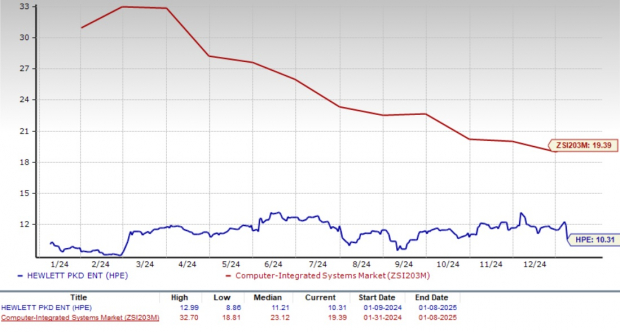

Hewlett Packard Enterprise Firm HPE has delivered stellar efficiency over the previous 12 months, with its inventory surging 34.1%, outperforming the Zacks Computer – Integrated Programs, Zacks Computer and Technology sector and the S&P500 index’s return of 8.5%, 33.4% and 24.9%, respectively. The inventory has additionally outperformed business friends, together with Micron MU, Seagate Expertise STX and Superior Micro Gadgets AMD.

Whereas this rally showcases HPE’s resilience, the query stays: Is there extra room for development, or is it time to lock in earnings? For now, holding the inventory seems to be probably the most prudent technique.

GreenLake and AI Drive HPE’s Success

HPE’s rally over the previous 12 months has been pushed by robust efficiency in its key segments, significantly GreenLake and synthetic intelligence (AI) programs. There may be vital momentum within the adoption of HPE GreenLake as organizations are capitalizing on the flexibleness and scalability of this IT transformation resolution.

Hewlett Packard Enterprise Worth Efficiency Chart

Picture Supply: Zacks Funding Analysis

GreenLake’s buyer base expanded by roughly 34.5% 12 months over 12 months, reaching 39,000 within the fourth quarter of fiscal 2024. This development in buyer base has pushed the annualized income run price, which has elevated 48% 12 months over 12 months, exceeding $1.9 billion on the finish of the fiscal fourth quarter.

Hewlett Packard Enterprise continues to see strong demand for its AI system choices. Within the fourth quarter of fiscal 2024, HPE reported that it had $6.7 billion in cumulative orders for AI services because the first quarter of fiscal 2023. HPE’s new AI orders within the fiscal fourth quarter of 2024 have introduced its backlogs to a worth of $3.5 billion.

HPE’s Valuation Alerts a Discounted Alternative

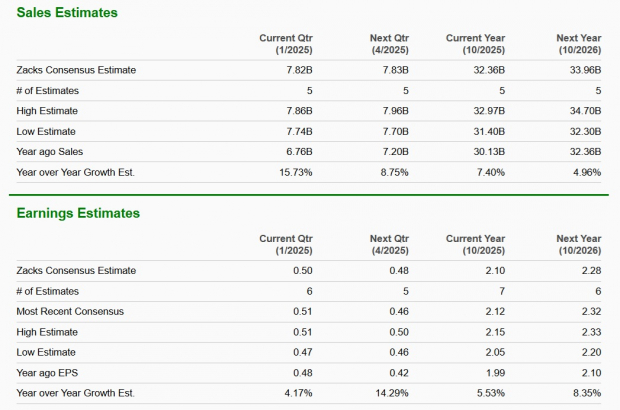

HPE’s valuation provides one other layer of enchantment. The inventory trades at a ahead 12-month price-to-earnings (P/E) ratio of 10.31, considerably decrease than the Zacks Laptop – Built-in Programs business common of 19.39. Equally, the ahead 12-month price-to-sales (P/S) ratio of 0.89 is considerably decrease than the business common of three.34. This favorable valuation makes HPE a sexy choice for long-term traders.

Hewlett Packard Enterprise P/E (F12M) Chart

Picture Supply: Zacks Funding Analysis

Brief-Time period Challenges Cloud the Outlook for HPE

Whereas Hewlett Packard Enterprise is gaining from the rising adoption of AI, the corporate can also be going through sure headwinds. The corporate’s near-term prospects may be damage by softening IT spending. Larger rates of interest and protracted inflationary pressures are hurting shopper spending. Then again, enterprises are suspending their giant IT spending plans attributable to a weakening world financial system amid ongoing macroeconomic and geopolitical points.

HPE’s clever edge division is beneath strain from the buildup of stock ranges amongst HPE’s buyer base. Revenues within the Clever Edge division dropped 20% 12 months over 12 months within the fourth quarter of fiscal 2024. On this phase, HPE’s switching and campus options are experiencing softer demand.

Furthermore, because of the low mixture of high-margin Clever Edge revenues, HPE’s gross margin is going through strain. Within the fiscal fourth quarter, HPE’s non-GAAP gross margin contracted 390 foundation factors (bps) on a year-over-year foundation and 90 bps on a quarter-over-quarter foundation to 30.9%.

HPE’s monetary providers division can also be experiencing a decrease single-digit development. The Monetary service phase’s revenues of $893 million elevated 2% 12 months over 12 months within the fiscal fourth quarter of 2024. The softness in these two segments was attributable to weakening IT spending.

The Zacks Consensus Estimate for fiscal 2025 and 2026 prime and backside strains doesn’t depict a robust monetary restoration within the close to time period for the corporate. The Zacks Consensus Estimate for fiscal 2025 earnings has been revised downward to $2.10 previously 30 days. The Zacks Consensus Estimate for fiscal 2026 earnings estimates has been revised downward to $2.28 previously 30 days.

Picture Supply: Zacks Funding Analysis

Discover the newest EPS estimates and surprises on Zacks Earnings Calendar.

Conclusion: Maintain HPE Inventory for Now

HPE’s GreenLake and AI-driven development sign promising long-term potential, however near-term challenges, together with softer demand and margin pressures, warrant warning. Its engaging valuation and strong market positioning justify holding the inventory for now. Whereas HPE navigates these headwinds, affected person traders may benefit as the corporate positions itself for a stronger restoration.

HPE inventory carries a Zacks Rank #3 (Maintain) at current. You may see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Analysis Chief Names “Single Greatest Decide to Double”

From 1000’s of shares, 5 Zacks consultants every have chosen their favourite to skyrocket +100% or extra in months to come back. From these 5, Director of Analysis Sheraz Mian hand-picks one to have probably the most explosive upside of all.

This firm targets millennial and Gen Z audiences, producing almost $1 billion in income final quarter alone. A current pullback makes now a super time to leap aboard. After all, all our elite picks aren’t winners however this one might far surpass earlier Zacks’ Shares Set to Double like Nano-X Imaging which shot up +129.6% in little greater than 9 months.

Free: See Our Top Stock And 4 Runners Up

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Seagate Technology Holdings PLC (STX) : Free Stock Analysis Report

Micron Technology, Inc. (MU) : Free Stock Analysis Report

Hewlett Packard Enterprise Company (HPE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.