Synthetic intelligence (AI) is the most popular matter on Wall Road and is increasing rapidly to Essential Road as companies undertake these options at lightning speeds. Open AI’s ChatGPT triggered a search and question revolution, whereas Nvidia’s unprecedented development helped energy the Nasdaq Composite and S&P 500 to new highs.

AI is an enormous subject, and buyers have oodles of choices, from corporations that present tech analysis, like Gartner, to these offering built-in software program, like Microsoft’s Copilot, to information middle reminiscence suppliers like Micron Technology. However most of us haven’t got limitless funds to put money into every thing.

When you have just a few thousand {dollars} in a retirement account or rattling round within the financial institution, I’ve a few concepts. I believed I’d give attention to two terribly completely different corporations that might present long-term earnings.

SoundHound AI

Rising prices and an absence of accessible employees have made drive-thru and fast-casual eating places discover alternate options. In the meantime, automakers are searching for next-gen conversational intelligence. Voice recognition conversational intelligence solves each issues, and SoundHound’s software program affords this to many acquainted manufacturers, akin to White Citadel, Jersey Mikes, Stellantis, and Honda.

I have been important of SoundHound AI (NASDAQ: SOUN) up to now. On the finish of 2022, the corporate’s money steadiness bottomed out at simply $10 million towards $35 million in debt. $10 million makes development extraordinarily troublesome for an unprofitable firm with unfavourable money move — it isn’t a recipe for achievement.

Nevertheless, administration drastically improved its place to $200 million in money and no debt final quarter, as proven under, though the corporate elevated its share depend considerably to do it.

SOUN Cash and Equivalents (Quarterly) information by YCharts

The rise in share depend is a troublesome tablet for the prevailing shareholders, however the dilution ought to drastically gradual now that the corporate is on strong footing.

SoundHound trades for 26 instances gross sales, which appears excessive for an unprofitable, cash-flow-negative firm. Nevertheless, the valuation drops drastically when accounting for the speedy development. SoundHound hit $13.5 million in gross sales in Q2 on 54% year-over-year development. It expects income to leap from $80 million in 2024 to $150 million subsequent 12 months. This brings the price-to-sales ratio to a extra palatable 12.5.

SoundHound is not a inventory for everybody; smaller corporations are usually riskier, albeit with large upside potential. Areas like voice-enabled sensible TVs, residence units, carryout ordering, and retail are just about untapped. Nonetheless, it is best to not put all of your eggs in a single basket, so here is a extra mainstream thought.

Amazon

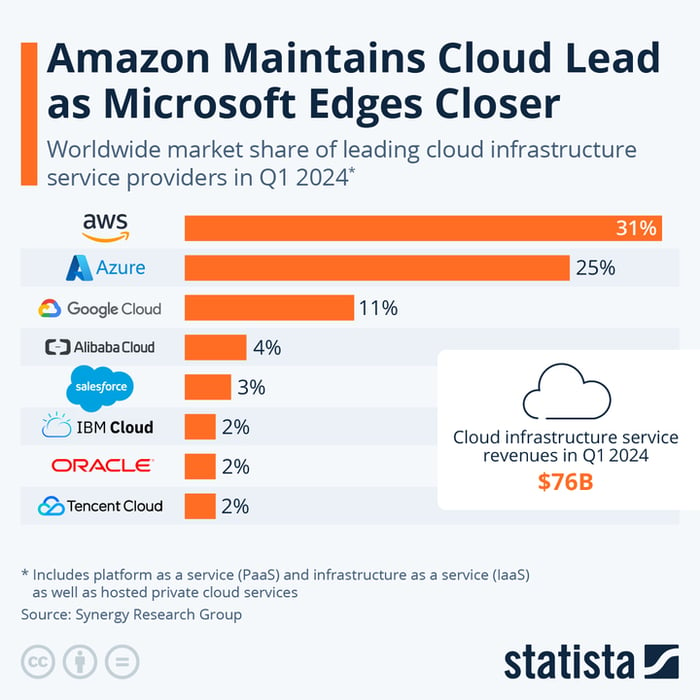

Amazon (NASDAQ: AMZN) is about 1,000 instances bigger than SoundHound by market capitalization. It is also a important cog within the AI machine. We use extra information than ever, and the necessity for it retains rising. Cloud service suppliers, like Amazon Internet Providers (AWS), are important to energy data-guzzling AI functions. As proven under, AWS is the most important supplier, with almost a 3rd of the market.

