Simply a few weeks in the past buyers had been fearing the worst. Inflation was coming in sizzling, rates of interest cuts had been off the desk, and analysts had been shouting about stagflation. Now just some days later, broad fairness indexes are once more approaching all-time highs.

All it took as a measly -6% selloff within the S&P 500 to begin scaring buyers out of positions in good shares. When small pullbacks just like the one on the finish of April are met with vigorous shopping for like we noticed these final couple weeks, you recognize the bull market is undamaged.

Shares are nearly all the time climbing the “wall of fear.”

The hiccups that trigger mini selloffs are improbable shopping for alternatives.

The US financial system is extraordinarily sturdy within the face of document excessive rates of interest. US family wealth is at all-time highs encouraging client spending, the US authorities is spending on huge infrastructure initiatives reminiscent of semiconductors and nuclear vitality, and although there could also be a slight delay, expansionary financial coverage is on its approach.

Rising client and authorities spending grows earnings, and falling rates of interest will enhance liquidity. These are the driving elements in markets, and they’re pointing to a unbroken bull market now.

Moreover, this bull market continues to be within the early innings. Superb companies are nonetheless buying and selling for very affordable and even low cost valuations and are ripe for the discerning investor.

The Zacks Rank repeatedly amazes me with its capability to determine main shares, and right here I’ll present you three of my favorites. Not solely do these shares have high Zacks Ranks, however they’re additionally displaying relative power, low-cost valuations, and have rock stable enterprise fundamentals and progress.

Alphabet

Google dad or mum firm Alphabet GOOGL skilled some hefty upgrades to its earnings estimates this final week, boosting it to a Zacks Rank #1 (Robust Purchase) ranking.

Analysts have unanimously revised earnings estimates increased, with FY24 climbing by practically 12%. EPS are forecast to develop at 17.2% yearly over the following 3-5 years, which is an unbelievable tempo for a mammoth firm like Alphabet.

Picture Supply: Zacks Funding Analysis

Worth motion in Alphabet inventory has additionally made some encouraging advances in latest months. After displaying some questionable motion early within the yr, GOOGL inventory has considerably outperformed the Nasdaq index and its mega-cap expertise counterparts during the last three months.

Moreover, it has been forming what appears like a compelling bull flag. If the inventory can escape from the latest highs, it ought to make one other bull run.

Picture Supply: TradingView

PDD Holdings

PDD Holdings PDD often known as Pinduoduo, is a Chinese language e-commerce platform that makes a speciality of group shopping for offers. It makes use of a social commerce mannequin, encouraging customers to share offers with family and friends to unlock further reductions. The corporate’s enterprise mannequin focuses on leveraging social networks and progressive advertising and marketing methods to drive gross sales and engagement.

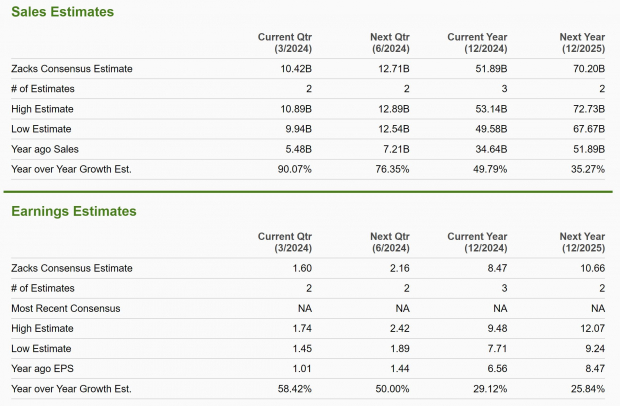

Income at PDD Holdings has exploded in the previous few years, rising annual gross sales from $2 billion in 2018 to $35 billion within the final yr. This large tempo of progress is anticipated to proceed with gross sales anticipated to climb 50% this yr and 35% subsequent yr.

Picture Supply: Zacks Funding Analysis

Pinduoduo has additionally seen some hefty upgrades to its earnings estimates, giving it a Zacks Rank #1 (Robust Purchase) ranking. Present quarter earnings had been revised increased by 27% during the last two months and FY24 have elevated by 18% over the identical interval.

PDD Holdings is at the moment buying and selling at a major low cost too. Its one yr ahead earnings a number of of 16.5x is nicely under the market common, and its two-year median of 25.6x.

However what makes this valuation seem particularly low-cost is PDD’s PEG Ratio which considers EPS progress. Over the following 3-5 years EPS are forecast to develop 49.3% yearly, giving it a PEG ratio of simply 0.3.

PulteGroup

PulteGroup PHM, one of many main homebuilding companies within the US and not too long ago jumped as much as a Zacks Rank #1 (Robust Purchase), reflecting strongly upward trending earnings revisions.

PulteGroup together with the opposite homebuilder shares are extraordinarily nicely positioned for the present financial surroundings.

Whereas some buyers fear concerning the sturdy worth appreciation within the residential residence market over the previous few years, it’s unlikely to decelerate. The fact of the US residence market is that there’s a large scarcity of obtainable housing. Not even 7% mortgage charges might decelerate the market!

Due to the restricted provide of housing, homebuilders are prone to rating sturdy earnings within the coming years.

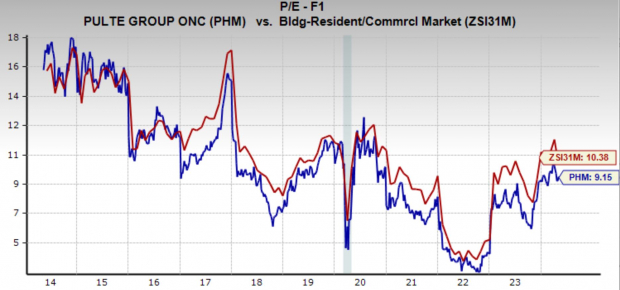

However what makes PulteGroup particularly interesting is its earnings progress expectation in relation to its valuation.

PHM is at the moment buying and selling at a one yr ahead earnings a number of of 9.2x, which is just under its 10-year median of 9.6x and the business common of 10.4x. However analysts are anticipating EPS to develop 17.7% yearly over the following 3-5 years, giving PulteGroup a PEG ratio of 0.52.

That’s a particularly interesting stage primarily based on the metric.

Picture Supply: Zacks Funding Analysis

Backside Line

For buyers trying so as to add publicity to shares, these three shares are price diving into.

I additionally notably like this mixture of shares as a result of it provides you a relatively broad and diversified mixture of firms. You will have huge tech, which embrace cloud, content material and search at Alphabet, housing with PulteGroup, and China with PDD Holdings.

Diversification like this provides buyers the posh of assorted exposures. So, if one sector or geography underperforms, there’s a risk one other will outperform.

Zacks Names “Single Greatest Choose to Double”

From hundreds of shares, 5 Zacks consultants every have chosen their favourite to skyrocket +100% or extra in months to come back. From these 5, Director of Analysis Sheraz Mian hand-picks one to have probably the most explosive upside of all.

It’s an American AI firm that’s driving low proper now, nevertheless it has rounded up purchasers like BMW, GE, Dell Pc, and Bosch. It has prospects for not simply doubling however quadrupling within the yr to come back. After all, all our picks aren’t winners however this one might far surpass earlier Zacks’ Shares Set to Double like Boston Beer Firm which shot up +143.0% in little greater than 9 months and NVIDIA which boomed +175.9% in a single yr.

Free: See Our Top Stock And 4 Runners Up

PulteGroup, Inc. (PHM) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

PDD Holdings Inc. (PDD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.