The approaching Trump presidency is more likely to be thrilling, however loads is unknown. Traders want strong ways to deal with commodities, the inventory market, bonds, crypto, and naturally supreme cash .

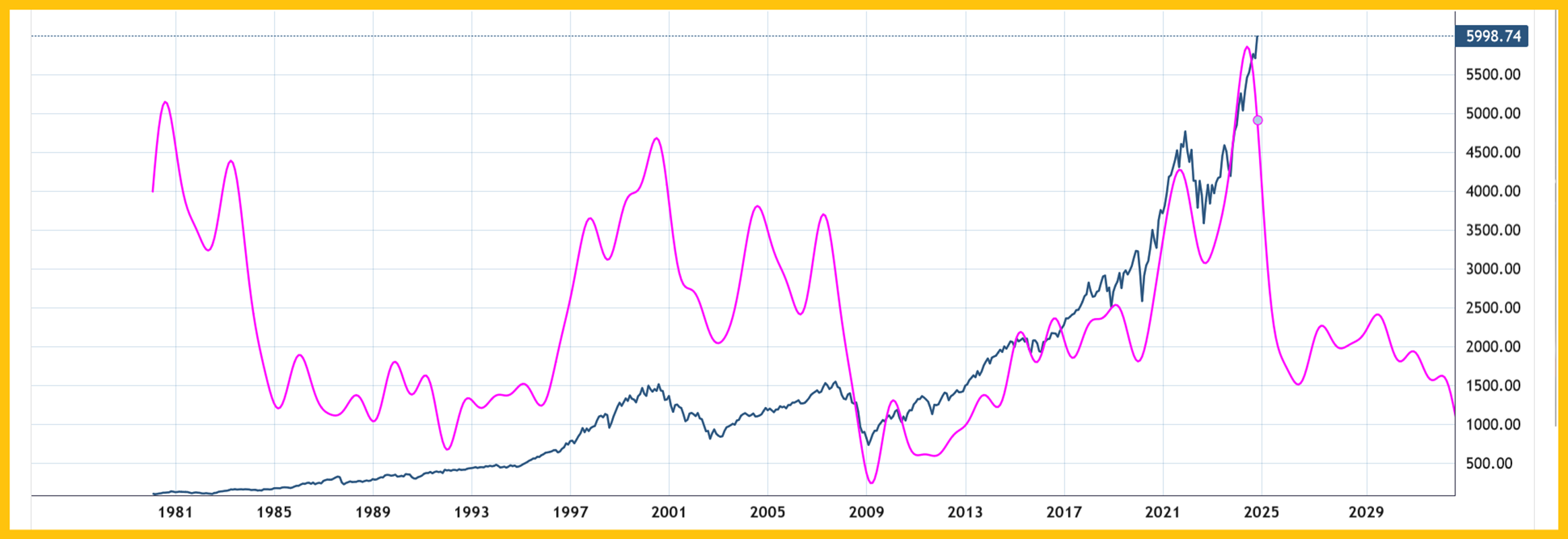

Foundation the Shiller/CAPE ratio, the US inventory market simply grew to become the second most overvalued within the historical past of the nation!

A have a look at the market from a cyclical perspective. Utilizing a mixture of greater than a dozen long-term cycles, the is projected to enter a long-term bear market in 2025.

Crypto? The 6 month cycle chart for bitcoin. Cycle evaluation tends to flounder in a sideways market, but it surely’s fairly correct at projecting main highs… and it’s projecting one for bitcoin is going on now.

With () close to a key spherical quantity ($100,000), some “alt” cash are taking centre stage, whereas bitcoin itself possibly be making fairly a major high.

What might develop into to be seen as a “chart of the last decade” within the years forward. is a key indicator of Mainstreet inflation, and foundation this CANE ETF, an enormous inverse H&S base sample is in play. I’m a purchaser, and with some respectable measurement.

is one other commodity in base sample mode. I’m additionally a purchaser of this mighty steel.

The bottom sample suggests a 50% value surge is imminent.

