SpaceX, the most well liked and most extremely valued non-public firm, has seen extraordinary investor curiosity recently. Like many different high-profile startups, it has chosen to stay non-public as institutional buyers proceed to pour cash into the agency.

Since SpaceX shares don’t commerce on a inventory trade, investing will not be simple when you’re not an enormous non-public fairness investor, a enterprise capitalist, or an worker. Since retail buyers can’t buy its shares instantly, they’re exploring different choices.

A small, comparatively unknown ETF has seen its belongings greater than double because it added SpaceX to its holdings, and a closed-end fund has been on a wild journey, buying and selling at an insane premium to the worth of its underlying belongings. We discover the fund choices obtainable to retail buyers.

Why Everybody Needs a Slice of SpaceX

Elon Musk based SpaceX in Could 2002, earlier than he turned concerned with Tesla. The corporate now has a de facto monopoly on rocket launches, in accordance with The Wall Road Journal, providing a launch frequency and value effectivity that opponents are unable to match.

After the awe-inspiring engineering feat of catching a heavy booster rocket with chopstick-like mechanical arms, its valuation surged to about $350 billion, up from roughly $210 billion in June 2024.

Its satellite-internet division, Starlink, is reported to be a money cow. Whereas not a lot is understood about its funds, merchants are betting that the corporate might safe extra authorities contracts as a result of Musk’s proximity to President Trump.

In his inaugural tackle, Trump promised to ship astronauts to Mars. Musk beforehand predicted that Starship, the world’s strongest rocket, might attain the planet inside two years. The administration might play a key position in serving to SpaceX obtain its Mars ambitions.

Baron Mutual Funds

Billionaire investor Ron Baron has been a robust supporter of Elon Musk for a very long time. Ron has constantly bought SpaceX shares yearly since 2017 on behalf of his mutual funds and different accounts, in accordance with his letter dated July 16, 2024.

Baron Companions Fund BPTRX presently has 15% of its complete belongings in SpaceX, whereas Baron Targeted Progress Fund BFGFX holds 11% of its internet belongings in SpaceX as of 12/31/24. The funds have returned 51% and 38%, respectively, over the previous yr, in comparison with the S&P 500’s achieve of 25%.

Tesla TSLA is the highest holding in each funds, which have considerably outperformed their respective benchmarks since inception.

Picture Supply: Stockcharts

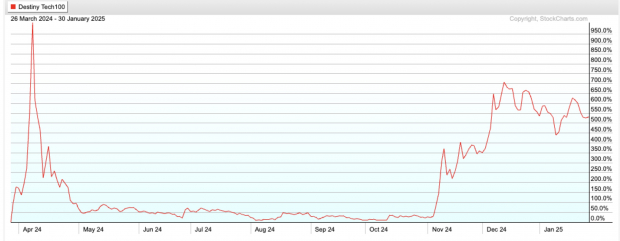

The Future Tech 100 (DXYZ)

The Future Tech 100 is a closed-end fund that intends to spend money on a portfolio of the highest 100 venture-backed non-public know-how firms. It presently holds 22 firms, with SpaceX making up 37% of the portfolio.

The fund has surged greater than 500% since its inception in March final yr, however its efficiency has been extraordinarily unstable. Extra importantly, it usually trades at an enormous premium to its internet asset worth (NAV).

After a euphoric surge of over 1,000% proper after its debut—pushed by speculators piling in to achieve publicity to the most well liked unicorns—it plunged, giving up most of its beneficial properties. Regardless of a latest leap, it’s nonetheless buying and selling considerably beneath its all-time excessive.

As of September 30, 2024, DXYZ reported an NAV of $5.32 per share, but it’s presently buying and selling at over $55 per share. The fund updates the truthful worth of its holdings on a quarterly foundation, so whereas the newest NAV is unknown, the premium might nonetheless be near 1,000%.

Traders ought to do not forget that a closed-end fund’s market worth can deviate considerably from its NAV primarily based on provide and demand, in contrast to ETFs and mutual funds.

