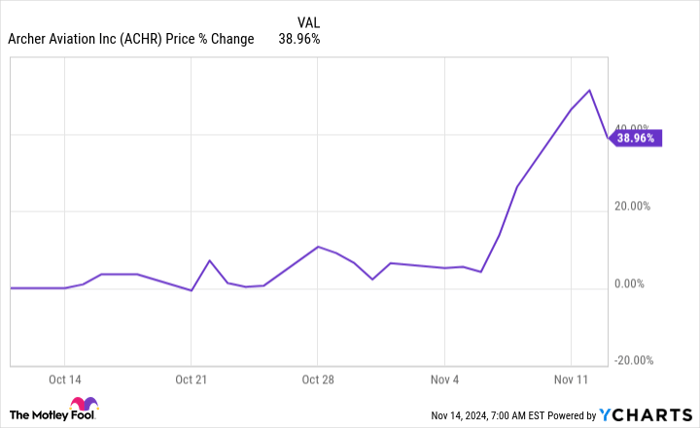

Shares of Archer Aviation (NYSE: ACHR) have risen practically 40% over the previous month, as of this writing. Nearly all of that advance has are available simply the few days following the corporate’s third-quarter 2024 earnings launch.

It was a superb earnings replace in some ways, however buyers ought to go in right here cognizant of the dangers that also exist for Archer and its shareholders.

Archer’s replace was filled with positives

From a big-picture perspective, the corporate’s objectives are extremely bold. First it’s seeking to create a brand new type of plane, an electrical vertical takeoff and touchdown (eVTOL) short-haul aircraft. And it desires to make use of that aircraft to create a wholly new transportation business, air taxis.

It is not the one firm engaged on such a mission, however it’s, impressively, getting nearer and nearer to each objectives. This was highlighted within the third-quarter report.

Picture supply: Getty Photos.

Archer Aviation’s main bullet factors in its earnings information launch inform a compelling story.

- Its manufacturing unit is about for completion within the coming weeks, with the purpose to be constructing piloted plane for testing and early industrial deployment by 2025.

- It mentioned it is nearing completion of part 3 of the Federal Aviation Administration (FAA) certification course of whereas persevering with to quickly advance part 4, the final step to safe certification.

- Administration additionally reported that it established a consortium led by the Abu Dhabi Funding Workplace to launch industrial air taxi providers within the United Arab Emirates as early because the fourth quarter of 2025.

- Lastly, it entered right into a partnership with Soracle — a three way partnership between Japan Airways and the Japanese producer Sumitomo — with a deliberate order of as much as $500 million. That introduced the full worth of the orders that clients have indicated their curiosity in making to $6 billion.

Corporations usually intensify the positives and play down the negatives in these reviews, however it actually does appear to be Archer is getting near the end line, which helps clarify the inventory’s speedy ascent following the earnings launch.

Being a millionaire maker requires multiple good replace

The issue is that every one of this excellent news continues to be simply main as much as the purpose when the corporate has a product to construct and promote. It is not there but, despite the fact that it’s getting nearer.

The excellent news is great, however there’s nonetheless lots that should go proper earlier than the upstart airplane maker is a sustainably worthwhile enterprise. Inverting the script on the bullet factors above is more likely to be a useful warning.

For instance, the manufacturing unit is sort of full, however there’s more cash to be spent earlier than it’s. Then it must work by the kinks which can be frequent when a manufacturing unit opens.

And even when every little thing goes as deliberate, it can solely be producing planes for testing functions at first. It’s a foundational funding, however opening up that manufacturing unit is not the top recreation.

Then there are the part 3 and part 4 FAA approval processes. It is progressing with this effort, however till it’s carried out, there’s extra time and money to spend on one thing which will nonetheless, ultimately, not get remaining approval. Certain, from what Archer Aviation is saying, it looks like approval will occur, however there’s all the time a danger that it could not.

The consortium with the UAE and the cope with Soracle each converse to the market that would await Archer Aviation, together with a backlog that is as giant as $6 billion. This means what the long run may appear to be if Archer’s aircraft will get authorized, examined, and adopted for its supposed function as an air taxi.

However all of these dominos have to line up, together with the truth that most of the people has to embrace the concept of air taxis, which presently do not exist. In different phrases, the market the corporate is concentrating on could not find yourself being giant sufficient to assist the enterprise over the long run.

Archer Aviation is an aggressive funding

Might Archer Aviation mint some millionaires out of aggressive growth investors? Certain, if every little thing works out based on plan.

However there are a number of shifting elements right here, and this inventory might be not one which conservative buyers must be till the corporate has reached just a few extra milestones. So that you want a really constructive view of the corporate and its long-term prospects if you’ll purchase Archer Aviation.

Don’t miss this second likelihood at a probably profitable alternative

Ever really feel such as you missed the boat in shopping for probably the most profitable shares? You then’ll need to hear this.

On uncommon events, our professional staff of analysts points a “Double Down” stock suggestion for firms that they suppose are about to pop. Should you’re apprehensive you’ve already missed your likelihood to speculate, now’s one of the best time to purchase earlier than it’s too late. And the numbers converse for themselves:

- Amazon: should you invested $1,000 once we doubled down in 2010, you’d have $22,819!*

- Apple: should you invested $1,000 once we doubled down in 2008, you’d have $42,611!*

- Netflix: should you invested $1,000 once we doubled down in 2004, you’d have $444,355!*

Proper now, we’re issuing “Double Down” alerts for 3 unimaginable firms, and there might not be one other likelihood like this anytime quickly.

*Inventory Advisor returns as of November 11, 2024

Reuben Gregg Brewer has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.