earnings lineup this week after reporting their This fall outcomes on Tuesday and Wednesday respectively.

Going into the weekend traders could also be pondering which of those automakers stands out as the higher funding. That mentioned, right here’s a overview of Normal Motors and Tesla’s This fall experiences and outlook to assist get a greater gauge of whether or not GM or TSLA ought to be within the portfolio.

Picture Supply: Zacks Funding Analysis

GM’s This fall Outcomes

Striving to take electrical automobile market share from Tesla and Ford F, Normal Motors delivered 42,000 EVs throughout This fall which greater than doubled from its year-ago mark of 19,305. The leap was attributed to an expanded product line of recent electrical fashions together with the Chevy Equinox EV and Cadillac Lyric.

Normal Motors offered a complete of 1.03 million autos worldwide, growing from 943,000 in This fall 2023. Quarterly gross sales of $47.71 billion rose 11% from $42.98 billion a 12 months in the past and comfortably topped estimates of $44.06 billion. Adjusted earnings got here in at $1.92 per share, spiking 55% from EPS of $1.24 within the comparative quarter and eclipsing expectations of $1.85.

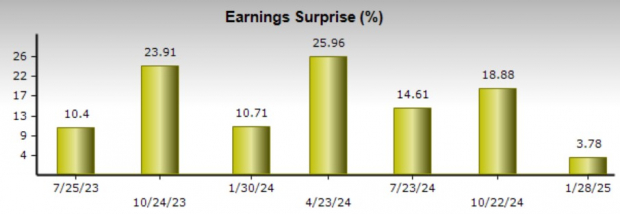

Moreover, Normal Motors has surpassed the Zacks EPS Consensus for ten consecutive quarters with a median earnings shock of 15.81% in its final 4 quarterly experiences.

Picture Supply: Zacks Funding Analysis

Tesla’s This fall Outcomes

Tesla’s This fall deliveries had been at a document 495,570 autos in comparison with EV gross sales of 484,507 within the prior 12 months quarter. Nonetheless, This fall gross sales of $25.7 billion missed estimates of $27.5 billion regardless of rising 2% 12 months over 12 months. Arising quick on its backside line as nicely, Tesla posted This fall EPS of $0.73 with expectations at $0.75 though this was a rise from $0.71 per share within the comparative quarter.

Notably, Tesla has missed earnings expectations in three of its final 4 quarterly experiences with a median EPS shock of 0.79%.

Picture Supply: Zacks Funding Analysis

GM Full Yr Outcomes & Steerage

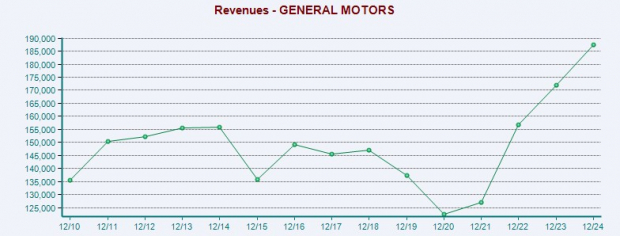

Rounding out fiscal 2024, Normal Motors whole gross sales had been up 9% to $187.45 billion. Even higher, annual earnings spiked 38% to $10.60 per share versus EPS of $7.68 in 2023.

Picture Supply: Zacks Funding Analysis

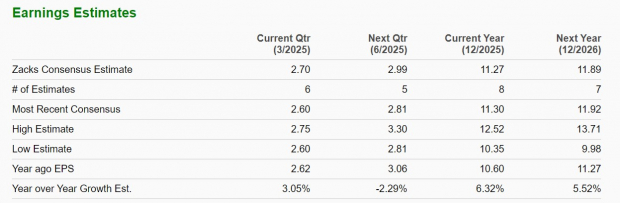

Offering FY25 EPS steering, Normal Motors expects earnings within the vary of $11.00-$12.00 per share with the present Zacks Consensus at $11.27 or 6% development.

Based mostly on Zacks estimates, Normal Motors’ backside line is projected to extend one other 5% in FY26. It’s additionally noteworthy that Normal Motors’ FY25 steering requires adjusted EBITDA to be between $13.7 billion-$15.7 billion with adjusted automotive free money circulation to vary from $11 billion-$13 billion.

Picture Supply: Zacks Funding Analysis

Tesla Full Yr Outcomes & Steerage

Pivoting to Tesla, FY24 gross sales had been up 1% to $97.69 billion. Nevertheless, Tesla’s EPS dipped to $2.42 from $2.60 per share in 2023. Tesla did spotlight that its Mannequin Y was the best-selling automotive on the planet final 12 months.

Picture Supply: Zacks Funding Analysis

Whereas Tesla didn’t present particular FY25 steering, the EV chief is aiming for 20%-30% development in automobile deliveries. Zacks projections name for Tesla’s annual earnings to soar 35% in FY25 to $3.27 per share. Extra intriguing, FY26 EPS is projected to broaden one other 22%.

Picture Supply: Zacks Funding Analysis

Backside Line

In the meanwhile Normal Motors and Tesla inventory each land a Zacks Rank #3 (Maintain). Extra upside in these in style auto shares could rely on the development of earnings estimate revisions within the coming weeks. With regard to holding positions within the portfolio, Normal Motors consistency is interesting and Tesla’s development trajectory will definitely preserve traders engaged.

Zacks’ Analysis Chief Names “Inventory Most More likely to Double”

Our group of consultants has simply launched the 5 shares with the best likelihood of gaining +100% or extra within the coming months. Of these 5, Director of Analysis Sheraz Mian highlights the one inventory set to climb highest.

This high decide is among the many most modern monetary corporations. With a fast-growing buyer base (already 50+ million) and a various set of leading edge options, this inventory is poised for giant positive aspects. In fact, all our elite picks aren’t winners however this one might far surpass earlier Zacks’ Shares Set to Double like Nano-X Imaging which shot up +129.6% in little greater than 9 months.

Free: See Our Top Stock And 4 Runners Up

General Motors Company (GM) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Ford Motor Company (F) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.