Mayhem

Attempting to fit a square secure right into a rounded opening. Seeking in All the Incorrect Places.

Could we have recognized at the time what headings would certainly arise?

No. Yet what appeared is that from reserve banks to sovereign investing as well as loaning to geopolitics to anti-globalism to continuous resources concerns as well as food lacks to climbing worldwide financial obligation- absolutely nothing is as it was.

Extra headings?

Below are a couple of:

Rates-While ECB raises.50-they additionally claim they will cover at 4%

Financial Institutions– Regional Banks ETF looks reduced still with SIVB declaring Phase 11

With $300 Billion included in the equilibrium sheet-this is the reverse of QT-and signals an additional absence of control

Financial institutions obtained $165 billion from the FED-more than in 2008

Extra on the United States Buck

Many worrying is if the decreases (simply dropped from 114 in September to under 104 this past week), after that what?

Will the price issue whatsoever in the battle versus rising cost of living?

Therefore, our leading choice for 2023 was as well as still is.

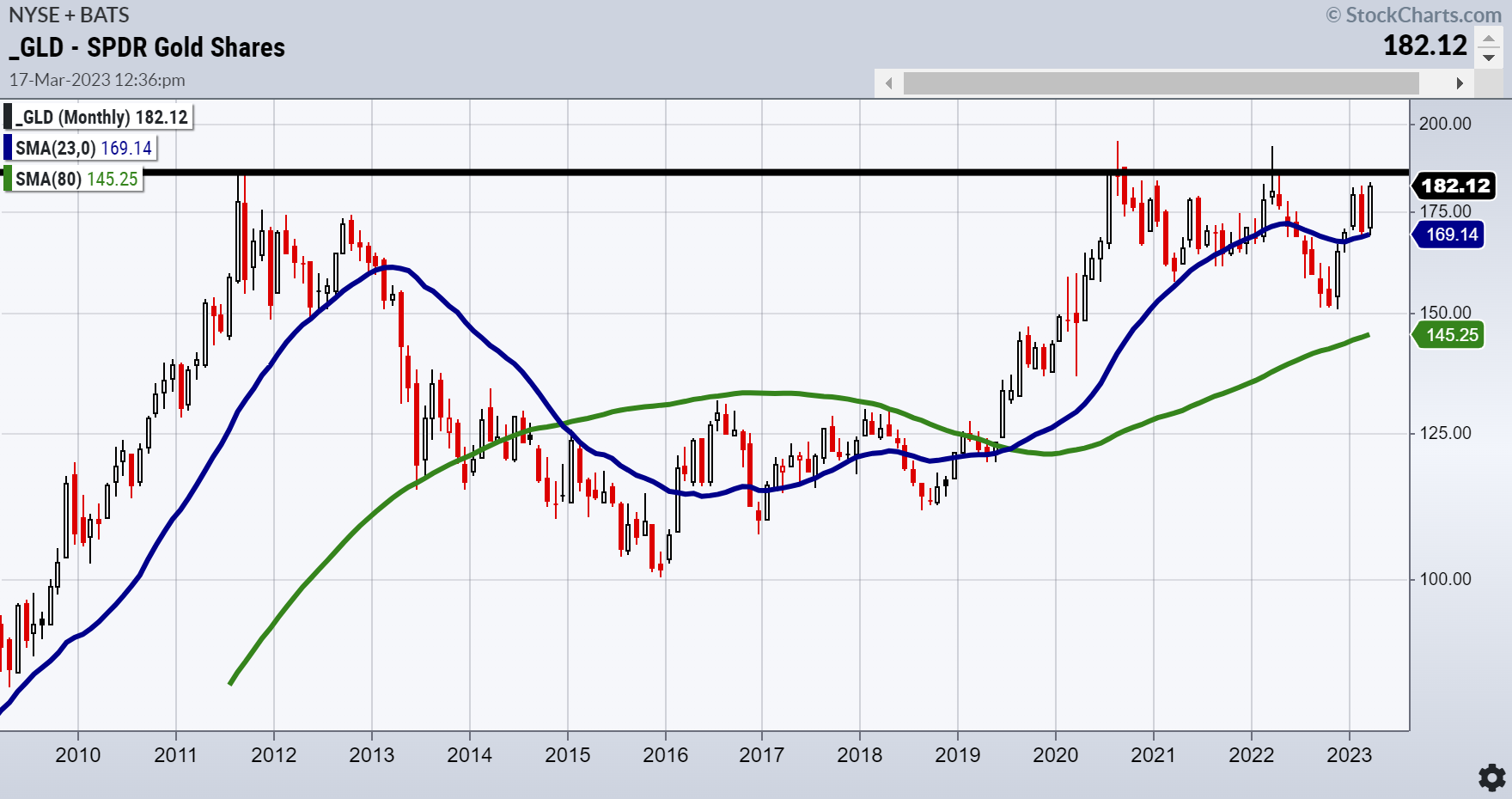

This is the regular monthly graph of gold as translucented the ETF GLD (NYSE:-RRB-.

It dates to pre-2011, when gold was climbing after the 2008 dilemma. In August 2011, an additional massive heading struck the marketplace:

S.& P. Downgrades Debt Rating of U.S. for the First Time

In August 2011, gold added to 184.82 prior to the political dancing was fixed, as well as everybody played good once again.

Because the thick straight line extended throughout the web page to this month, GLD has not had a month-to-month close over those 2011 highs.

Nevertheless, in August 2020, the GLD daily high was a short-term pop to 194.45, yet GLD shut a lot reduced later on that month.

