The house building contractor market has actually strongly developed itself as one of the leading industries in the securities market, supplying an amazing efficiency over the previous year. House contractors presently being in the leading 2% of the Zacks Market Ranking, with 10 supplies racking up a Zacks Ranking # 1.

Sustained by an assemblage of elements, consisting of a relentless shortage in real estate supply and also a decrease in rate of interest over the in 2014, the market has actually delighted in a higher trajectory without any indications of decreasing. This was a substantial shock for several on Wall surface Road, as a lot of experts predicted an economic crisis at the start of the year, which need to have tested the industry.

Moreover, strengthened by boosting profits quotes and also sensible appraisals, house building contractor supplies look like engaging financial investments, with solid return capacity for financiers. Although there are a variety of supplies in the industry with persuading principles, I will certainly concentrate on D.R. Horton DHI, PulteGroup PHM, and also NVR NVR, which have all outmatched the marketplace YTD and also over the last years.

Picture Resource: Zacks Financial Investment Research Study

D.R. Horton

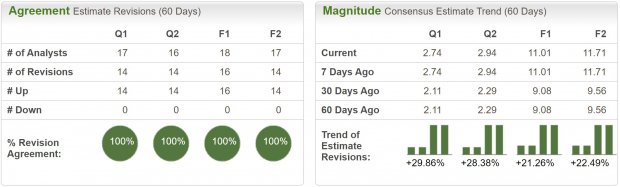

After experiencing some hostile downgrades in the 2nd fifty percent of 2022, DHI is back to being updated once more. D.R. Horton flaunts a Zacks Ranking # 1 (Solid Buy), suggesting higher trending profits alterations. Incomes quotes have actually been modified 20-30% greater throughout durations over the last 2 months.

Picture Resource: Zacks Financial Investment Research Study

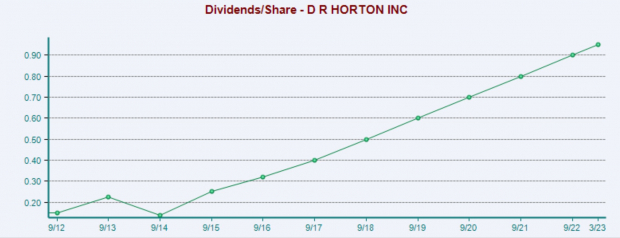

Not just is DHI a constant cultivator, and also well placed in the existing real estate atmosphere, however monitoring is additionally charitable with returning cash money to investors. DHI has a reward return of 1%, which has actually been boosted by approximately 15% each year over the last 5 years. In addition, over the last 5 years, the share matter has actually been minimized by 10% many thanks to equip buy-back programs.

Picture Resource: Zacks Financial Investment Research Study

DHI is presently trading at a 1 year forward profits multiple of 10.2 x, which remains in line with the market standard, and also listed below its 10-year average of 11.6 x. In addition, the market itself is listed below its 10-year average of 11.1 x.

Picture Resource: Zacks Financial Investment Research Study

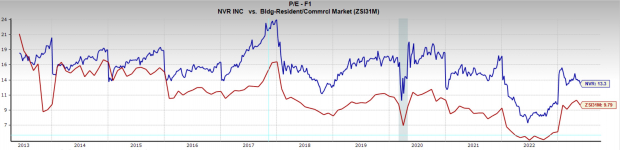

NVR

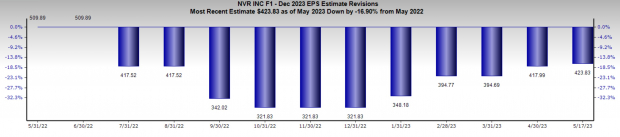

NVR is additionally a Zacks Ranking # 1 (Solid Buy) house building contractor supply, with higher trending profits alterations. In the graph listed below we can see simply exactly how extreme the alterations reduced were entering into completion of 2022, and also just how highly they have actually recoiled this year. It must be kept in mind that quotes are still listed below what they were a year back.

Picture Resource: Zacks Financial Investment Research Study

Unlike various other homebuilders, NVR’s single company is offering and also constructing high quality houses by normally obtaining ended up structure great deals, without the danger of owning and also creating land in an intermittent market.

NVR gets ended up great deals at market value from numerous third-party land programmers under the Whole lot Acquisition Agreements to make sure that the lawful commitment and also financial loss is restricted for the down payment, in situation of failing.

The whole lot procurement method aids the firm to prevent monetary needs and also dangers related to straight land possession and also land advancement. This method permits it to get performance and also an one-upmanship over its peers.

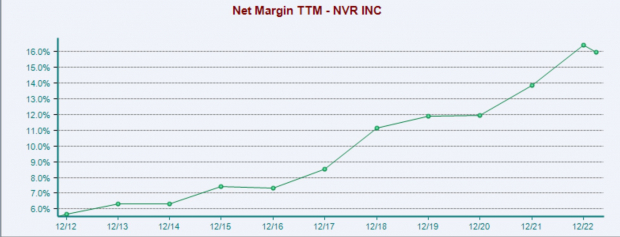

NVR has actually taken care of to increase Web Margins significantly over the last 10 years, partially many thanks to this method. Over that time margins have actually virtually tripled from 6% to 16%.

