Dwelling Depot HD, Lowe’s LOW, and TJX Firms TJX are the important thing retailers popping out with quarterly outcomes this week. Nevertheless, many available in the market might be ready for Nvidia’s NVDA launch after the market’s shut on Wednesday, February 26th.

Dwelling Depot shares have modestly completed higher than Lowe’s shares within the year-to-date interval, although each have underperformed the broader market in a big approach.

The chart under exhibits the one-year efficiency of Dwelling Depot (blue line; up +4.2%), Lowe’s (inexperienced line; up +4.5%), the Zacks Building sector (orange line; up +5.2%), and the S&P 500 index (crimson line; up +21.1%).

Picture Supply: Zacks Funding Analysis

The working atmosphere for Dwelling Depot and Lowe’s stays difficult, because the rate of interest backdrop continues to be unfavorable regardless of the U.S. Fed’s easing coverage. As reconfirmed by Friday’s weak January Current Dwelling Gross sales numbers, the ensuing elevated mortgage charges stay an enormous headwind for gross sales.

Whereas developments in New Dwelling Gross sales have a bearing on combination development actions and financial development, the outlook for Dwelling Depot and Lowe’s is intently tied to Current Dwelling gross sales as the upkeep, repairs, and transforming initiatives for these older properties drive their gross sales. However with dwelling costs nonetheless rising, albeit at a moderating tempo, and mortgage charges remaining elevated, affordability points preserve potential consumers on the sidelines.

This unfavorable working atmosphere has been weighing on Dwelling Depot’s same-store gross sales pattern, which has been damaging in every of the final 8 quarters. The present Zacks Consensus estimate is for a -1.7% same-store gross sales decline, which might comply with the -1.3% comp decline within the November 12th quarterly launch.

Dwelling Depot is anticipated to usher in $3.03 in EPS on $39.02 billion in revenues, representing year-over-year adjustments of +7.5% and +12.2%, respectively. Estimates for the interval have modestly ticked up in latest days, with the $3.03 estimate up from $3 a month in the past.

Similar-store gross sales have been below stress at Lowe’s as properly, with the present Zacks Consensus estimate reflecting a -1.67% decline. This follows the -1.10% decline vs. estimates of a -2.83% decline within the previous quarter. Lowe’s is anticipated to usher in $1.82 per share in earnings on $18.29 billion in revenues when it reviews outcomes earlier than the market’s open on Wednesday, February 26th. This represents year-over-year adjustments of +2.8% in EPS and a -1.7% decline in revenues.

With the Consumed monitor to remain on the easing course, buyers would count on treasury yields to return down ultimately. That stated, the yield curve is unlikely to shift down in parallel, with the shorter finish of the curve reflecting the central financial institution’s easing coverage and the longer finish proving to be considerably ‘sticky’ to replicate expectations of a extra sturdy development atmosphere. The tariffs uncertainty is one other threat issue for these operators, each when it comes to potential supply-chain disruptions in addition to the power to cross on the ensuing greater prices to finish shoppers.

The read-through for Dwelling Depot and Lowe’s of this rate of interest dialogue is that mortgage charges might not come down as quick or as a lot as anticipated in a Fed easing cycle. Which means that developments within the current dwelling gross sales area are unlikely to meaningfully enhance over the close to time period, although one would count on the medium- to long-term outlook on the prevailing dwelling gross sales entrance to be optimistic on financial and demographic grounds.

With respect to the Retail sector’s 2024 This fall earnings season scorecard, we now have outcomes from 21 of the 33 retailers within the S&P 500 index. Common readers know that Zacks has a devoted stand-alone financial sector for the retail area, which is not like the location of the area within the Shopper Staples and Shopper Discretionary sectors within the Customary & Poor’s normal business classification. The Zacks Retail sector contains Dwelling Depot, Lowe’s, different conventional retailers, on-line distributors like Amazon AMZN, and restaurant gamers.

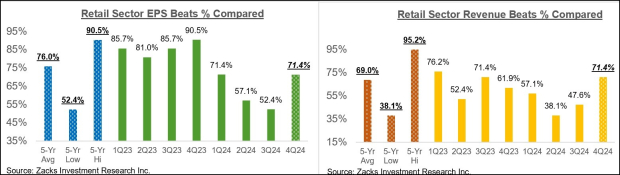

Whole This fall earnings for these 21 retailers which have reported are up +36.8% from the identical interval final yr on +6.9% greater revenues, with 71.4% beating EPS estimates and an equal proportion beating income estimates.

The comparability charts under put the This fall beats percentages for these retailers in a historic context.

Picture Supply: Zacks Funding Analysis

As you may see above, the proportion of those firms beating consensus EPS estimates represents a notable enchancment over what we had seen from this group of Retail sector firms within the previous two quarters however in any other case stays under the typical for the previous 20 quarters. The income beats proportion for this group of firms is monitoring above different latest durations in addition to the historic common.

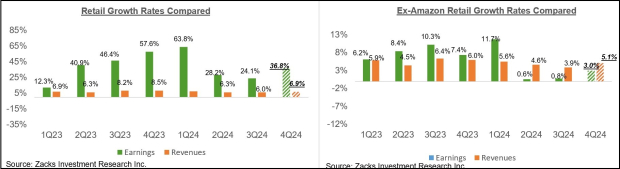

With respect to the elevated earnings development charge at this stage, we like to indicate the group’s efficiency with and with out Amazon, whose outcomes are among the many 21 firms which have reported already. As we all know, Amazon’s This fall earnings had been up +86.9% on +10.5% greater revenues, beating EPS and income expectations.

