- The complicated information of SVB’s failing are still unidentified, as well as the present state of events is driven by feelings

- Bond market volatility has actually increased to degrees not seen because the Great Financial Situation as well as can bring about a sell-off in supplies

- On The Other Hand, Bitcoin has actually seen a current inflow of $200 billion, up 38% in the last 7 days

SVB was an openly traded financial institution. It was concentrated on brand-new innovations, implying it did a lot of its service with united state start-ups. In current weeks, SVB Financial Team introduced that it had actually marketed $21 billion in safety and securities as well as $2.25 billion in brand-new shares to fortify its funds.

This dismayed its financiers, that at some point wished to withdraw their cash from the financial institution. Initiatives to discover brand-new customers were deserted, as well as the Federal Down payment Insurance coverage Corp compelled the financial institution to shut.

The exact same innovation firms that created SVB to expand so quick created SVB to stop working. With the operate on branches, SVB needed to market bonds (which had actually shed several of their worth), leading to losses of $1.8 billion that would certainly not have actually struck the annual report if they had actually been held to maturation.

SVB’s troubles accompanied the closing of Silvergate Resources (NYSE:-RRB- as well as Credit Score Suisse (NYSE:-RRB-.

I have actually experienced lots of remarks from experts as well as speculators going over specific repercussions that I differ with. In addition, these remarks usually appear to be based upon baseless presumptions.

We still have really little concept of the min information of what has actually occurred, as well as the only typical string connecting all the significant (unanticipated) occasions is exactly how little we understand, both concerning exactly how they unravel as well as what may take place in the months as well as years ahead.

The present state of events is driven by feelings, which usually causes incorrect evaluations.

Lots of are not concentrating on the unknowns bordering this occasion:

- Why did the financial institution spend a lot resources in long-dated Treasury bonds?

- Why was Peter Thiel (as well as others) suggesting startups/businesses to prepare to safeguard down payments?

- Existed any kind of various other disputes of passion?

- What various other financial institutions might have comparable troubles with their “risk-free” financial investments?

Presently, also on the EU side, the option is to attend to the liquidity issue yet not the solvency issue. The last is minimized and even dealt with as non-existent, as well as the primary option is based upon comforting speeches.

The went on as well as elevated rate of interest by 50 basis factors, highlighting the local nature of the issue. Is the local financial situation simply a had occasion, or is the best tornado coming?

Whenever we have such inquiries, the starting point to look is the bond market. Any kind of signal of stress and anxiety will certainly often tend to materialize itself right here.

Allow’s overlay the volatility index with the supply index.

ACTION, the index that determines the suggested volatility of the united state bond market, establishes the “mood” via 2 worths, 80 factors standing for market tranquility as well as 100 factors standing for severe instability.

When the index dropped listed below 80 as well as got to 38, standing for a lowest level, it indicated that supplies were mosting likely to collapse. Nonetheless, it has actually because rallied back over 100.

This is due to the fact that financiers have actually gone back to bonds. In the last couple of months, it has actually dropped back to the 100 degree. It is currently back at 180. This is very high volatility, suggesting danger hostility on financiers’ component.

This sort of bond volatility has actually not been seen because the Great Financial Situation. Its connection with the VIX implies that volatility in one property course usually causes volatility in the various other.

Simply consider exactly how very closely these lines comply with each various other, so if one is trending greater, the various other will likewise be drawn greater. Does that mean more comprehensive marketing stress for supplies?

That claimed, we have actually all been considering remembrance – also if it is not the subprime/securitized home mortgage fiasco of 2008-09, I can not (as well as nobody can) warranty that absolutely nothing undesirable will certainly take place.

However if there is one style that unifies all these (past) occasions, as stated over, it is exactly how little we know exactly how they are unraveling in actual time. The worry is still of a systemic virus.

Can this panic go viral as well as bring about a collapse of the financial system?

The has actually made its largest relocation because the very early 1980s. Isn’t that a good idea, you might state? Upside down return contours are leading indications of economic crises.

So does this mean that a solid relocation higher can bring tranquility? Theoretically.

Superimposing the spread with the, whenever the last rallied out of the unfavorable region (2001-2007-2020), the bearish market, received the graph above, started.

I am not claiming it will certainly take place 100% of the moment, yet it is specific that bond market volatility is never ever a good idea for the marketplace as a whole.

The financial institutions remain to get via all this. In 2022 alone, reserve banks got a document 1,136 lots of gold, worth concerning $70 billion.

Gold is getting to March 2022 highs (+9% to day from March 8th degrees) as the financial situation impends.

Could it make brand-new 52-week highs?