Picture Supply: Stockcharts.com

ARK Enterprise Fund

Launched in September 2022, Cathie Wooden’s Ark Enterprise Fund (ARKVX) is a closed-end interval fund that invests in each private and non-private corporations. SpaceX is its largest holding, making up about 16% of the portfolio as of 12/31/24.

Different well-known startups, together with Epic Video games and OpenAI, are additionally amongst its high holdings. Non-public firms make up roughly 83% of its complete portfolio.

The fund is up about 11% over the previous yr. Since its inception via December 31, 2024, it has returned about 19%, underperforming the S&P 500’s 26% return over the identical interval.

Like different closed-end interval funds, ARKVX permits buyers to redeem solely a restricted quantity per quarter throughout particular time frames.

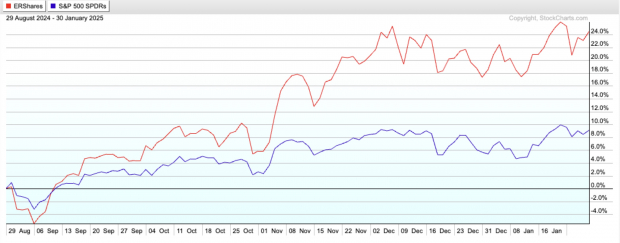

The Entrepreneur Non-public-Public Crossover ETF (XOVR)

XOVR is the primary ETF to carry a personal firm. The fund modified its ticker and technique in August however stays targeted on entrepreneurial firms.

The fund just lately added SpaceX via a special-purpose automobile (SPV). As The Wall Road Journal identified, such SPVs could cost charges as excessive as 25% of any beneficial properties, and it’s unclear how these charges will influence the worth of its SpaceX place.

The fund’s SpaceX place has declined barely from 12.3% as of December 12, as a result of inflows. Primarily, if the fund gathers extra belongings, it might want to purchase extra SpaceX shares to keep away from dilution.

Moreover, there may be little readability on how the ETF will decide a “truthful worth” for its SpaceX place as required by the SEC.

The fund presently has about $300 million in belongings and expenses an expense ratio of 0.75%. Since altering its technique in August, the ETF has returned about 24%, in comparison with the S&P 500’s 9% achieve.

Picture Supply: stockcharts

Different high holdings embrace NVIDIA (NVDA), Alphabet GOOGL, and Meta Platforms META. (Learn:

Will We See Extra Non-public Asset ETFs in 2025?

As the marketplace for non-public belongings continues to broaden, a few of the greatest asset managers are racing to deliver them to retail buyers. Nevertheless, the inherent illiquidity and valuation challenges of personal belongings make it tough to bundle them into an ETF that provides intraday liquidity and pricing.

The SEC locations a 15% restrict on open-ended funds holding illiquid investments. It defines an funding as illiquid if it can’t be offered inside seven days with out considerably impacting its market worth.

BlackRock, the world’s largest asset supervisor, is making a major push into non-public markets, investing almost $28 billion to amass private-equity agency World Infrastructure Companions, private-assets information supplier Preqin, and personal credit score supervisor HPS Funding Companions.

In the meantime, State Road has partnered with Apollo World to file for a novel private and non-private credit score ETF, the place Apollo would function a liquidity and pricing supplier for the fund. This fund will present perception into the challenges of packaging non-public belongings into ETFs.

ETFs have helped facilitate entry to beforehand inaccessible market areas. The business is understood for its innovation, and buyers love the ETF construction. ETFs have usually acted as instruments for worth discovery during times of market disruption.

I imagine the business will discover methods to pretty worth illiquid belongings frequently, and we’ll see extra non-public asset ETFs in 2025.

Need key ETF data delivered straight to your inbox?

Zacks’ free Fund E-newsletter will transient you on high information and evaluation, in addition to top-performing ETFs, every week.

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Get Your Free (BPTRX): Fund Analysis Report

Get Your Free (BFGFX): Fund Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.