Powell’s Hawkish Feedback Shake Equities

Ten days after the election, the sugar excessive and animal spirits seem like lastly carrying off. Tech shares and the Nasdaq 100 Index ETF (QQQ) lastly encountered some heavy promoting stress after feedback from Federal Reserve Chairman Jerome Powell earlier within the week. Powell stated, “The financial system isn’t sending indicators that U.S. central financial institution must be in a rush to decrease rates of interest.” Traders should perceive that markets are pushed by liquidity, particularly from the Federal Reserve. Nonetheless, contemplating the roaring rally for the reason that presidential election, Powell taking the foot off the dovish gasoline pedal is no surprise. With shares up 5% final week, some profit-taking is anticipated. Under are 5 extra causes shares will prone to discover help:

1. Technical Confluence Zone

The value motion illustrates that QQQ is retreating to a high-probability purchase zone, which features a retest of the breakout and $500 spherical quantity, a every day value hole fill, and the rising 50-day shifting common.

Picture Supply: Zacks Funding Analysis

2. OPEX

Friday is choices expiration. Typically, shares commerce funky on choices expiration days as merchants reposition.

3. Wholesome Breadth Beneath the Hood

The foremost generally inform a partial story concerning market well being. To be able to get the total story, market contributors should examine breadth (participation). Although the main indices light laborious, solely ~60% of shares have been decrease for the session. Although markets have been down, main shares like Tesla (TSLA), Coinbase (COIN), MicroStrategy (MSTR), and Root (ROOT) have been up.

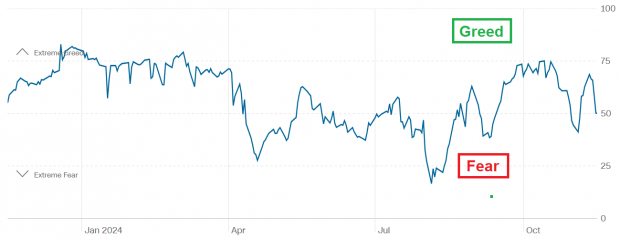

4. Dramatic Sentiment Shift

This week, the “CNN Worry & Greed” indicator confirmed that sentiment plunged from “Greed” to “Impartial” ranges. Savvy buyers use sentiment as a contrarian indicator.

Picture Supply: CNN

5. Seasonality

Historic seasonality means that markets are inclined to retreat into Thanksgiving week earlier than rallying into year-end.

Backside Line

Friday’s market swoon could seem intimidating on the floor. However, a number of items of proof, together with the QQQ chart, sentiment, and seasonality recommend that the draw back will likely be restricted.

Should-See: Photo voltaic Shares Poised to Skyrocket

The photo voltaic business stands to bounce again as tech firms and the financial system transition away from fossil fuels to energy the AI increase.

Trillions of {dollars} will likely be invested in clear vitality over the approaching years – and analysts predict photo voltaic will account for 80% of the renewable vitality growth. This creates an outsized alternative to revenue within the near-term and for years to come back. However it’s a must to decide the proper shares to get into.

Discover Zacks’ hottest solar stock recommendation FREE.

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Invesco QQQ (QQQ): ETF Research Reports

MicroStrategy Incorporated (MSTR) : Free Stock Analysis Report

Root, Inc. (ROOT) : Free Stock Analysis Report

Coinbase Global, Inc. (COIN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.