Gold and USD Index Underneath Trump’s Presidency

And no, I don’t imply Trump’s presidency, however that’s true as nicely. I imply the rally within the USD Index and the declines within the treasured metals and mining shares.

On a short-term foundation, it may appear as if the rally was so enormous that it is unsustainable. I agree; it was very sharp and nothing wanting spectacular, however whether or not it is sustainable is a totally totally different matter.

To reply the query about this rally’s sustainability, we have to zoom out and see what the scenario seems to be like generally – not simply within the case of the latest value strikes.

In any case, a better transfer is likely to be extreme for a short-term transfer, but it surely won’t be extreme in any respect when in comparison with the earlier greater uptrends.

And that’s precisely what zooming out reveals.

Implications for Valuable Metals

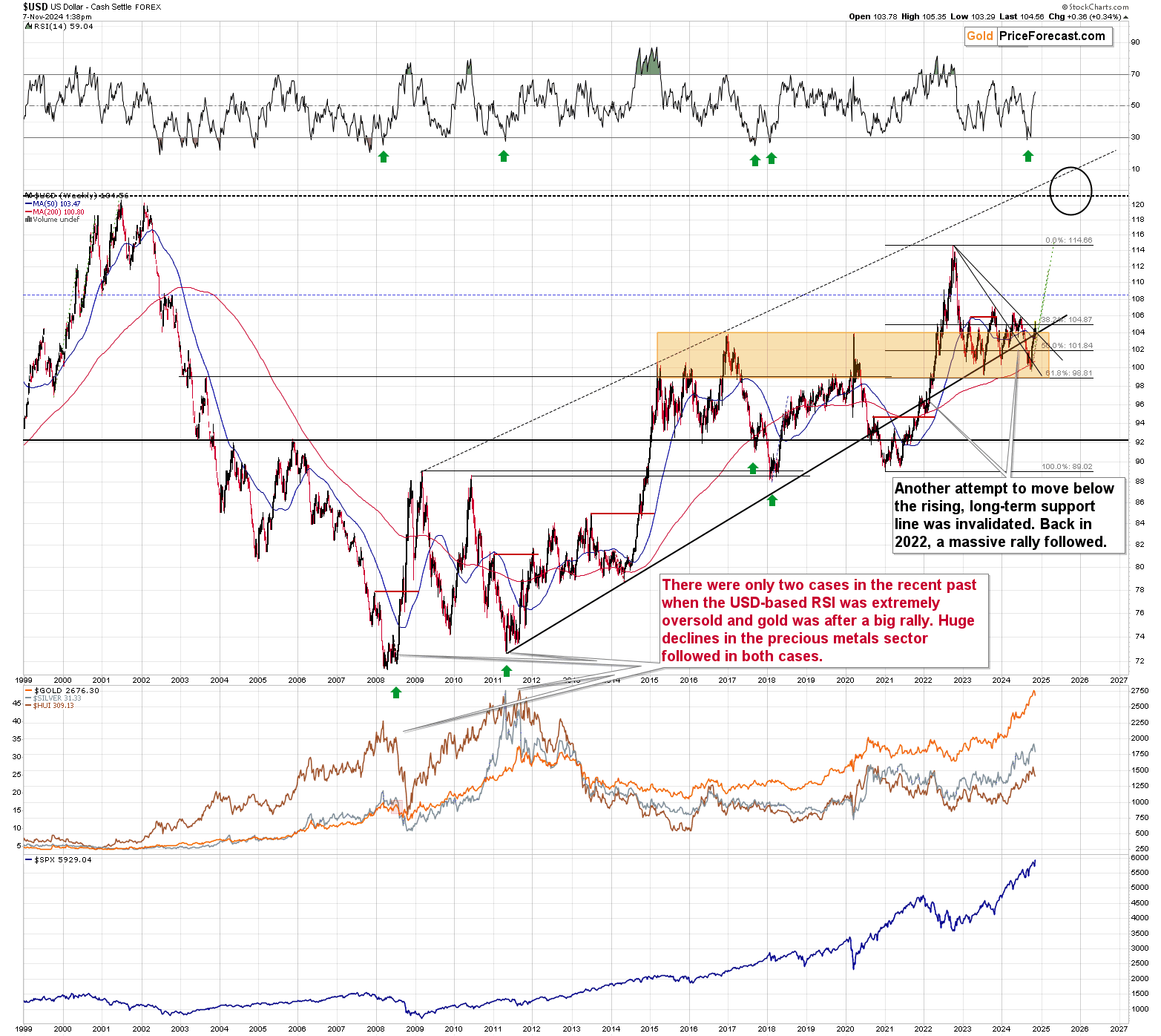

The USD Index simply invalidated its breakdown under the highly effective, rising assist line based mostly on the 2011 and 2014 lows. There have been three earlier breakdowns under this line, all invalidated. They had been all adopted by sizable rallies within the USDX, however just one is absolutely much like what we noticed within the earlier months due to how lengthy the USDX stayed under the road.