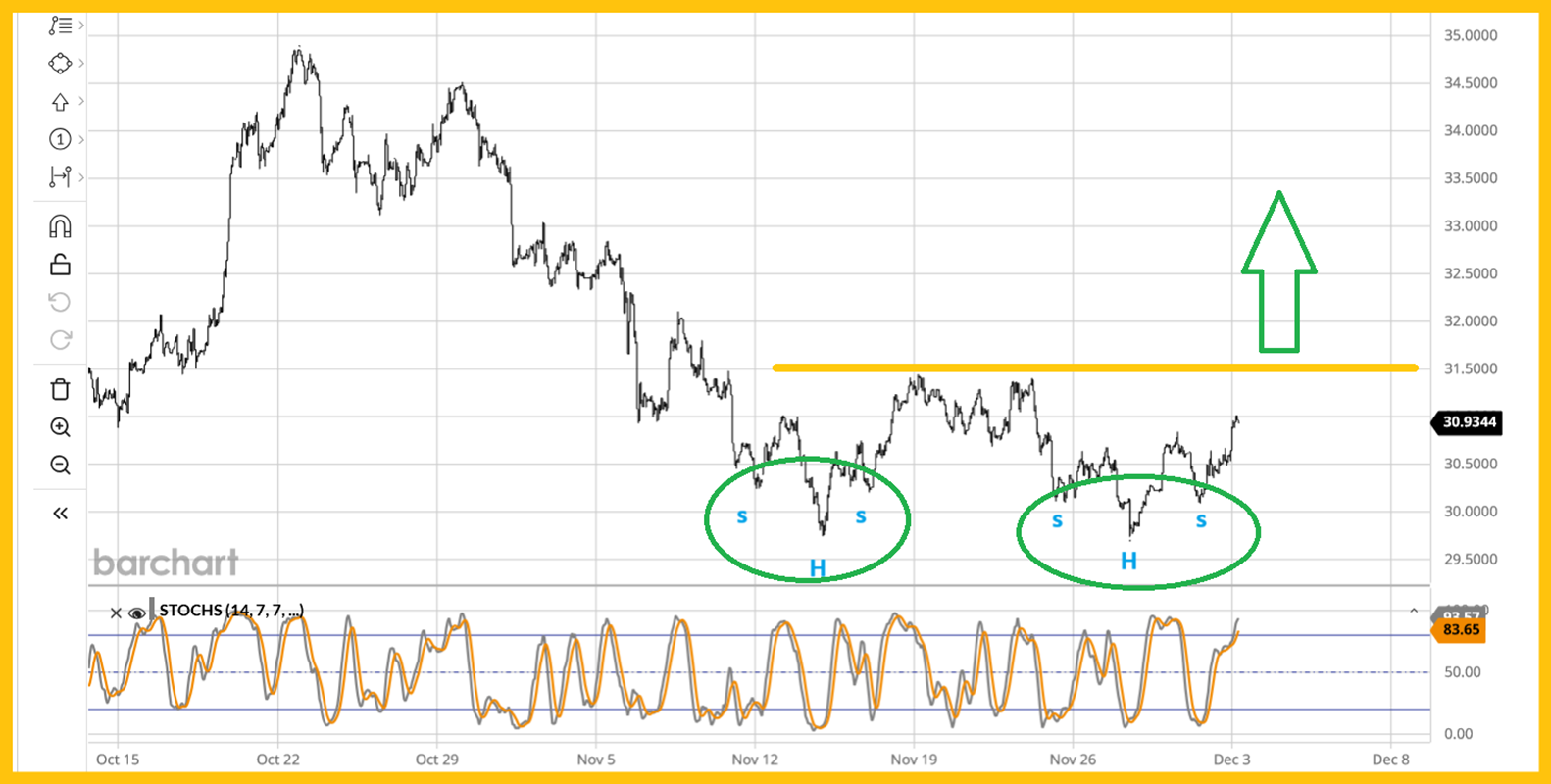

With palladium and sugar on the transfer, can be far behind? The short-term silver chart, which appears phenomenal.

There are twin inverse H&S bottoms in play, as half of a bigger double backside set-up.

A possible tail wind is the US greenback. There’s lastly some H&S high motion in play on the every day chart.

Within the short-term, the US jobs report on Friday might present some greenback power and weak spot for gold, however because the ridiculously overvalued inventory market begins to roll over, there could possibly be fairly a stunning institutional exit from the greenback.

Group Trump might attempt to halt the outflow with even greater tariff taxes than he plans now, however that plan might backfire and assist create a miniature 1929 kind of scenario.