Professionals can see this graph in 2 methods.

Initially, three-way and even quadruple tops around 184-185.

OR

A substantial upside down 12-year head as well as shoulders base, which, if the neck line gets rid of, gauges the gold transfer to around 260.

Virtually near to the 2023 ask for gold to increase or most likely to around $3000 an ounce. You choose which side of the T.A. call you wish to get on.

Nevertheless, see the buck as your finest indication. Under 104, rising cost of living strikes us in 2 methods. High price of items as well as reduced buying power.

Certainly, maintain the turmoil in your evaluation, presuming we have yet to see all the causal sequences of current headings (in addition to China, Russia, as well as North Korea all constantly on the back heater).

Neglect the Experts, comply with the Mathematics

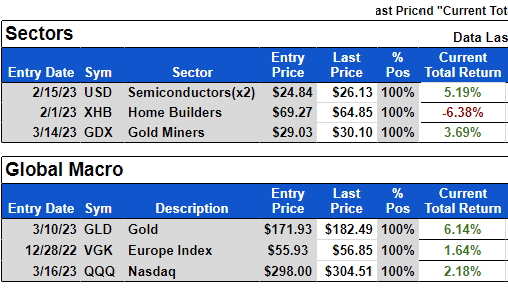

Sectors Table

MarketGauge’s treasures Worldwide Macro (Worldwide Equities: Macro Sectors)

Existing holdings based upon M.G.’s exclusive signs reveal GLD as well as gold miners GDX (NYSE:-RRB- in the profile.

Furthermore, the design holds Nasdaq (NASDAQ:-RRB- as well as Semiconductors (NASDAQ:-RRB-. Interesting to see exactly how the quants will certainly fix moving forward.

ETF Recap

- S&P 500 (SPY) 390 critical as well as 380 assistance

- Russell 2000 (IWM) Still weak comparatively-170-180 array currently

- Dow (DIA) 310 assistance 324 resistance

- Nasdaq (QQQ) 328 is the 23-month M.A. resistance-300 assistance

- Regional financial institutions (KRE) 44 assistance 50 resistance-still appears like reduced in shop

- Semiconductors (SMH) 255.64, last month’s high. 248 local assistance

- Transport (IYT) Clutch holds 218 as well as requires to clear 224 once a week close

- Biotechnology (IBB) Shut inside the previous week’s trading array

- Retail (XRT) 60 large assistance as well as 64 large resistance