House Depot HD reported revenues on Tuesday, and also it was instantly clear that there had actually been a downturn in investing at the house renovation store. Sales can be found in -3% listed below price quotes, which was the greatest earnings miss out on in current background. Revenues had the ability to defeat assumptions, nevertheless they still revealed a -6% YoY decrease.

Year of Small Amounts

chief executive officer Ted Decker defined business’ current efficiency appropriately:

” After a three-year duration of unmatched development for our industry, throughout which we expanded sales by over $47 billion, we anticipated that monetary 2023 would certainly be a year of small amounts for the house renovation market. Our sales for the quarter were listed below our assumptions largely driven by lumber depreciation and also negative weather condition … We likewise observed even more broad-based stress throughout business contrasted to when we reported 4th quarter results a couple of months back.”

Uncertainties that the post-Covid boom drew onward a significant quantity of customer investing can be verified by House Depot’s revenues outcomes. Naturally, the large concern is just how much additionally will investing agreement?

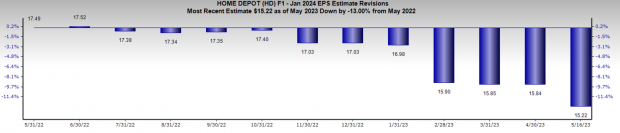

Revenues price quotes have actually been devalued throughout the board over the last 2 months and also HD presently holds a Zacks Ranking # 4 (Market). Yet, while there might be more murkiness in House Depot’s revenues assumptions, there are some calming datapoints that the most awful might be near.

Photo Resource: Zacks Financial Investment Research Study

Healing in Homebuilder Industry

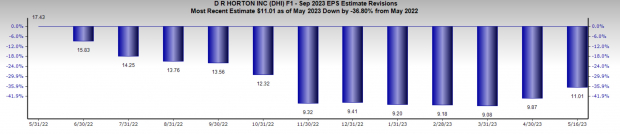

The homebuilding industry appears like it might have seen the lows in revenues assumptions. D.R. Horton DHI has actually seen revenues price quotes changed greater given that bottoming at the end of 2022. In addition, the homebuilder industry is just one of the best sectors out there, presently being in the leading 2% of the Zacks Sector Ranking. In addition, share rates of DHI are pressing all-time highs, while the remainder of the industry is setting up comparable returns.

This renovation in revenues assumptions for the homebuilder industry might be a promise for House Depot. It is feasible that homebuilding business might be a leading indication for building investing, indicating HD might see an enter sales in the coming months.

Photo Resource: Zacks Financial Investment Research Study

The photo listed below programs that revenues price quotes for HD are still pressing the lows. Yet, while HD and also DHI remain in surrounding markets, the small inconsistency in consumers and also their objectives might clarify the difference in efficiency and also assumptions.

Lots of HD consumers are making house renovations, which is an extremely optional cost. Additionally, homebuilders are developing brand-new houses, and also with the architectural rigidity in real estate supply, might be gaining from that essential distinction.

Photo Resource: Zacks Financial Investment Research Study

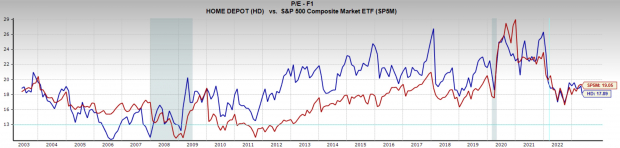

Assessment

House Depot is trading at a 1 year forward revenues multiple of 17.9 x, which is listed below the marketplace standard of 19x, and also listed below its 20-year typical of 18.6 x. While HD has actually seldom traded listed below the marketplace standard in regards to multiples in the last years, you can see leading up to the economic situation it did. So, while it is rather comforting to see HD with a poor appraisal, it should not be utilized to attempt and also time a base.

Photo Resource: Zacks Financial Investment Research Study

Technical Point Of View

The technological graph pattern on House Depot is rather calming. Listed below, we can see HD has actually traded to a substantial degree of assistance. The $265-$ 280 degree was held 2 times in 2015, and also currently complying with the inadequate revenues record it has really turned around off this degree once again.

HD births would certainly anticipate this weak revenues record to send out the supply with this degree of assistance, yet remarkably, purchasers have actually tipped up.

Photo Resource: TradingView

Profits

The profession arrangement on HD is presently rather dirty. While there are some calming variables the essential photo leans bearish. Specifically if the economic climate surrender later on this year, and also enters into an economic downturn, capitalists need to anticipate HD revenues to proceed the pattern lower.

Zacks Names “Solitary Best Select to Dual”

From hundreds of supplies, 5 Zacks professionals each have actually picked their favored to increase +100% or even more in months to find. From those 5, Supervisor of Study Sheraz Mian hand-picks one to have one of the most eruptive benefit of all.

It’s an obscure chemical business that’s up 65% over in 2015, yet still economical. With unrelenting need, skyrocketing 2022 revenues price quotes, and also $1.5 billion for redeeming shares, retail capitalists might enter any time.

This business might equal or exceed various other current Zacks’ Supplies Ready To Dual like Boston Beer Business which skyrocketed +143.0% in little bit greater than 9 months and also NVIDIA which flourished +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

The Home Depot, Inc. (HD) : Free Stock Analysis Report

D.R. Horton, Inc. (DHI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights and also point of views shared here are the sights and also point of views of the writer and also do not always show those of Nasdaq, Inc.