Gold? Gold was technically overbought on this weekly chart on the latest excessive, however that’s now not the case.

Elliott wave evaluation is subjective, however one easy interpretation would have gold within the late a part of a significant C wave.

This wave might have ended on the $2800 space excessive, but it surely probably has a couple of smaller legs increased to go. From there, a D wave correction might see gold commerce all the way down to the respectable help zone of $2450-$2300.

That pullback would additionally put gold on the neckline of the massive inverse H&S sample that launched Wave C… and an excellent E wave can be launched from there!

The short-term outlook for gold relies upon loads on how enthusiastic Chinese language residents are about celebrating the brand new yr.

The excellent news is that the Chinese language inventory market (foundation the FXI ETF) has pulled again to the bottom sample breakout zone and appears set to surge. Why would this occur with the economic system there in such tough form?

Effectively, the stimulus (cash printing) introduced thus far has been purposed in the direction of out-of-control municipal debt. New US tariffs might persuade the Chinese language authorities to announce much more cash printing… sufficient to create panic shopping for of the inventory market.

The residents would have a good time the rallying inventory market and potential flip within the economic system with hefty purchases of gold.

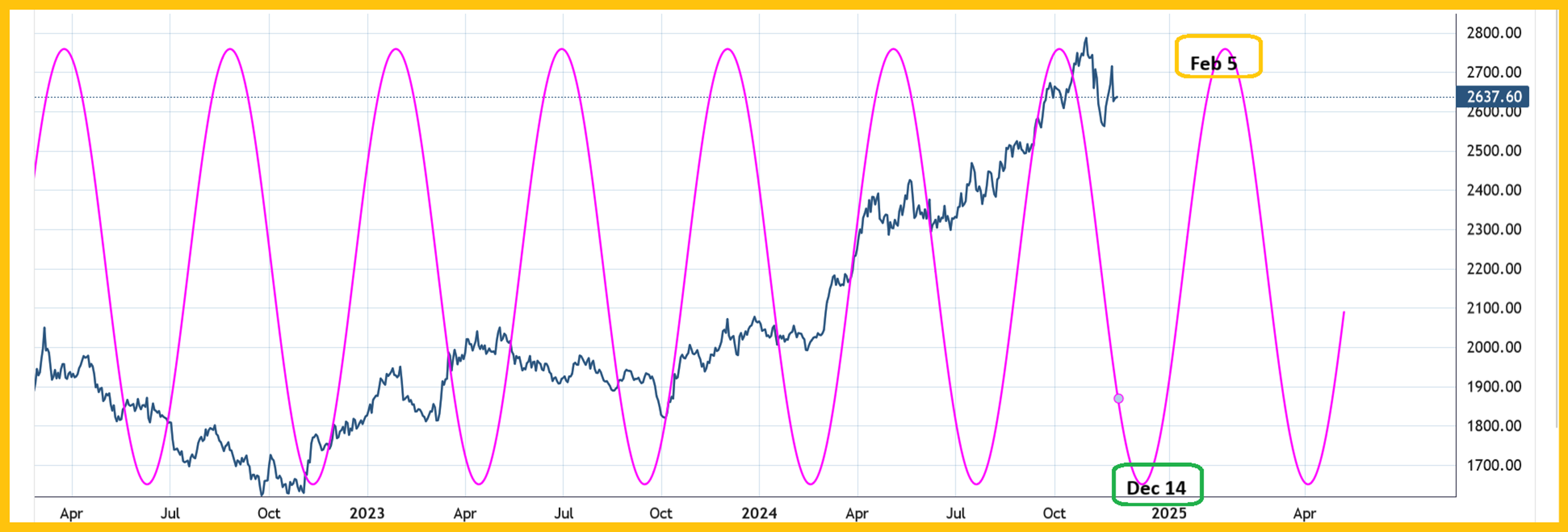

The four-month gold cycle chart. The subsequent low within the cycle comes round Dec 14 and the subsequent excessive comes close to the Chinese language New Yr peak at about Feb 5, 2025.

A have a look at why that is necessary to gold and silver inventory buyers, and word the important thing 14,5,5 Stochastics motion on the backside the chart. It’s approaching oversold and sure will get there simply because the 4month gold cycle low happens. A flip ought to assist launch GDX (NYSE:) out of the massive inverse H&S sample… and usher in 12 to 24 months of outperformance towards gold!