Picture Resource: Zacks Financial Investment Research Study

NVR is trading at a 1 year forward profits multiple of 13.3 x, which is over the market typical 9.8 x, however listed below its 10-year average of 16x. Nonetheless, with its one-of-a-kind procurement method, and also high margins, NVR most likely makes a costs assessment.

Picture Resource: Zacks Financial Investment Research Study

PulteGroup

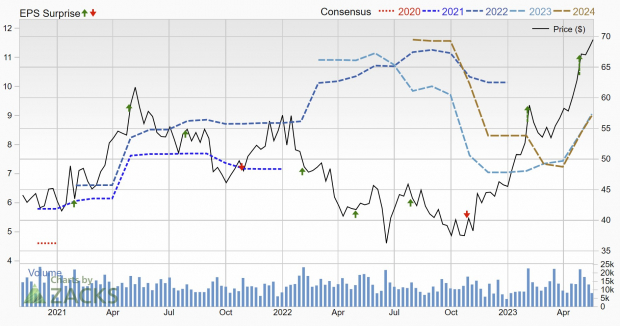

PulteGroup supply is blowing up to brand-new all-time highs also. After being reduced with completion of 2022, financiers are currently captured flat-footed as profits quotes are modified greater and also the supply fees greater. Pulte additionally takes pleasure in a Zacks Ranking # 1 (Solid Buy), mirroring the solid fad in profits quotes upgrades.

Picture Resource: Zacks Financial Investment Research Study

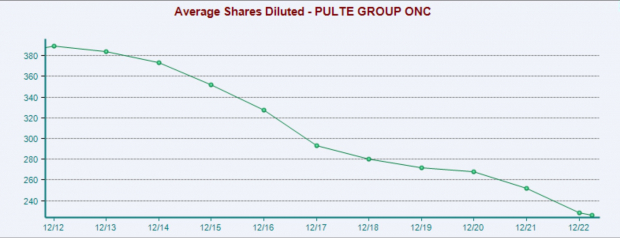

PHM is extremely charitable with its financiers also, making massive initiatives to return cash money to investors. Along with decreasing its share matter by 40% over the last 10 years though buybacks, PHM additionally provides a reward which is has actually increased yearly given that 2012. The returns settlement has actually been boosted by approximately 12% each year over the last 5 years.

Picture Resource: Zacks Financial Investment Research Study

PHM is trading at a 1 year forward profits multiple of 7.7 x, which is well listed below the market typical 10.3 x, and also listed below its 10-year average of 10.4 x. This is an eye-catching assessment for a firm with a lengthy background of expanding sales, returning cash money to investors, and also taking advantage of nonreligious rigidity in its particular market.

Picture Resource: Zacks Financial Investment Research Study

Rate Of Interest

In the graph listed below of the Ten-Year Treasury return, we can see that rate of interest came to a head back in November 2022 and also have actually trended reduced given that. If you contrast this graph with the house building contractor supplies, you will certainly see that house contractors started to rally specifically when prices came to a head. This isn’t shocking as reduced home mortgage prices bring about even more house purchasing.

In addition, we can currently be reasonably positive that rate of interest will certainly remain to trend reduced as a result of unsupported claims from the Federal Get. After elevating rate of interest 5% given that 2021, the Fed has actually currently made it clear that they are close to, otherwise totally done elevating rate of interest. Reduced prices imply less expensive home mortgages, which need to urge more toughness in house purchasing.

Picture Resource: TradingView

Real Estate Supply

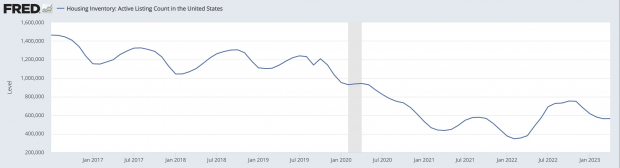

Any individual that has actually attempted purchasing a residence in the last 2 years understands simply exactly how affordable the marketplace has actually been. And also any individual that hasn’t attempted purchasing a house has actually checked out it or spoken with somebody that has. Besides numerous markets that were remarkably warm throughout the post-Covid boom, a lot of regional property markets have actually stayed exceptionally supply constricted.

The real estate boom and also breast of 2008 had something of a stressful impact on real estate programmers, due to the fact that ever since real estate supply has actually broken down. Also in even more current years we can see that the quantity of energetic property listings has actually greater than cut in half in the last 5 years. As a result of this, house contractors and also their items are an exceptionally warm product.

Picture Resource: St Louis Fed

Profits

Also after the solid add in the market, house building contractor supplies are still engaging financial investments. High Zacks Ranks and also technological graph patterns make them solid near-term financial investment prospects. While nonreligious tailwinds, and also reduced appraisals make them extremely appealing long-lasting financial investments.

5 Supplies Ready To Dual

Each was handpicked by a Zacks specialist as the # 1 preferred supply to get +100% or even more in 2021. Previous referrals have actually risen +143.0%, +175.9%, +498.3% and also +673.0%.

A lot of the supplies in this record are flying under Wall surface Road radar, which offers a wonderful chance to participate the very beginning.

Today, See These 5 Potential Home Runs >>

PulteGroup, Inc. (PHM) : Free Stock Analysis Report

D.R. Horton, Inc. (DHI) : Free Stock Analysis Report

NVR, Inc. (NVR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights and also viewpoints revealed here are the sights and also viewpoints of the writer and also do not always mirror those of Nasdaq, Inc.