The one related case is the 2020 breakdown and its invalidation that passed off in early 2022. Again then, the USD Index continues to rally for about 15 index factors. If the identical occurs once more (be aware: I’m not writing about one thing utterly new occurring – I’m writing in regards to the latest previous being repeated), then the USD Index might rally to about 120 – it’s a vital, medium-term excessive.

Can the USD Index actually transfer as excessive? Sure – it could be simply historical past’s rhyme, nothing notably new.

The influence on the dear metals market could be detrimental, and the above chart exhibits how dangerous issues might get.

Given the latest extraordinarily oversold studying from the RSI and the excessive gold lately rallied, there are solely two related conditions within the latest previous: the 2011 excessive (proper earlier than that prime) and the ultimate 2008 high. Gold, silver, and mining shares plunged in each instances, so the implications are very bearish.

On a facet be aware, the medium-term bottoms within the USD Index are sometimes accompanied by some type of principle based mostly on which the USD is changing into ineffective and substituted by different currencies. Again in 2008 it was the dual deficit and lately de-dollarization is what is commonly talked about as the explanation for greenback’s “unavoidable” loss of life. I obtained fairly many requests to touch upon it when the USD Index was bottoming earlier this 12 months and I’ve been repeating that it’s seemingly an indication of the underside that this subject emerged (an indication of extraordinarily detrimental sentiment) and never a sound elementary motive for decline’s continuation.

Perhaps the world will step away from utilizing the USD, however:

-

That is unlikely to occur anytime quickly.

-

For my part, it will likely be a transfer towards CBDC (gov’t crypto) and never different fiat currencies.

Transferring again to the above chart, the analogy to 2011 is especially fascinating – again then gold continued to rally for a while after greenback’s RSI moved under 30. The identical occurred lately, gold continued to maneuver greater after which made a transparent high – identical to what we noticed in 2011.

Shares and Broader Market Traits

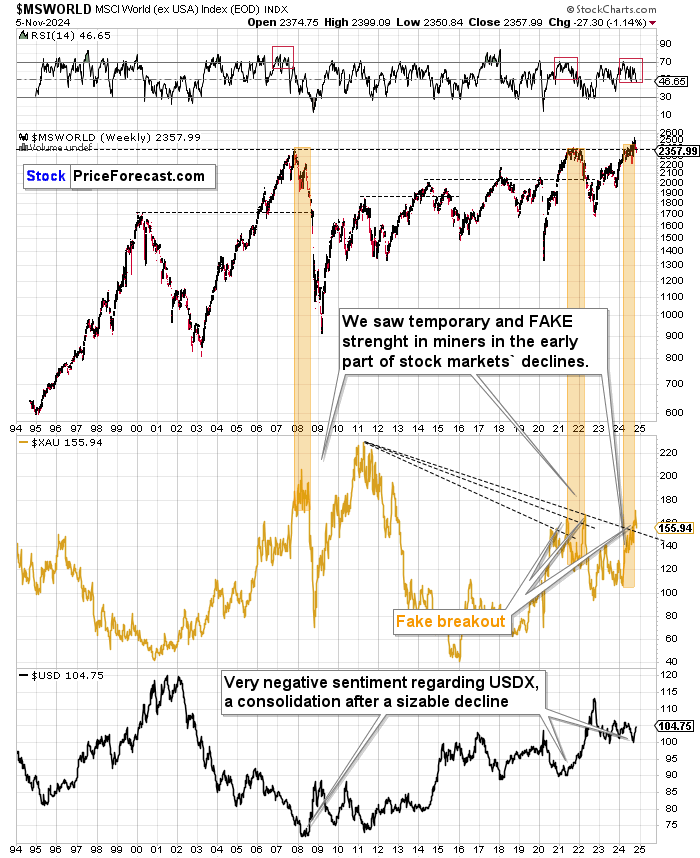

Now, as I wrote yesterday, the scenario would grow to be notably bearish for mining shares if the inventory market additionally declined. Particularly, seeing world shares (not simply U.S. shares) collapse could be more likely to set off important declines within the miners.

That’s what occurred in 2008 and in 2022 – the declines in world shares and mining shares had been actually important. The XAU Index (proxy for gold and silver mining shares) in the midst of the above chart exhibits simply how tiny the latest decline was in comparison with what we noticed in 2022 and – extra importantly – 2008. In case you can’t see the present decline there, relaxation assured it’s there; it’s simply so tiny that it’s barely seen.

Curiously, each: 2008 and 2022 declines in world shares had been accompanied by huge rallies within the USD Index… So, if one is underway, then world shares can slide, taking miners with them.