AWS accounts for a rising portion of Amazon’s whole income — 18% in Q2 2024 in comparison with 16% in Q2 2023. That is terrific for Amazon as AWS is very worthwhile, posting a 36% working margin final quarter in comparison with 10% for the corporate as a complete. If you happen to nonetheless consider Amazon as a product firm, assume once more; 58% of whole gross sales final quarter had been from providers like AWS, digital promoting, Prime, and third-party vendor providers.

This could excite buyers since providers are usually extra worthwhile than merchandise. The continued migration to providers and the resurgence of AWS on the again of AI pushed working earnings to $30 billion for the primary six months of 2024 in comparison with simply $12 billion for a similar interval of 2023.

Amazon has different irons within the AI hearth, like Amazon Bedrock, which supplies foundational fashions that clients can customise to go well with their wants, and forays into designing AI chips. The corporate has the assets to be a significant participant within the business.

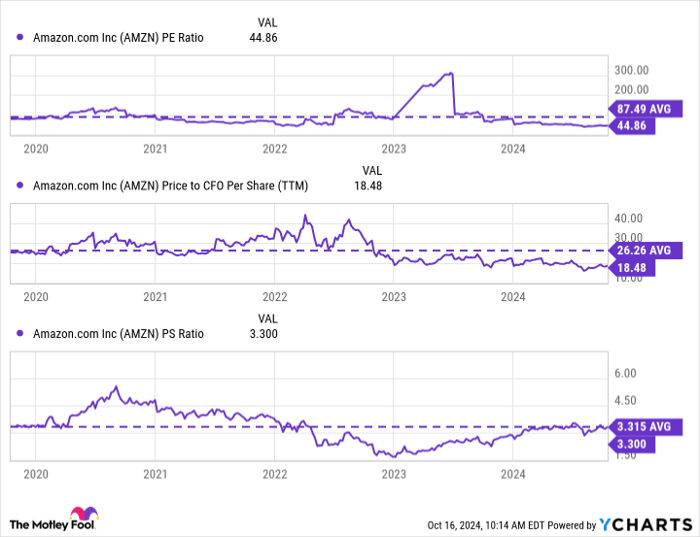

Now, let us take a look at the inventory, which trades under its latest averages based mostly on earnings, money move, and gross sales, as depicted under.

AMZN PE Ratio information by YCharts

Traders ought to at all times contemplate their danger tolerance (what’s yours? Attempt this quiz to search out out) when selecting how one can divide their cash between investments. On this case, SoundHound is riskier than Amazon however has a extra explosive potential upside due to its smaller dimension.

A typical long-term investor with medium danger tolerance ought to contemplate weighting their {dollars} closely towards Amazon with a smaller speculative place in SoundHound. In distinction, an aggressive investor may do the alternative.

Do you have to make investments $1,000 in SoundHound AI proper now?

Before you purchase inventory in SoundHound AI, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the 10 best stocks for buyers to purchase now… and SoundHound AI wasn’t certainly one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… in the event you invested $1,000 on the time of our suggestion, you’d have $839,122!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of October 14, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Bradley Guichard has positions in Amazon and Micron Expertise and has the next choices: lengthy January 2025 $2 calls on SoundHound AI. The Motley Idiot has positions in and recommends Amazon, Microsoft, and Nvidia. The Motley Idiot recommends Gartner and recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.