Hillenbrand HI reported adjusted earnings per share (EPS) of $1.01 in fourth-quarter fiscal 2024 (ended Sept. 30, 2024), which beat the Zacks Consensus Estimate of 93 cents. The underside line declined 11% yr over yr resulting from value inflation, decrease quantity and better curiosity expense. This was partially offset by the Schenck Course of Meals and Efficiency Supplies (“FPM”) acquisition, favorable pricing and financial savings from the beforehand introduced restructuring.

Together with one-time gadgets, HI reported earnings of 17 cents per share in contrast with 24 cents within the year-ago quarter.

Keep up-to-date with all quarterly releases: See Zacks Earnings Calendar.

Hillenbrand’s quarterly revenues rose 10% yr over yr to $838 million attributed to the FPM acquisition. The highest line beat the Zacks Consensus Estimate of $797 million.

Natural revenues decreased 1% yr over yr as favorable pricing and better aftermarket elements and repair revenues have been offset by decrease capital tools quantity.

Hillenbrand Inc Worth, Consensus and EPS Shock

Hillenbrand Inc price-consensus-eps-surprise-chart | Hillenbrand Inc Quote

Hillenbrand’s Operational Replace

The price of gross sales climbed 10.9% yr over yr to $549 million. The gross revenue rose 8% yr over yr to $288.4 million. The gross margin expanded to 48.7% from the year-ago quarter’s 33.5%. Working bills rose 26% yr over yr to $193 million.

Adjusted EBITDA dipped 2% from the year-ago quarter to $143.8 million. Adjusted EBITDA margin was 17.2% within the fiscal fourth quarter , which marked a 210-basis level contraction from the year-ago quarter.

HI’s Phase Performances in This fall

Revenues from the Superior Course of Options section have been $591 million. The 15% year-over-year enhance was attributed to the FPM acquisition. Natural revenues decreased 2% yr over yr as favorable pricing and better aftermarket elements and repair revenues have been offset by decrease capital tools quantity.

Adjusted EBITDA was $117 million, flat in contrast with the year-ago quarter. Price inflation and decrease quantity have been offset by favorable pricing and value actions. Adjusted EBITDA margin was 19.8%, which declined 300 foundation factors from the fourth quarter of fiscal 2023.

The Molding Expertise Options section’s revenues have been $247 million, which have been in step with the year-ago quarter. Adjusted EBITDA was $42 million, which declined 8% yr over yr resulting from value inflation and unfavorable product combine. This was partially offset by financial savings from the beforehand introduced restructuring actions. Adjusted EBITDA margin was 17%, which marked a 150-basis level year-over-year contraction.

Hillenbrand’s Money & Debt Place

The corporate had money and money equivalents of $199 million on the finish of fiscal 2024, down from $243 million at fiscal 2023-end. Liquidity was round $799 million, together with $243 million of money in hand and the remaining capability beneath its revolving credit score facility.

Money circulation from working actions was $191 million in contrast with $207 million within the final fiscal yr. Hillenbrand returned $62.5 million to shareholders by way of dividends in fiscal 2024.

HI’s long-term debt was $1.87 billion as of Sept. 30, 2024, in contrast with $1.99 billion as of Dec. 31, 2023.

HI’s 2024 Outcomes

Hillenbrand’s adjusted EPS declined 6% yr over yr to $3.32 in fiscal 2024, which beat the Zacks Consensus Estimate of $3.23. Together with one-time gadgets, the corporate reported a lack of $3.03 per share in opposition to earnings of $1.53 per share in fiscal 2023.

HI’s revenues rose 13% yr over yr to $3.2 billion, which surpassed the Zacks Consensus Estimate of $3.14 billion.

Hillenbrand Initiates Fiscal 2025 Outlook

The corporate expects revenues to be within the vary of $2.925 – $3.090 billion. Adjusted EBITDA is anticipated to be within the band of $452-$488 million . HI expects adjusted EPS to be between $2.80 and $3.15 .

First-quarter 2025 revenues are anticipated to be between $685 million and $705 million. Adjusted EPS is projected to be within the band of 52-57 cents.

HI’s Worth Efficiency & Zacks Rank

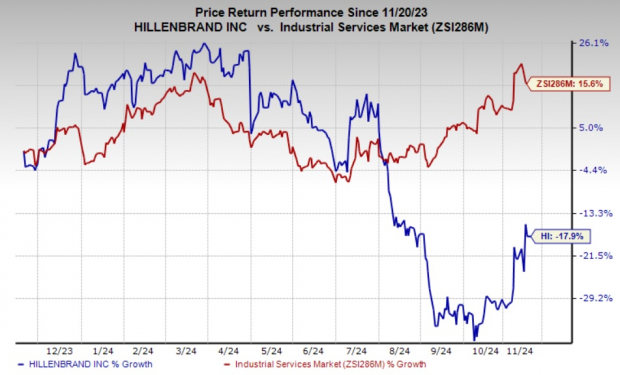

Up to now yr, Hillenbrand’s shares have misplaced 17.9% in opposition to the industry’s 15.6% progress.

Picture Supply: Zacks Funding Analysis

Hillenbrand at present carries a Zacks Rank #3 (Maintain). You possibly can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Efficiency of Different Industrial Providers Shares

ScanSource SCSC reported adjusted EPS of 84 cents within the first quarter of fiscal 2025 (ended Sept. 30, 2025), which beat the Zacks Consensus Estimate of 77 cents . Earnings improved 13.5% from the year-ago quarter’s determine of 74 cents per share.

SCSC posted revenues of $775.58 million , which missed the Zacks Consensus Estimate of $799 million. This compares with year-ago revenues of $876.31 million.

SiteOne Panorama Provide, Inc. SITE recorded adjusted EPS of 97 cents within the third quarter, which missed the Zacks Consensus Estimate of $1.18. The corporate posted earnings of $1.25 per share within the third quarter of 2023.

SITE registered revenues of $1.21 billion , which surpassed the Zacks Consensus Estimate of $1.18 billion. The highest line rose 2.4% yr over yr.

W.W. Grainger, Inc. GWW reported EPS of $9.87 in third-quarter 2024, which missed the Zacks Consensus Estimate of $9.98. Nonetheless, the underside line improved 4.7% yr over yr, aided by the robust performances of the Excessive-Contact Options N.A. and Limitless Assortment segments.

Grainger’s quarterly revenues rose 4.3% yr over yr to $4.39 billion. The highest line, nonetheless, missed the Zacks Consensus Estimate of $4.41 billion. Every day gross sales elevated 2.6% from the prior-year quarter. We had predicted each day gross sales progress of two.8%.

Solely $1 to See All Zacks’ Buys and Sells

We’re not kidding.

A number of years in the past, we shocked our members by providing them 30-day entry to all our picks for the whole sum of solely $1. No obligation to spend one other cent.

Hundreds have taken benefit of this chance. Hundreds didn’t – they thought there should be a catch. Sure, we do have a purpose. We wish you to get acquainted with our portfolio companies like Shock Dealer, Shares Beneath $10, Expertise Innovators,and extra, that closed 228 positions with double- and triple-digit positive factors in 2023 alone.

W.W. Grainger, Inc. (GWW) : Free Stock Analysis Report

ScanSource, Inc. (SCSC) : Free Stock Analysis Report

SiteOne Landscape Supply, Inc. (SITE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.