From an operational standpoint, Residence Depot (NYSE: HD) has been coping with a troublesome setting for the previous few years. Identical-store gross sales have declined constantly because the finish of 2022. Regardless of that, the inventory has held up nicely, and is up by round 40% over the previous yr as of this writing.

In its fiscal third quarter, which ended Oct. 27, same-store gross sales declined once more. Nonetheless, the decline was smaller than anticipated, and it appears like the corporate might be set to show the nook someday subsequent yr. So with a possible turnaround forward for the enterprise, is that this a superb time to purchase the inventory?

Identical-store gross sales

Residence Depot’s same-store sales simply fell for the eighth straight quarter. That is a streak it would look to interrupt quickly.

| Metric | Q3 2022 | This fall 2022 | Q1 2023 | Q2 2023 | Q3 2023 | This fall 2023 | Q1 2024 | Q2 2024 | Q3 2024 |

|---|---|---|---|---|---|---|---|---|---|

| Identical-store gross sales progress | 4.3% | (0.3%) | (4.5%) | (2%) | (3.1%) | (3.5%) | (2.8%) | (3.3%) | (1.3%) |

| U.S. same-store gross sales progress | 4.5% | (0.3%) | (4.6%) | (0.2%) | (3.5%) | (4%) | (3.2%) | (3.6%) | (1.2%) |

Information supply: Residence Depot earnings experiences. Residence Depot’s fiscal quarters finish roughly one month after commonplace calendar quarters.

For its fiscal 2024 third quarter, Residence Depot’s comparable-store gross sales fell by 1.3%; nevertheless, that was a significantly better outcome than the three.3% decline that analysts had anticipated, in accordance with StreetAccount. The variety of transactions edged down by 0.2%, whereas the typical ticket measurement shrank by 0.8%.

One space of continued weak spot for the retailer has been big-ticket objects, which the corporate defines as these costing $1,000 or extra. Comparable gross sales on these objects have been 6.8% decrease. Administration mentioned it continues to see softer engagement round greater reworking tasks that will require financing.

In contrast to previous quarters, although, the corporate noticed quite a few classes put up comp gross sales progress, together with paint, energy, out of doors backyard, constructing supplies, and indoor backyard.

The house enchancment retailer’s general income rose by 6.6% to $40.2 billion, bolstered by its latest acquisition of SRS Distribution. Adjusted earnings per share (EPS), in the meantime, dropped by 2% to $3.78. These outcomes have been above the analysts’ consensus estimates for EPS of $3.64 on $39.3 billion in gross sales, as compiled by LSEG.

Along side the quarterly report, administration adjusted its full-year same-store gross sales steering. The retailer now anticipates same-store gross sales to say no by 2.5%, an enchancment from the prior outlook for a decline of between 3% to 4%. Administration mentioned the up to date steering mirrored its stable Q3 outcomes in addition to incremental hurricane-related gross sales.

It forecast full-year gross sales would rise by 4%, up from earlier steering of between 2.5% and three.5%. This takes under consideration its acquisition of SRS Distribution and an additional week in fiscal 2024 in comparison with fiscal 2023.

Picture supply: Getty Pictures

A turnaround might be close to

It has been a troublesome couple of years for Residence Depot partly as a result of the pandemic pulled ahead a variety of demand on dwelling reworking tasks, after which as a result of the mix of inflation and better rates of interest impacted financing prices and slowed housing turnover. A number of dwelling reworking tasks are initiated across the shopping for and promoting of properties, however the dwelling turnover charge hit its lowest stage in a minimum of 30 years via the primary eight months of 2024, with solely 2.5% of properties altering arms.

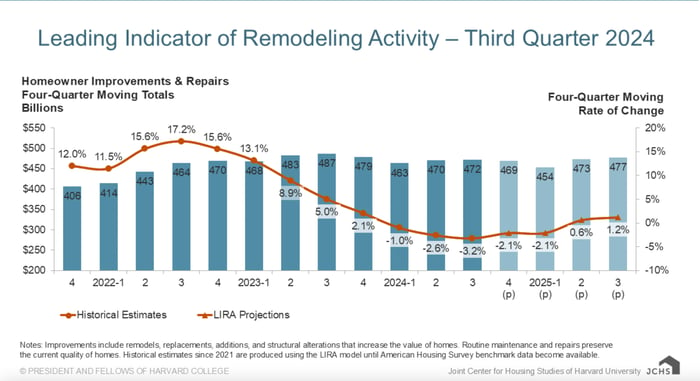

Nonetheless, the Fed has begun to decrease its benchmark rate of interest once more, and there ought to be pent-up demand within the dwelling enchancment area, each of which bode nicely for Residence Depot in 2025. Based on the Main Indicator of Transforming Exercise (LIRA), printed by the Joint Middle for Housing Research at Harvard College, reworking exercise is poised to return to progress within the second half of 2025. Residence Depot tends to outperform the LIRA, so I believe the corporate will see same-store gross sales flip constructive even sooner.

Supply: Joint Middle for Housing Research of Harvard College

Is Residence Depot inventory a purchase?

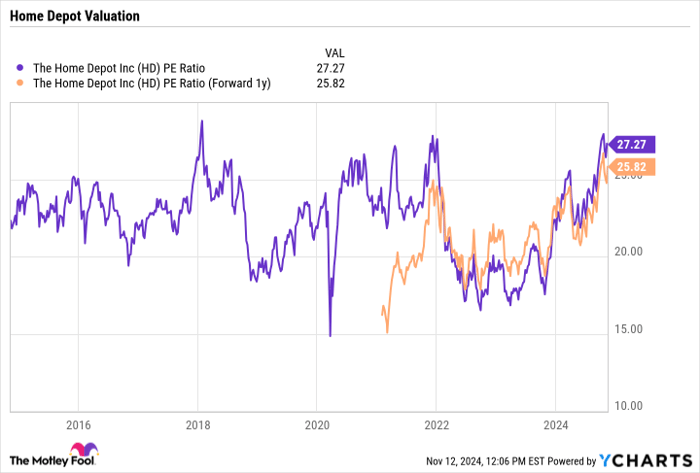

Residence Depot’s inventory has held up nicely regardless of its declining same-store gross sales, so shares usually are not within the cut price bin. It just lately traded at a price-to-earnings (P/E) ratio of about 27 and a ahead P/E of slightly below 26, based mostly on analysts’ estimates for subsequent yr. These ratios are fairly near the excessive finish of its historic averages.

HD PE Ratio knowledge by YCharts.

Nonetheless, Residence Depot ought to begin to see some working leverage as soon as its same-store gross sales start to extend, and that ought to result in earnings progress. I would contemplate shopping for Residence Depot inventory earlier than that turnaround begins, because it appears just like the headwinds the corporate has been going through ought to begin dissipating subsequent yr.

Do you have to make investments $1,000 in Residence Depot proper now?

Before you purchase inventory in Residence Depot, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 best stocks for traders to purchase now… and Residence Depot wasn’t one in every of them. The ten shares that made the reduce may produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… in the event you invested $1,000 on the time of our suggestion, you’d have $899,361!*

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of November 11, 2024

Geoffrey Seiler has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Residence Depot. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.