On Sept. 18, the Federal Reserve voted to decrease interest rates for the primary time in 4 years. There are particular shares that may profit from this transfer.

However first, I ought to mood expectations. For starters, traders should not get too hung up on rates of interest as a result of they don’t seem to be predictable. Even voting members of the Federal Reserve are sometimes unsuitable in the case of forecasting rates of interest a yr prematurely. Most individuals aren’t going to have extra perception than the Federal Reserve itself. Subsequently, predicting the place rates of interest shall be in a yr or two is nothing greater than a coin flip.

Furthermore, rates of interest cannot repair a nasty enterprise. For that reason, traders nonetheless have to work laborious at figuring out robust secular traits and good companies in these areas.

All this mentioned, there are strong companies that may profit from the latest fee minimize. And I consider Ground & Decor (NYSE: FND), Pushed Manufacturers (NASDAQ: DRVN), and Tanger (NYSE: SKT) are three such companies.

1. Ground & Decor

Ground & Decor owns and operates giant, warehouse-style residence enchancment shops, not not like House Depot. However moderately than fill its places with common residence enchancment merchandise, the corporate primarily shares objects comparable to tile, hardwood, and different objects essential for flooring installations. It is a massive market, and Ground & Decor is area of interest sufficient to carve out its spot within the house.

On the finish of 2020, Ground & Decor solely had 133 places. However as of the second quarter of 2024, the corporate already had 230 places and expects to open greater than 20 extra earlier than the top of the yr. Opening new places at this tempo has allowed it to shortly develop each the highest and backside strains.

FND Revenue (TTM) information by YCharts

Concentrating on 500 places by the top of the last decade, there might be loads of progress forward for Ground & Decor’s enterprise, which can increase the inventory to robust features.

Nevertheless, gross sales have just lately slowed for Ground & Decor — it is an issue widespread amongst residence enchancment retailers. Reworking exercise tends to gradual when rates of interest are excessive as a result of individuals are much less inclined to maneuver or take out a home equity line of credit. However now that charges are coming down, it could reinvigorate a sluggish residence enchancment trade, benefiting Ground & Decor’s shareholders.

2. Pushed Manufacturers

In my opinion, issues must get fairly unhealthy with the financial system earlier than most individuals quit washing their automobiles and altering their motor oil — this stuff get completed commonly. And that gives regular enterprise for Pushed Manufacturers, contemplating it has greater than 1,800 upkeep outlets and over 1,100 automobile washes, in addition to gives different companies within the automotive house.

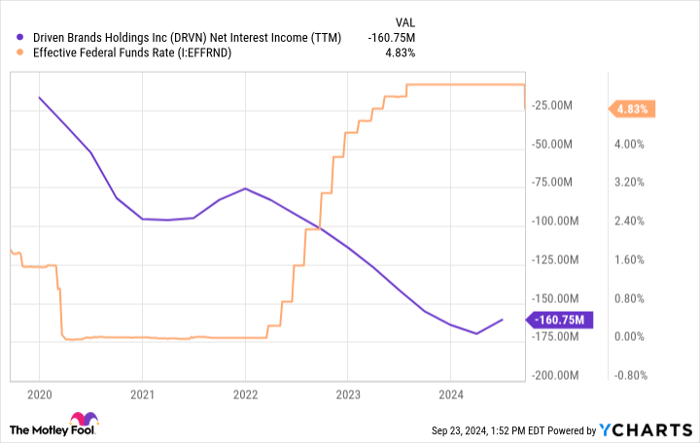

The principle fault with Pushed Manufacturers is that it has a whole lot of debt — about $2.9 billion as of the second quarter of 2024. That is loads contemplating it is solely generated $2.3 billion in income during the last 12 months. And when rates of interest went up in recent times, curiosity funds additionally went up.

DRVN Net Interest Income (TTM) information by YCharts

Now that the Federal Reserve is reducing rates of interest once more, Pushed Manufacturers ought to take pleasure in a measure of reduction in the case of servicing its debt.

Pushed Manufacturers is an in any other case worthwhile enterprise. Earnings earlier than curiosity, taxes, depreciation, and amortization (EBITDA) adjusts for debt servicing bills. The corporate earned $283 million in adjusted EBITDA within the first half of 2024, with its major automobile wash and upkeep enterprise segments individually incomes a revenue as effectively.

Administration for Pushed Manufacturers is focusing on not less than $535 million in adjusted EBITDA in 2024 — it is already greater than midway there. And with a present enterprise value of simply $5.2 billion, it is a low cost inventory at this time at lower than 10 instances this yr’s adjusted EBITDA.

3. Tanger

Tanger is a small real estate investment trust (REIT) consisting of 38 outlet malls as of the second quarter of 2024. One of many major issues to observe listed here are its occupancy ranges. It could be problematic if tenants have been doing poorly and breaking their leases. However as of Q2, occupancy is robust at greater than 96%.

This inventory advantages from decrease rates of interest in a roundabout method. As a REIT, Tanger is required to distribute a specific amount of earnings to shareholders as a dividend. And it is common for it to have a high-yield dividend.

To be clear, there are a number of issues that may impression its dividend yield. However one in every of these components is rates of interest.

When charges are excessive, dividend shares comparable to Tanger aren’t in as a lot demand as a result of traders can get good assured returns from bonds. There isn’t any level in taking as a lot threat with a inventory. This could trigger dividend inventory costs to fall till the dividend yield is excessive sufficient to justify the added threat of investing in a inventory moderately than a bond. However this reverses when charges fall — the yield from a REIT inventory comparable to Tanger turns into extra enticing.

I would already be a little bit late to level out the advantages of Tanger inventory. It is up greater than 40% over the previous yr, partly as a result of traders doubtless anticipated the approaching fee change and needed to lock in Tanger’s dividend at the next yield — in spite of everything, occupancy ranges are robust, so there’s cause for confidence within the enterprise. However its dividend yield of three.5% continues to be enticing, and the inventory worth may rise greater with future fee cuts, that are on the desk.

Extra than simply rate of interest cuts

To shut, I need to reiterate a degree I made at first: Traders should not construct a complete investment thesis on rates of interest — traders cannot predict what charges will do, and fee adjustments will not make a nasty firm nice. However I consider Ground & Decor, Pushed Manufacturers, and Tanger are good companies within the first place. And these good enterprise get an additional profit from decrease charges, which is why I highlighted this trio right here.

Do you have to make investments $1,000 in Ground & Decor proper now?

Before you purchase inventory in Ground & Decor, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 best stocks for traders to purchase now… and Ground & Decor wasn’t one in every of them. The ten shares that made the minimize may produce monster returns within the coming years.

Think about when Nvidia made this record on April 15, 2005… in case you invested $1,000 on the time of our advice, you’d have $760,130!*

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 23, 2024

Jon Quast has positions in Pushed Manufacturers, Ground & Decor, and Tanger. The Motley Idiot has positions in and recommends House Depot. The Motley Idiot recommends Tanger. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.