HSBC Holdings HSBC shares touched a five-year excessive of $49.46 throughout Thursday’s buying and selling session. 12 months to this point, the inventory has risen 21.5%, outperforming the industry’s soar of seven.8%.

In the identical time-frame, HSBC’s peer, UBS Group AG UBS, has declined 0.9%, whereas Barclays BCS shares have skyrocketed 70.5%.

12 months-to-Date Worth Efficiency

Picture Supply: Zacks Funding Analysis

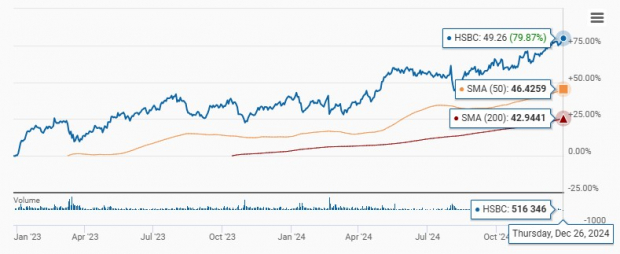

Technical indicators counsel power for HSBC. The inventory is buying and selling above its 50-day and 200-day transferring averages. It alerts strong upward momentum and worth stability for HSBC. This underscores optimistic market sentiments and confidence within the firm’s monetary well being and prospects because it continues its Asia pivot technique and simplifies world operations.

50-Day & 200-Day Shifting Averages

Picture Supply: Zacks Funding Analysis

HSBC has been aggressively restructuring its world footprint to cut back prices and complexity. The corporate intends to place itself as a high financial institution for high-net-worth and ultra-high-net-worth purchasers in Asia.

In sync with this, final week, HSBC introduced a deal to divest its French life insurance coverage arm, HSBC Assurances Vie (France), to Matmut Société d’Assurance Mutuelle. Additionally, in September 2024, the corporate agreed to promote its personal banking enterprise in Germany to BNP Paribas and its South Africa enterprise to FirstRand Financial institution and Absa. In April 2024, the corporate introduced an settlement to divest its Argentina enterprise, whereas in February, HSBC agreed to promote its Armenian unit. The corporate already exited retail banking companies in the US, Canada, France, New Zealand, Greece and Russia.

HSBC intends to reinvest the proceeds from the divestitures in increasing its presence in Southeast Asia and China, the place the financial institution believes it may leverage its current strengths to drive progress. As such, the corporate acquired Citigroup’s retail wealth administration enterprise in China and Singapore-based SilkRoad Property Companions Group. Additionally, it has relaunched its personal banking enterprise in India.

HSBC is simplifying its organizational construction into 4 companies (Hong Kong, UK, Company & Institutional Banking and Worldwide Wealth & Premier Banking), enabling it to rapidly ship on its strategic priorities. This transfer goals to mitigate the overlapping processes and decision-making built-in into the present construction, resulting in speedy execution. Comparable steps are being taken by BCS and UBS too. Each lenders try to concentrate on core companies to drive profitability.

Regardless of the unsure macroeconomic atmosphere, HSBC’s capital place stays strong. Given the strong capital place and decrease debt-equity ratio in contrast with the business, the corporate constantly rewards shareholders. HSBC expects a dividend payout ratio of fifty% (excluding the impacts of acquisitions and disposals) for 2024. Additional, it intends to provoke a share buyback of as much as $3 billion, which might be accomplished by February 2025.

HSBC Inventory Buying and selling at a Low cost

HSBC inventory is at present buying and selling at a 12-month trailing price-to-tangible e book (P/TB) of 0.89X. That is beneath the business’s 1.99X. This reveals that the inventory is cheap at current.

Worth-to-Tangible Guide Ratio (TTM)

Picture Supply: Zacks Funding Analysis

HSBC inventory is cheap in contrast with UBS, which has a P/TB of 1.27X. However, it’s buying and selling at a premium BCS’ P/TB of 0.60X.

Is HSBC Inventory Price Betting On?

HSBC’s strong capital place, enterprise restructuring and simplifying initiatives will help its Aisa pivot technique. Sturdy model worth, comparatively decrease charges and a worldwide community are anticipated to behave as tailwinds. In 2025, the corporate is more likely to reap the advantages of its efforts to shift away from much less worthwhile operations globally.

Given its favorable long-term prospects and decrease valuation, buyers may contemplate investing in HSBC inventory now. Those that have already got the inventory of their portfolio can contemplate holding on to it for strong returns.

HSBC at present carries a Zacks Rank #2 (Purchase). You’ll be able to see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Naming Prime 10 Shares for 2025

Wish to be tipped off early to our 10 high picks for the whole lot of 2025?

Historical past suggests their efficiency may very well be sensational.

From 2012 (when our Director of Analysis Sheraz Mian assumed duty for the portfolio) via November, 2024, the Zacks Prime 10 Shares gained +2,112.6%, greater than QUADRUPLING the S&P 500’s +475.6%. Now Sheraz is combing via 4,400 firms to handpick the most effective 10 tickers to purchase and maintain in 2025. Don’t miss your likelihood to get in on these shares after they’re launched on January 2.

Be First to New Top 10 Stocks >>

Barclays PLC (BCS) : Free Stock Analysis Report

UBS Group AG (UBS) : Free Stock Analysis Report

HSBC Holdings plc (HSBC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.