The 2 comparability charts under present the This fall earnings and income development relative to different latest durations, each with Amazon’s outcomes (left aspect chart) and with out Amazon’s numbers (proper aspect chart)

Picture Supply: Zacks Funding Analysis

As you may see above, many of the earnings development at this stage for the Retail sector is coming from Amazon, with This fall earnings for the remainder of the group that has reported up solely +3% on +5.1% greater revenues. There’s respectable top-line development, even on an ex-Amazon foundation, which successfully displays headline inflationary developments within the financial system.

This fall Earnings Season Scorecard

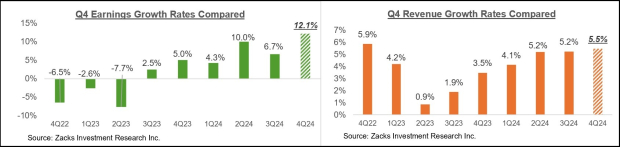

By means of Friday, February 21st, now we have seen This fall outcomes from 429 S&P 500 members, or 85.6% of the index’s whole membership. Whole earnings for these firms are up +12.1% from the identical interval final yr on +5.5% greater revenues, with 77.9% beating EPS estimates and 66.2% beating income estimates.

The comparability charts under put the This fall earnings and income development charges relative to different latest durations for a similar group of index members.

Picture Supply: Zacks Funding Analysis

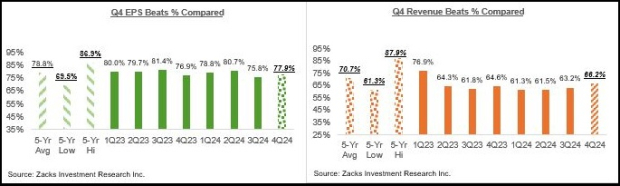

The comparability charts under put the This fall EPS and income beats percentages relative to different latest durations for a similar group of firms.

Picture Supply: Zacks Funding Analysis

Key Earnings Studies This Week

We have now over 750 firms on deck to report outcomes this week, together with 54 S&P 500 members. Along with the aforementioned Dwelling Depot and Lowe’s releases, now we have Nvidia NVDA and Salesforce CRM reporting outcomes this week. Dell Applied sciences, HP, Warner Brothers Discovery, Snowflake, and TJX Firms are different notable firms reporting this week.

The Nvidia launch after the market’s shut on Wednesday, February 26th, is especially notable given the corporate’s main function in offering chips to the continuing AI-focused buildout actions. There was a sentiment change about Nvidia following the DeepSeek announcement, although a lot of Magazine 7 firms which can be Nvidia’s prospects seem like sticking with their capex plans, at the very least for now. We envision administration addressing the DeepSeek subject on theearnings calland offering visibility on the demand outlook.

Nvidia is anticipated to usher in 84 cents in EPS on $37.7 billion in revenues, representing year-over-year adjustments of +61.5% and +70.7%, respectively. Estimates have largely remained steady and unchanged, which is a big downshift from the spectacular optimistic revisions pattern that had been in place over the previous yr. This shift in revisions pattern explains the inventory’s latest struggles, lagging the Tech sector and the S&P 500 index this yr.

The Earnings Large Image

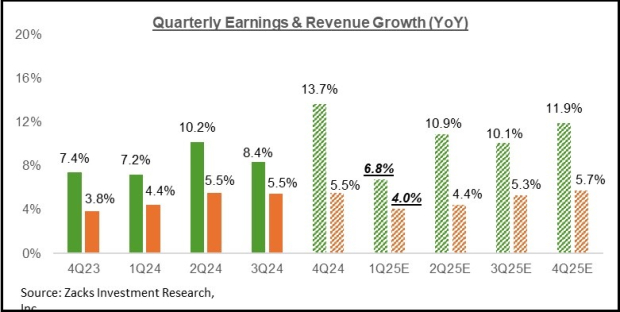

The chart under exhibits the This fall earnings and income development expectations within the context of the place development has been within the previous 4 quarters and what’s anticipated within the coming 4 quarters.

Picture Supply: Zacks Funding Analysis

Excluding the contribution from the Magazine 7 firms, This fall earnings for the remainder of the S&P 500 index can be up +9% on +4.5% greater revenues.

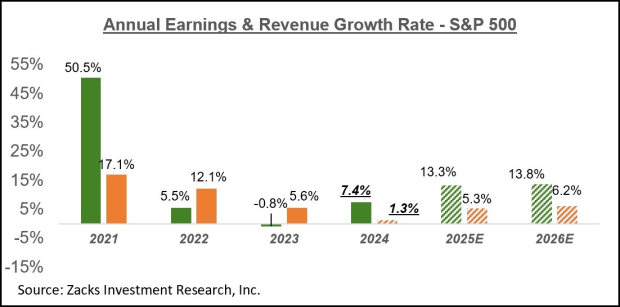

The chart under exhibits the general earnings image on a calendar-year foundation, with double-digit earnings development anticipated in 2025 and 2026.

Picture Supply: Zacks Funding Analysis

For an in depth take a look at the general earnings image, together with expectations for the approaching durations, please take a look at our weekly Earnings Tendencies report >>>> Retail Earnings: A Closer Look

7 Greatest Shares for the Subsequent 30 Days

Simply launched: Specialists distill 7 elite shares from the present record of 220 Zacks Rank #1 Sturdy Buys. They deem these tickers “Most Doubtless for Early Value Pops.”

Since 1988, the complete record has crushed the market greater than 2X over with a median achieve of +24.3% per yr. So you’ll want to give these hand picked 7 your quick consideration.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Salesforce Inc. (CRM) : Free Stock Analysis Report

The TJX Companies, Inc. (TJX) : Free Stock Analysis Report

Lowe’s Companies, Inc. (LOW) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

The Home Depot, Inc. (HD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.