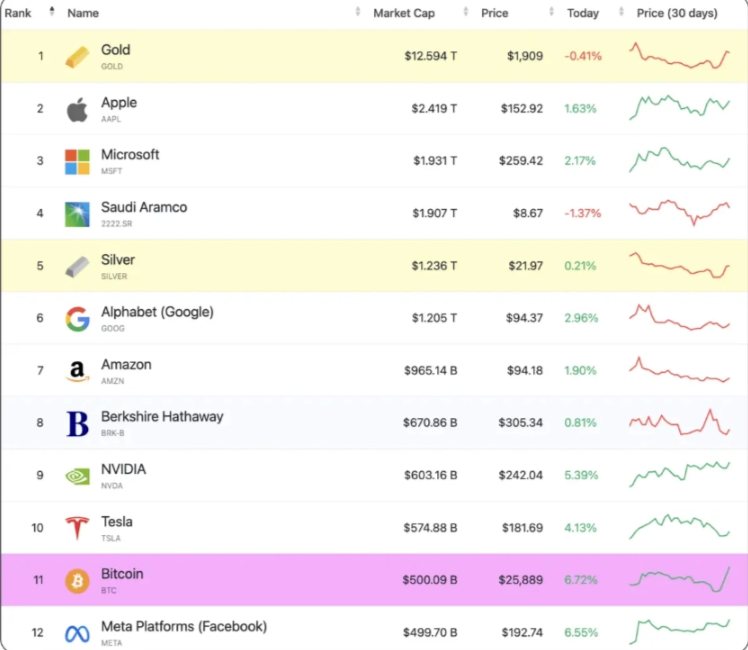

On The Other Hand, as it continues to be on top of the globe’s most useful properties by market capitalization, is climbing up the positions (well worth greater than as well as ).

Bitcoin is the variety of individuals that trust it, the strength of that confidence, as well as the future worth it stands for.

So we can state it’s still rather underestimated, as well as the longer it makes it through, the reduced the danger as well as better the capability of coming to be an irreversible shop of worth like gold.

In the recently, the cryptocurrency market has actually seen an inflow of $200 billion. Bitcoin is up 38% in the last 7 days, while is up 26% (since this writing).

As well as the complete crypto market cap has actually boosted from $918 billion to $1.17 trillion. Are individuals placing cash right into BTC faster than the Fed can publish $300 billion out of slim air to release the financial institutions?

Cathie Timber remains to get Coinbase Global Inc (NASDAQ:-RRB- show to the ARK Future Generation Net ETF (NYSE:-RRB- as well as the ARK Development ETF (NYSE:-RRB-, making up concerning 30 percent of all shares acquired in 2023.

Also Buffett, that has actually been important of cryptocurrencies, has actually banked on (Brazilian fintech titan), which supplies crypto trading solutions.

Perhaps CZ (Binance) is ideal?

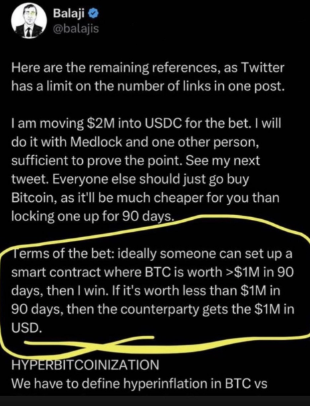

Or Balaji (the previous Principal Modern technology Police officer of Coinbase)?

Tweet by Balaji

Business owner, founder of Counsyl, 21 Inc/Earn, previous CTO of Coinbase, as well as General Companion of Andreessen Horowitz, Balaji is wagering $2 million that 1 BTC will certainly deserve $1 million in 90 days.

This is due to the fact that the financial institutions are bankrupt.

On the other hand, Bitcoin struck $28,000 when the Fed launched its spending plan, disclosing that $300 billion will certainly be infused right into the economic situation in feedback to the situation.

The occasion, which need to not be ignored, almost squashed Measurable Firm by embracing the contrary approach, i.e., Measurable Easing.

Bitcoin is unstable now, as well as it will possibly go laterally later on. However at the exact same time, it will certainly need to hold the $26K degree that can enable energy to bring it towards $30K.

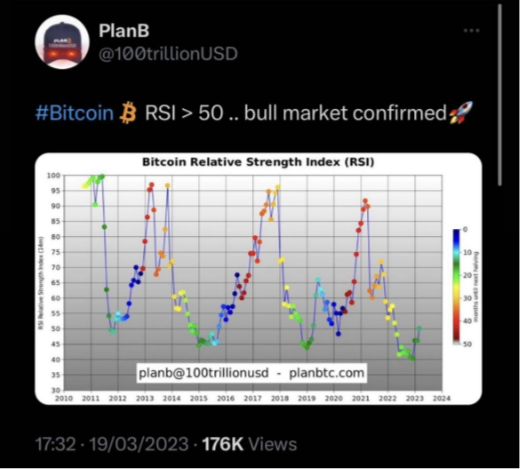

Likewise, according to PlanB, the booming market will begin once again.

Tweet by PlanB

We can see that the digirìtal money is back over the 4-year relocating standard (1,458 days) along with the favorable RSI.

Historically, the SMA 1458 indication has actually shown to be a dependable assistance for bitcoin.

Finally, the marketplace is just doing what it has actually constantly done due to the fact that financier actions has actually not transformed a lot over the previous 100 years.

***

Please Note: This post is created for educational objectives just; it does not comprise a solicitation, deal, suggestions, therapy or referral to spend therefore it is not meant to incentivize the acquisition of properties at all. I would love to advise you that any kind of sort of property, is reviewed from several viewpoints as well as is extremely dangerous as well as consequently, any kind of financial investment choice as well as the linked danger continue to be with the financier.